Peak Gold – Biggest Gold Story Not Being Reported

Commodities / Gold and Silver 2017 Mar 22, 2017 - 04:00 PM GMTBy: GoldCore

– Peak gold – Biggest gold story not being reported

– Peak gold – Biggest gold story not being reported

– Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets

– Decline in gold production at world’s top 10 gold mining companies – Byron King

– “No new big mines being built in the world today” – Glencore CEO Glasenberg

– Primary global gold output declined in 2016 – Thomson Reuters via Mining.com

– 2016 was first year of fall in mine production since 2008

– Rising safe haven demand from ‘Trumpflation’ and geopolitical tensions and falling mine supply should lead to “much higher gold prices”

– What happens when the unstoppable force of robust global demand for gold meets the immovable object of a small, finite, rare and dwinding supply of physical gold?

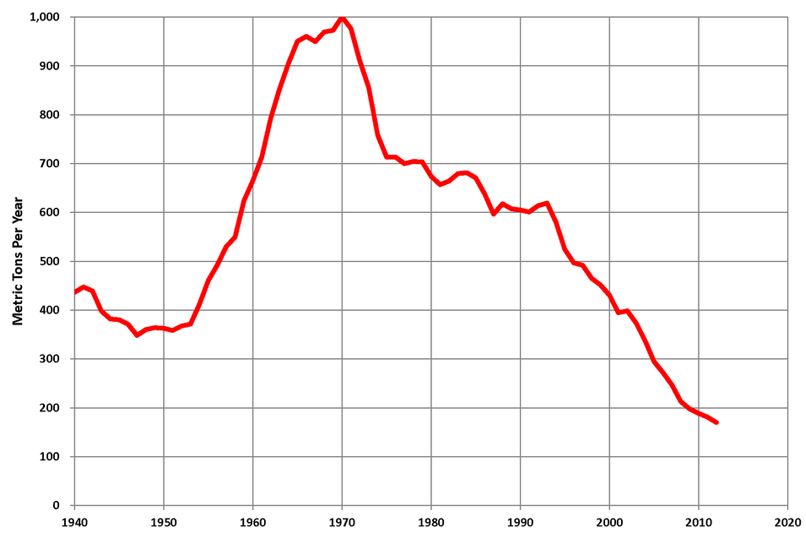

South Africa Gold Production

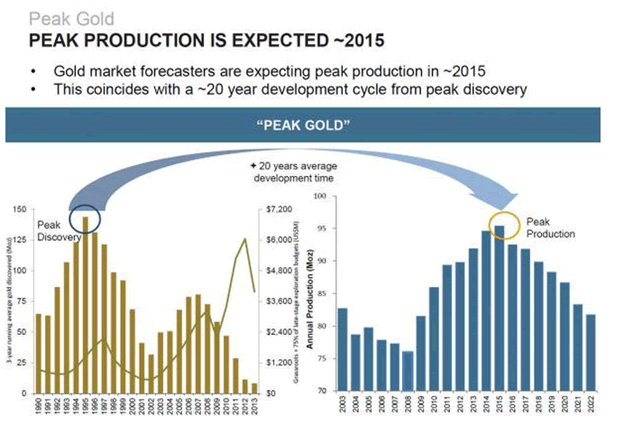

We have written about ‘peak gold’ and the ramifications of the underappreciated peak gold phenomenon for the gold market since 2008. The risk of falling gold production and a consequent reduction in supply are slowly percolating into the mainstream and analysts are asking whether 2015 or 2016 marked the year of peak gold production.

Byron King has written about this increasingly important supply factor in the gold market and brings together the views and research of Glencore CEO, Ivan Glasenberg, Thomson Reuters GFMS and others.

Goldman Sachs

The collapse in South African gold production (see chart above) is the ‘classic canary in the coal mine’ and likely foreshadows the coming decline in global gold production.

South Africa produced over 1,000 tonnes of gold in 1970 but production has fallen to below 250 tonnes in recent years (see chart above). This is a collapse as these are levels last seen in 1922 and happened despite the massive technological advances of recent years and more intensive mining practices.

