Oil Market - You Won't Get a Clearer Warning Than This One

Commodities / Crude Oil Mar 04, 2017 - 04:20 PM GMT  Technical analyst Clive Maund charts changes that portend a "brutal decline" in both the oil and precious metals markets.

Technical analyst Clive Maund charts changes that portend a "brutal decline" in both the oil and precious metals markets.

This quick update on oil is to point out that the latest oil COTs and Hedgers positions were at frightening extremes, as oil has struggled and failed, thus far, to break higher. This is viewed as meaning trouble—BIG TROUBLE—for the oil market, where we could see a precipitous drop as in 2014.

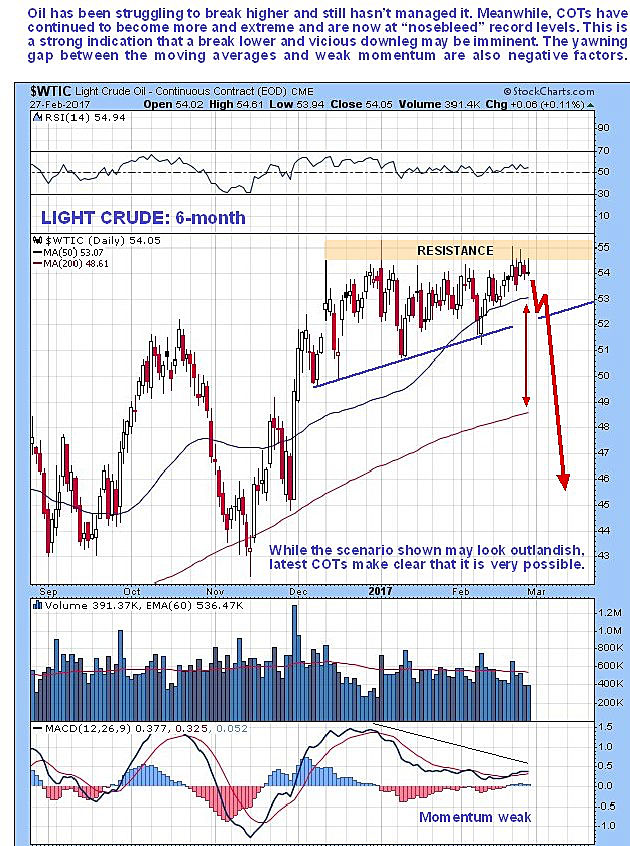

First, we review the latest 6-month chart for light crude, on which we see that oil has tried again to break above the line of resistance in the $55 area at the top of a triangular range and, so far, failed, and the quite large gap between the moving averages and weak momentum (MACD) are viewed as additional bearish factors. . .

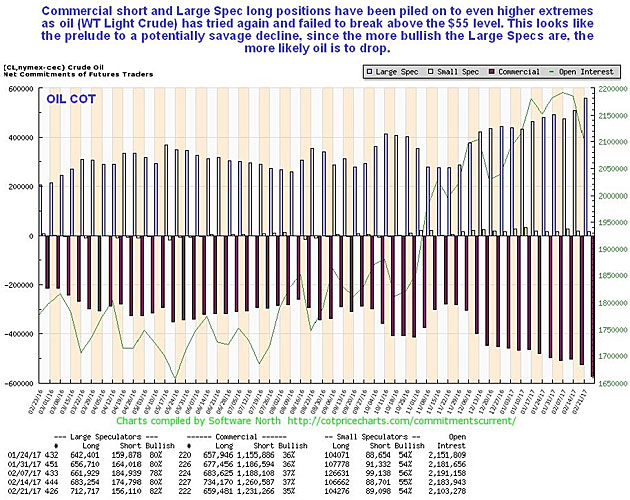

On oil's latest COT chart, we see that the usually wrong Large Specs are raving bullish, while the Commercials now hold record heavy short positions. . .

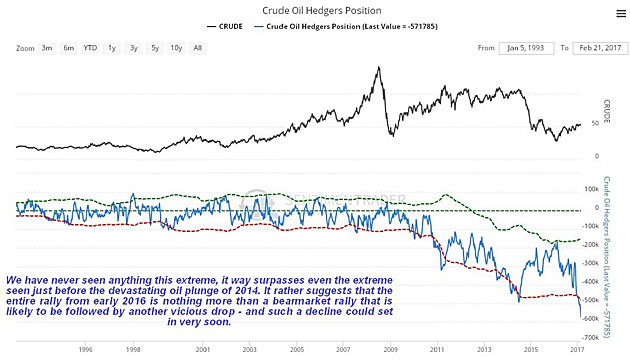

Meanwhile, the latest Hedgers chart, which is a form of COT chart going back much longer, shows positions at "off the scale" extremes. Even right before the 2014 bloodbath, they were not as extreme as they are now, and they were seriously extreme then.

Chart courtesy of www.sentimentrader.com

Meanwhile, oil stocks are not at all confirming the bullish attitude of Large Specs in the oil market. While oil itself has held up, oil stocks have gone into retreat. Superficially they look like a buy here, because on the 6-month chart for the XOI oil stock index, shown below, they can be seen to be oversold now, at support and above a rising 200-day moving average. This big disconnect between oil and oil stocks against the background of an extremely bearish COT structure suggests that oil is going to plummet soon.

The conclusion to all this is that a brutal decline in the oil price could be just around the corner, and the heavy drop in GDX today suggests that gold and silver are about to get taken down too (gold is completing a bearish Rising Wedge). Copper COTs call for a copper price smash too.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts courtesy of Clive Maund

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.