US Fed is Driving Stock Prices and Volatility

Stock-Markets / Stock Market 2017 Mar 19, 2017 - 06:22 PM GMTBy: Chris_Vermeulen

Last week’s news that the US Fed will raise rates from 0.75% to 1.00% drove the US markets, generally, over 0.40% higher after Fed Chairman Janet Yellen announced the hike. As of right now, the NASDAQ has pushed to a new all-time high and the SPY is very close to an all-time high.

Last week’s news that the US Fed will raise rates from 0.75% to 1.00% drove the US markets, generally, over 0.40% higher after Fed Chairman Janet Yellen announced the hike. As of right now, the NASDAQ has pushed to a new all-time high and the SPY is very close to an all-time high.

Yet, as we move into the end of March 2017 and begin the spring season, we have to be aware of the risks that are before us. OIL has recently seen a downward price break based on over supply, yet is up today on the Fed news. Gold and Silver are up nearly 2% today. The US Dollar is down nearly 0.75%.

How are we supposed to read all of these price variances as a trend or direction for trading signals?

Generally, on a day like today where the US Fed is driving the move, we can’t read into these signals clearly just yet. We can foresee a few things though. The Precious Metals are reacting to the fear side of the Fed move and the potential for a market pullback/correction. The US Dollar is reacting to the Fed news by pricing in an equity rotation from certain income sectors into others as well as the fact that the US Fed is now leading the race in terms of Central Banking Normalization. Of course, the EUR and GBP are pushing higher while the US Dollar retracts a bit.

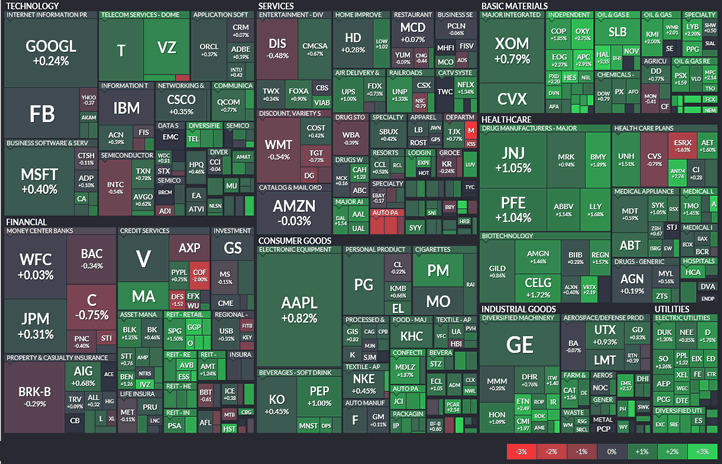

MarketProfile Table

What does this mean for equities? A quick look a the market profile of the general market shows us the following :

– Technology, Basic Materials, Healthcare, Industrial Goods, Utilities & Consumer Goods are strong

– Financials are underperforming (overall)

– Certain specific sectors (Discount Stores, Auto Parts Manufacturers & Department Stores) are underperforming (overall)

Remember though, this is but a single day’s price move in relation to the other 280 (roughly) trading days a year.

MarketProfile Weekly Table

Now, take a look at the Weekly market profile for the same market sectors. You’ll notice quite a difference between these two images.

The same sectors of the US market that are reacting to the Fed rate hike are not the “high fliers” that you might have thought. In fact, the overall market condition, currently, is relatively overbought. This is why many investors get lost in the data and news and try to chase trades that are not functional.

They don’t really have a system other than seeing what is moving and trying to catch a portion of that move. My Momentum Reversal Method (MRM) strategy is different in the sense that we look for proven setups in price action and generate highly accurate trading results. Not every trade is a winner. But most are and my track record shows you how I’m able to catch these moves early.

On a day driven by news, I suggest that most traders grab your favorite book and a cup of tea or coffee and wait for the real price triggers to generate trading signals. You should not try to make long term trading decisions on a “Fed Day” nor should you try to plan your investments on these price moves. The real market trends are masked by these “impulse moves” and you may need something like the Momentum Reversal Method (MRM) to assist you in making better trading decisions.

You can learn more about the Momentum Reversal Method at www.ActiveTradingPartners.com and review my historical and current trading signals there. I invite everyone to see if my system can assist you. As of today, my MRM trades are protected and running. Tomorrow may generate a few new entry triggers. The opportunity to find great trading signals is available each week, the trick is to wait for them to setup into the perfect entry pattern – then execute.

Enjoy the rest of the day folks!

By: John Winston

And Chris Vermeulen

www.ActiveTradingPartners.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.