Overbought US Dollar Should Give Gold Price Support

Commodities / Gold & Silver Aug 11, 2008 - 07:22 AM GMTBy: Mark_OByrne

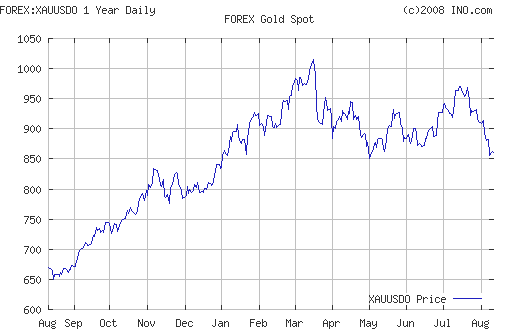

Gold finished trading in New York on Friday at $857.50, down $11.90 and silver was down 92 cents to $15.29. Gold has risen in Asian and early European trading and is trading at $860.10/860.60 per ounce (1230 GMT).

Gold finished trading in New York on Friday at $857.50, down $11.90 and silver was down 92 cents to $15.29. Gold has risen in Asian and early European trading and is trading at $860.10/860.60 per ounce (1230 GMT).

The continuing and sharp dollar rally has continued (and with the euro falling as low as 1.4927) and this is contributing to material weakness in the gold market. The dollar has its biggest one day rise against the euro since January 2001 and after today's further gains the dollar looks overbought in the short and medium term and this should result in gold being supported at the $850 level.

Oil is up some 1% today as the conflict in Georgia has created concerns regarding a disruption of supplies from the wider region.

$850/oz is the previous record high and was significant resistance for gold at the end of 2007. Technical analysis suggests that gold should remain above previous resistance and this level should remain fundamental support.

Physical buying is likely to reemerge as we are now at 14 week lows, well below the 200 day moving average and more price sensitive buyers (particularly in India) should again provide a floor to prices.

Investors would be wise not to think that stagflation or the worst financial crisis since World War II have disappeared. They have not and we appear to be experiencing another brief hiatus from financial and economic reality . Central bank buying and political jawboning has led to another dollar bear market rally and a massive bout of short covering. Stagflation remains a concern internationally and the ECB has again warned regarding inflation today. Central bank council member Klaus Liebscher said policy makers remain focused on the ``worrying'' level of inflation.

With negative real interest rates the dollar is likely to come under further pressure in the coming weeks, especially against the Swiss franc, some Asian currencies and most especially gold.

This Week's Data and Influences

Economic events this week pose risks to the dollar's most recent bounce - these include the release of international and TIC's reports for June, as well as the CPI report for July. There is also a host of economic activity reports are all expected to highlight that the economy still faces considerable downside risks. At the same time, however, the release of preliminary Q2 GDP data for the eurozone could result in the euro remaining weak..

Gold and Silver

Gold is trading at $860.10/860.60 per ounce (1230 GMT).

Silver is trading at $15.46/15.50 per ounce (1230 GMT).

PGMs

Platinum is trading at $1545/1552 per ounce (1230 GMT).

Palladium is trading at $333/338 per ounce (1230 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.