EURUSD: When Price Pattern Trumps Other "Reasons"

Currencies / Euro Mar 08, 2017 - 06:31 PM GMTBy: EWI

Waves of market psychology often warn of trend changes before the news -- see how

Waves of market psychology often warn of trend changes before the news -- see how

This was an eventful week in politics, monetary policy and the markets -- and to many observers, the three seemed to be linked.

On Wednesday (March 1), the U.S. dollar did something it hadn't done in almost two months: It got stronger. Two reasons were behind the move, said analysts: The Fed's imminent rate hike, and, President Trump's widely-covered address to Congress:

"The dollar hit a seven-week high on Wednesday after hawkish comments from two Federal Reserve officials late on Tuesday increased expectations that the U.S. central bank is closer to raising interest rates." (CNBC, March 1)

"U.S. Treasury yields rose along with the U.S. dollar...as investors...gave a sigh of relief after President Donald Trump's speech to Congress." (Reuters, March 1)

It's easy to attribute the dollar's sudden strength to those two stories, yet this adds up to a classic case of what we call post-market action rationalization. Yes, these are logical and satisfying explanations, but here is a litmus test for both: Next time the Fed makes a hawkish comment or the President speaks, what will the dollar do then?

There is no way to answer this using conventional market-forecasting tools, other than to say: Let's wait and see how the market reacts. But there is a better way.

As early as Monday (February 27), Elliott wave patterns in EURUSD, the euro-dollar exchange rate, already warned that the rally in the euro/weakness in the dollar was getting long in the tooth.

Said our forex-focused Currency Pro Service:

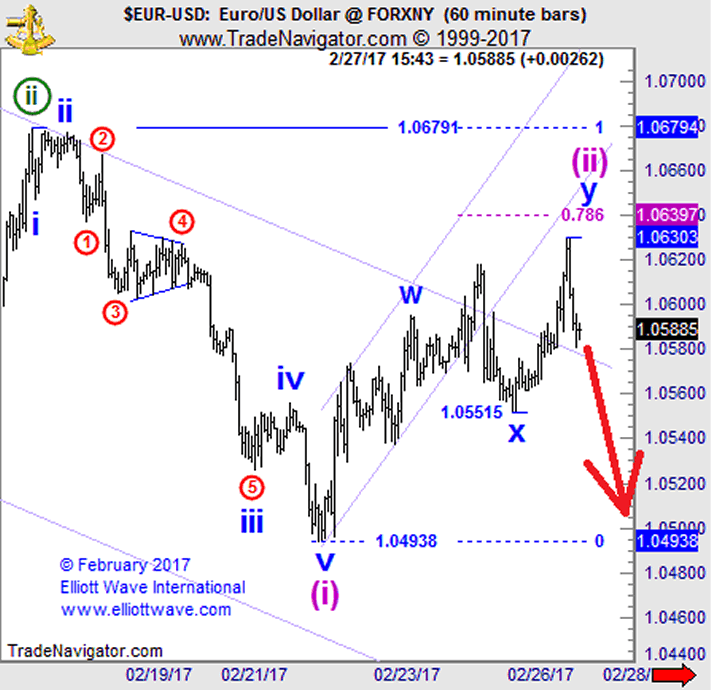

EURUSD

[Posted On:] February 27, 2017 03:47 PM

[Looking lower against 1.0679] (Last Price 1.0588): We are looking for a wave '(ii)' double zigzag correction top to form... And with an impulsive looking pullback occurring from 1.0630, a correction top may have been set already at that 1.0630 high point.

"Double zigzag" is Elliott wave speak for a complex correction. Even if you're not familiar with the method, the word "correction" tells you everything you need to know: It's a countertrend move that will likely be more than fully retraced once the trend resumes.

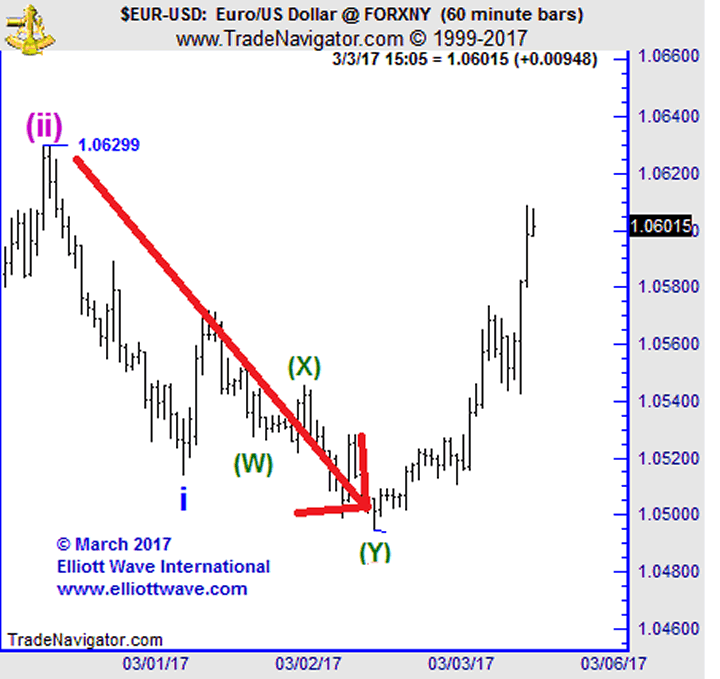

Which it did -- EURUSD fell, as expected. This March 3 Currency Pro Service chart shows you the extent of the euro decline/U.S. dollar rally (partial Elliott wave labels shown):

EURUSD

[Posted On:] March 03, 2017 03:14 PM

Now, it's hard not to notice that since that decline, EURUSD has rebounded. But again, the move is most likely part of (you guessed it) a correction.

So, no matter what you read in the news regarding the reasons for this latest euro rally, know that when the euro/dollar trend changes again, so will the mainstream's "reasons."

Introduction to the Wave Principle AppliedSee how Elliott waves can improve your trading In this free 15-minute video, EWI Senior Analyst Jeffrey Kennedy explains how to take the Wave Principle and turn it into a trading methodology. You'll learn the best waves to trade, where to set your protective stop, how to determine target levels, and more. |

This article was syndicated by Elliott Wave International and was originally published under the headline EURUSD: When Price Pattern Trumps Other "Reasons". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.