Credit card providers still clawing back lost fee income….

Personal_Finance / Credit Cards & Scoring Mar 22, 2007 - 01:18 PM GMTBy: MoneyFacts

Michelle Slade, personal finance analyst at Moneyfacts.co.uk – THE money search engine, comments: “Almost one year on from the OFTs response to tackle ‘excessive’ default fees, the credit card market still remains unsettled. Battling with rising bad debts, Bank of England rate increases and a huge loss in revenue from the capping of default fees, credit card providers have been forced to look for other ways to maintain their income stream.

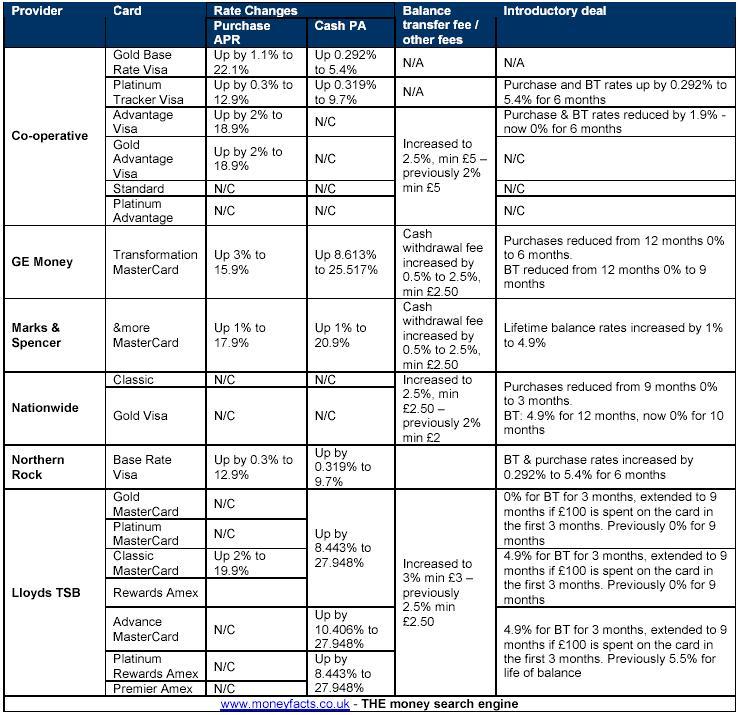

“In the last two weeks alone, six credit card providers have made major changes to some or all of their cards. Changes range from interest rate increases, by as much as 10% (on cash transactions), to shortening of interest free deals. If you delve further into the small print of their terms and conditions, cash withdrawal fees and foreign usage charges are rising, but perhaps the sneakiest of all is the requirement to make purchases as part of a 0% balance transfer deal.

Interest rate increases

With base rate increasing by 0.75% within the last year, this can not be the ‘excuse’ lenders use to raise interest rates by as much as 10%. With most credit card purchase rates at least three times that of base rate, the interest rate margin is far from small.

“Withdrawing cash from your credit card is a very expensive way to replenish your wallet, as you’re not just paying a high interest rate but also a withdrawal fee. For example GE Money has increased its cash rate to 25.517% and raised its withdrawal fee by 0.5%, while Lloyds TSB’s cash withdrawal rate has risen to 27.948%, an increase in some cases of up to 10.406%. Perhaps this shows lenders have cottoned on to the fact that in the current financial climate, many more people rely on their credit card to withdraw cash in order to make ends meet. It may also be that the card providers see the withdrawal of cash as an early warning sign that a customer may be encountering financial difficulties.

Balance transfer fees

“Every provider except Britannia BS now charges a balance transfer fee on 0% deals to new customers, something which until 18 months ago was virtually unheard off. These fees have been far from static, with many increasing the rate charged, so now 3% is not uncommon and many more removing any maximum cap.

“Such fees can provide significant upfront income to the card provider. Take for example a consumer transferring a balance of £3K; a 3% fee would generate £90.

Introductory deals

“The last two weeks has seen increased rates on some life of balance transfer offers and some quite dramatic cuts to the length of 0% deals. However the most significant change and perhaps the one which could potentially catch most customers unaware, comes from Lloyds TSB.

“Lloyds TSB has added covenants to its 0% for nine month deal. On its Gold or Platinum MasterCard, to qualify for the full nine months 0% you are required to make a purchase of £100 on your card within the first three months. Because the cheapest debt, i.e. the balance transfer, will be repaid first when your monthly repayment is made, your purchases will be immediately subject to interest, charged at 17.9% or 15.9% respectively and you will never be able to take advantage of an interest-free balance transfer deal.

“With fees and rates increasing and providers becoming more ‘creative’ with their terms and conditions, it is more and more important for consumers fully to understand any credit card deal before signing up.

“I wonder if the OFT really knew or appreciated the consequences of their default fee capping actions, as now many more borrowers are being hit by higher rates and fees, whilst those who abuse their credit facility are let off more lightly. Let’s hope they learn from the credit card market when deciding how to tackle overdraft fees.”

By Michelle Slade,

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.