Regarding global gold production, the world’s largest gold producer and now the world’s largest gold buyer China, has been the only major producer to see an increase in gold production in the last few years.

There has been a huge increase in Chinese gold mining supply in recent years. We wonder about the accuracy of some of this data and whether the figures are being exaggerated by gold mining companies in China and by bureaucrats. Gold mining companies sometimes exaggerate the scale of their assets in the ground and sometimes of their production as was seen in Bre-X, recently popularized in the movie ‘Gold’.

There is concern that gold production in China may actually be declining as older mines see reduced production.

From the Daily Reckoning:

Gold has performed exceedingly well since last Wednesday’s much-anticipated rate hike. It shot up about $25 Wednesday alone. Today it’s up another three bucks, to $1,233.

The most common argument for gold is fairly well-known. Trump’s massive new spending proposals will goose inflation, meaning a higher gold price.

But while most investors focus on the potential for increasing demand, few consider if supplies will be able to meet that demand. And if supplies can’t keep up with demand, that should lead to much higher gold prices.

After three years of drifting lower, gold prices began to recover last year. Still, despite last year’s gold price move, the world’s top 10 gold mining companies were focused more on cost cutting. The result was a decline in gold production from mines run by majors.

And Ivan Glasenberg, CEO of mining giant Glencore, says that “there are no new big mines being built in the world today.” That’s because the industry downturn between 2012 and 2015 — the Mining Zombie Apocalypse, as I like to call it — caused miners to slash exploration budgets, in essence storing up trouble for the future.

Thus, it’s worth taking note of a recent article at Mining.com by Frik Els — with whom I spent a week in the Yukon last summer.

Frik dissects a recent report by Thomson Reuters about how primary global gold output declined in 2016. Specifically, Mining.com sums up the report: “World gold mine supply fell by 22 tonnes, or 3%, year on year according to the GFMS Gold Survey, to 827 tonnes in the third quarter of 2016.

By all indications, mine supply contracted in the fourth quarter of 2016 as well.

That means 2016 was the first year of a fall in mine production since 2008.

And according to the Thomson Reuters report, there are “few new projects and expansions expected to begin producing this year, and those in the near-term pipeline are generally fairly modest in scale, hence our view that global mine supply is set to continue a multiyear downtrend in 2017.”

Read article on Daily Reckoning

We live on a small, finite planet which is confronted by massive population growth, a near infinite growth in global currency supply and in financial instruments such as derivatives. We are consuming all our natural resources in a completely unsustainable manner.

Now might be a good time to ask the important question

What happens when the unstoppable force of robust global demand for gold meets the immovable object of a small, finite, rare and dwinding supply of physical gold?

Gold Prices (LBMA AM)

22Mar: USD 1,246.10, GBP 999.50 & EUR 1,154.76 per ounce

21Mar: USD 1,232.05, GBP 989.21 & EUR 1,141.37 per ounce

20Mar: USD 1,233.00, GBP 993.92 & EUR 1,146.57 per ounce

17Mar: USD 1,228.75, GBP 991.85 & EUR 1,140.53 per ounce

16Mar: USD 1,225.60, GBP 998.74 & EUR 1,143.24 per ounce

15Mar: USD 1,202.25, GBP 986.69 & EUR 1,132.04 per ounce

14Mar: USD 1,203.55, GBP 992.33 & EUR 1,130.86 per ounce

Silver Prices (LBMA)

22Mar: USD 17.58, GBP 14.12 & EUR 16.30 per ounce

21Mar: USD 17.31, GBP 13.88 & EUR 16.01 per ounce

20Mar: USD 17.23, GBP 13.92 & EUR 16.03 per ounce

17Mar: USD 17.40, GBP 14.08 & EUR 16.21 per ounce

16Mar: USD 17.46, GBP 14.21 & EUR 16.28 per ounce

15Mar: USD 16.91, GBP 13.87 & EUR 15.92 per ounce

14Mar: USD 17.00, GBP 14.02 & EUR 15.99 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.