This is About So Much More Than Trump and Brexit

Politics / Religion Mar 23, 2017 - 05:26 AM GMTBy: Harry_Dent

I’ve been writing a lot about what I see as the mega trend right now… and what will make this economic winter season different from the 1930s.

I’ve been writing a lot about what I see as the mega trend right now… and what will make this economic winter season different from the 1930s.

We’re not just seeing a classic debt and financial asset bubble that will unravel into a deflationary depression, as occurred in the 1930s and many times throughout history.

We’re not just seeing a populist revolution, as we saw with Hitler and Mussolini in the 1930s and World War II, and as has occurred about every 84 years throughout history.

We ARE seeing the early stages of a major 250-year cultural, political and social revolution that revolves around religious values and political splits around the world… and it results in massive economic gains decades after.

The last such major revolution hit in the late 1700s when democracy and free market capitalism converged. That revolution set the stage for the greatest surge in affluence and globalization in history, especially from the mid-1800s forward.

Technologies further accelerated globalization and urbanization, especially since World War II. This has caused a growing divide in incomes and wealth, as well as in cultural, religious and social values, within countries and between major global regions.

One of my favorite and paradoxical principles of growth and evolution is this…

Technologies change faster than cultures, and cultures change faster than genes. This is the reason that any extended periods of strong growth and progress will create growing divergences in incomes and values that eventually become unsustainable at some point.

The typical developed country has six times the GDP per capita of the typical emerging country. At the more the extremes, it’s like 30 times. Southern and East European countries have as little as half the GDP per capita of North and Western Europe.

Globalization has succeeded so much that it has put very different cultures and income groups in each other’s face.

And we’ve had enough of it… particularly those who find themselves on the lower rungs.

It’s now clear to me that globalization has peaked for years, if not decades, to come and we’re going to have to regroup around regions and countries with common cultural and religious values before we can globalize again in a new, more bottoms-up network economy.

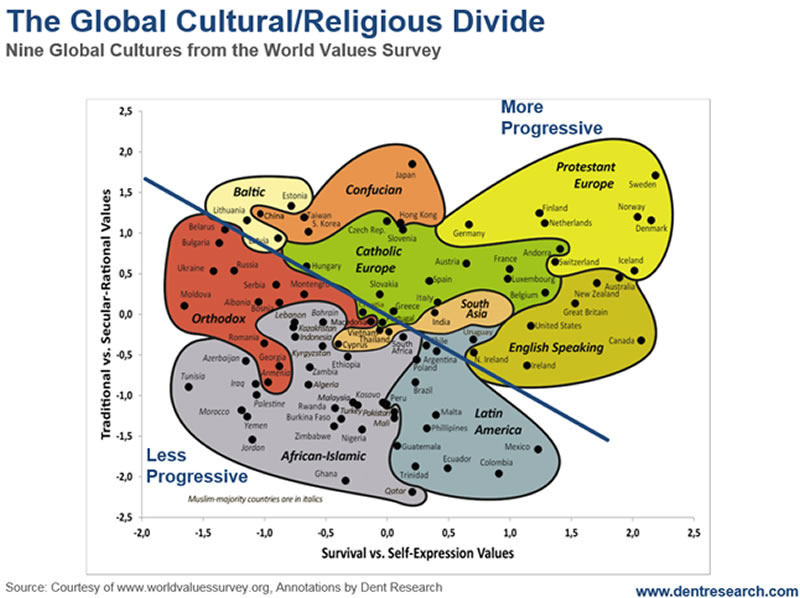

The best global graph of the major different cultures comes from The Global Values Survey out of a recent article by Will Wilkinson. This shows nine distinct global cultures around two variables that I find very meaningful. On the x axis is survival (conformist) versus self-expression (individualistic) values. On the y axis is traditional (faith) versus secular-rational (scientific) values.

Take a look at this…

If you go from the bottom left of the chart to the upper right, you’re going from less progressive and affluent to more progressive and affluent. From the upper left down to the lower right, you see the best representation of the blue/red – aka progressive/conservative – divide globally (the line I added to this chart shows this clearly).

The two groups that are the most rational and self-expressive are Protestant Europe and the English Speaking (often called the British offshoots).

Catholic Europe and Confucian East Asia are more on the rational side but less self-expressive.

The least progressive on both values is the African-Islamic group.

The East Europe/Russian Orthodox are more rational but low on self-expression.

Latin America is more traditional but more expressive.

You can see here why there is such a clash between the more affluent Christian cultures of Europe and the English-Speaking groups versus the African-Islamic ones. They’re quite literally on the extreme opposite sides on both value dimensions.

You can also see why Russia and the Eastern European Orthodox countries don’t get along with Western Europe and North America.

It’s noteworthy that there isn’t the same clash with Latin America, despite it being more traditional, because they’re largely Christian and are closer on the self-expressive scale.

Also note the borderline countries in that blue/red split: Montenegro, Macedonia, Vietnam, Thailand, South Africa, Chile, Argentina and Poland. With further urbanization and wealth, these could cross over to the more progressive or blue side.

This breakdown of the current situation helps us see what things might look like in the years and decades to come. Think about more effective trading and political zones. Europe could break into the more north/south divide between Protestant (more affluent and competitive) and Catholic. We could have two euros and maybe two Eurozones.

Now that Britain has left the union, why shouldn’t there be a stronger alliance between Great Britain, Scotland, Ireland, the U.S., Canada, Australia and New Zealand? These are highly compatible cultures with similar religions, lifestyles and language.

The Asian Tiger countries – Japan, South Korea, Taiwan, Singapore, Hong Kong and Coastal China – would make a great trade zone and alliance.

Southeast Asia could be a separate zone and possibly ally with India and the interior of China to make up a trade and political block with the biggest population in the world.

Putin’s desire to re-unite the Soviet Union could work, but only if the Orthodox countries remained sovereign and independent while forming a trading union like the Eurozone.

The dominant Sunni nations of the African-Islamic group could be a major alliance with the smaller and more concentrated Shia dominant countries or regions allying around Iran in the central Mid-East.

And of course, Latin America makes sense as a more integrated political trading block with common religion and language.

The trick is to first “break back down” into more coherent nations and let countries re-align around their progressive/conservative (blue/red) divisions… redrawing nationalistic borders and political policies so there’s more unity and common values in each sovereign entity. Only then can we build back up to greater growth and global integration again.

Maybe we need two to four U.S. regions, two blue and two red, with most states maintaining their political structures.

Iraq and Syria definitely need to redraw around Sunni, Shia and Kurd regions. The Kurds could go with Southern Turkey, the Shias with Iran, the Sunnis then take over the rest of Iraq and Syria.

This is going to be the major trend in coming years. And it will lay the groundwork for another mega global boom later in this century… but we can’t get there from here yet!

More to come on this deep and critical subject. Stay tuned.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.