Crude Oil Prices Volatility May Drive Expanded Stock Market Volatility

Commodities / Oil Companies Mar 13, 2017 - 03:52 PM GMTBy: Chris_Vermeulen

Last weeks move in Crude Oil, down over 8.8% was triggered by new “Record High” US inventory data and news that OPEC production cuts are near 85% compliance have prompted a breakdown. We have been expecting a breakout move for a few weeks and suspected production would outpace demand, as it has been for many months.

Last weeks move in Crude Oil, down over 8.8% was triggered by new “Record High” US inventory data and news that OPEC production cuts are near 85% compliance have prompted a breakdown. We have been expecting a breakout move for a few weeks and suspected production would outpace demand, as it has been for many months.

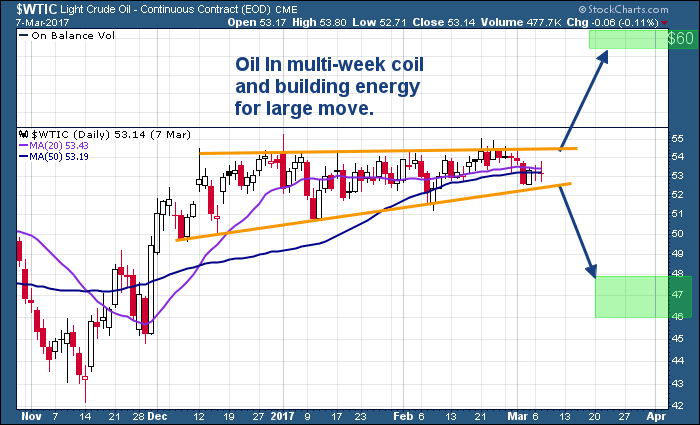

Below is the chart of oil we sent to followers of TheMarketTrendForecast service last week.

Price of oil after the breakdown which we traded SCO inverse fund

With the weekly EIA inventory report stated a huge 8.2 million barrel inventory increase while production levels are, overall, decreasing. This prompted a continued bearish price slide for Oil and Gas related equities. These moves will setup a number of superior opportunities in the future days and weeks for many traders. Initially, we want to be cautious of the impulse price moves and look to establish strategic trades when the opportunity is perfect.

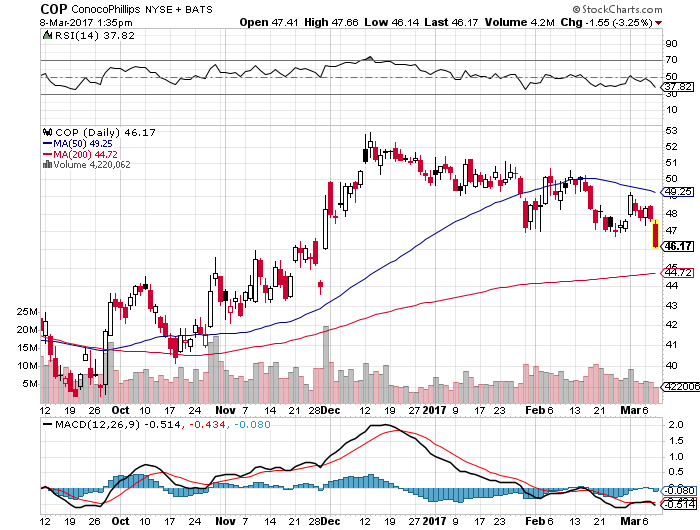

COP Chart

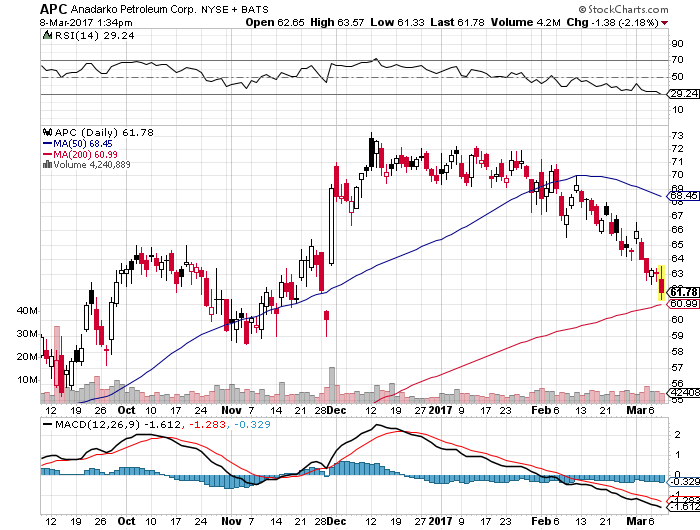

APC Chart

As these price moves play out over the next few days, we urge all traders to be cautious as we are expecting a dramatic increase in global market volatility to begin with just a few days. Our earlier analysis shows a very strong potential for dramatic volatility increases beginning near March 17th. This means these early moves may be “price traps” that catch inexperienced traders.

Most traders will attempt to follow this move and chase it lower. Even though there may be some validity to this method, we’ve found that the optimal entry is based on “Momentum Reversal Strategies”. In other words, waiting for the ideal timing and entry when the markets show signs that a major reversal is about to happen – we call it the Momentum Reversal Method (MRM).

This move in oil is an early warning that traders need to pay attention to. It will likely setup numerous MRM trade setup/entry opportunities over the next few days/weeks. These are the types of price anomalies that allow my MRM trading strategy to hone into finding great trades.

My Momentum Reversal Method (MRM) trading system allows me to follow these moves and take advantage of the most strategic entry positions for quick gains. Most trades last 3~25 days in length and equate to 7%~35% or more in profits. You can even stay up to date with my analysis and trading triggers with my SMS/Text Messaging alerts sent directly to your mobile device.

In closing, don’t chase this move in oil quite yet. Be aware that we are setting up for a much bigger move with much greater opportunities for traders. If you want to stay aware of these opportunities, then visit our web site to learn more, www.ActiveTradingPartners.com

By: John Winston

And Chris Vermeulen

www.ActiveTradingPartners.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.