The Next Financial Implosion Is Not Going To Be About The Banks!

Stock-Markets / Financial Crisis 2017 Mar 03, 2017 - 01:50 PM GMTBy: Gordon_T_Long

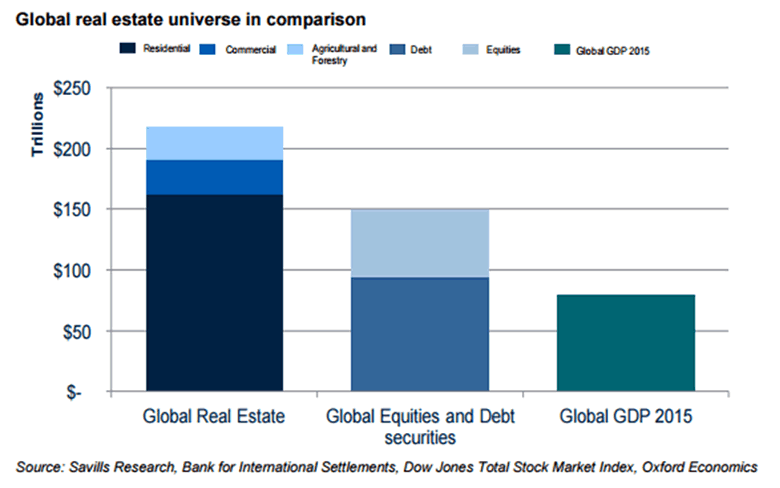

The Global Real Estate market dwarfs all financial markets by any comparison.

The Global Real Estate market dwarfs all financial markets by any comparison.

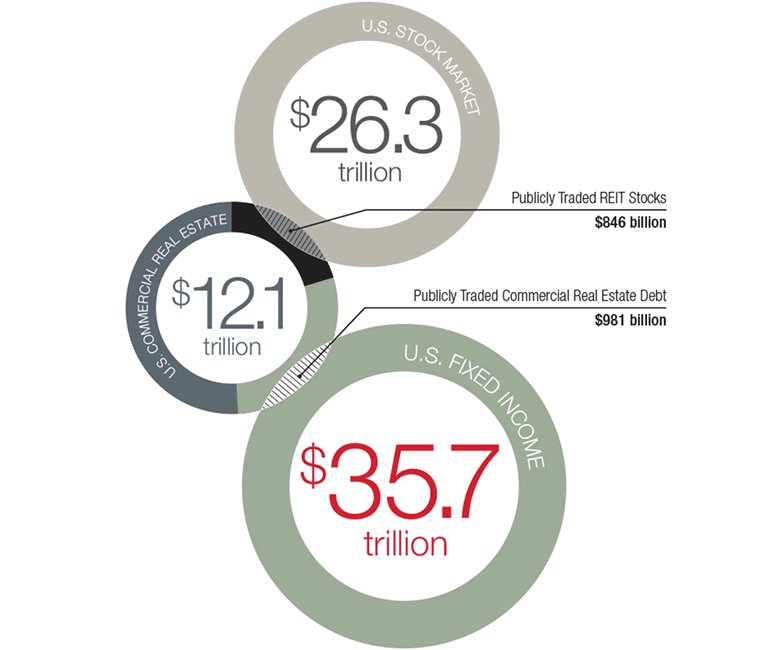

The Global Real Estate market being so large, it has always been stable and as such it is the favorite of institutions for long term investing - specifically Insurance companies, pensions, trusts endowments, small banks & credit unions etc. However, if it were to be destabilized only slightly it would have profound consequences globally, as well as in the US. The US Commercial Real Estate market presently approximates $13T or about one fifth the annual Global GDP.

A number of paradigms shifts currently underway and beginning to emerge could be just such catalysts.

The Us Commercial Real Estate market is so large it needs to be considered by sectors - Industrial, Office, Rental / Apartment and Retail. Through financing, regulations & codes, securitization products etc they are inexplicably linked. A shock wave in one will have consequences across the entire industry that can alter credit terms, financing availability, collateral requirements, rollover funding etc. In our new world of globalization, factors such as changes in foreign capital flows have a profound impact on any of the above variables.

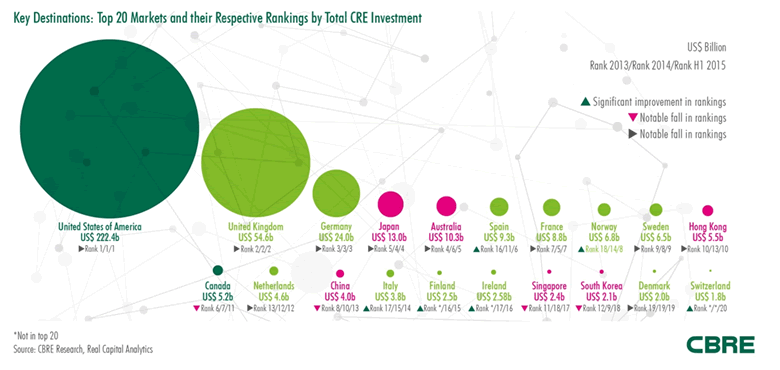

Few may appreciate that the US is a dominate destination for such foreign capital.

Banking problems abroad, such as the EU which would require repatriation of capital, could impact prices and rollover financing quickly since commercial real estate is typically financed on 5 and 10 years terms so that supporting collateral values are maintained. This is a requirement because owners can and do simply "walk" away when they fail and collateral is the only protection for investors. The collateral being solely the value of the remaining real estate asset.

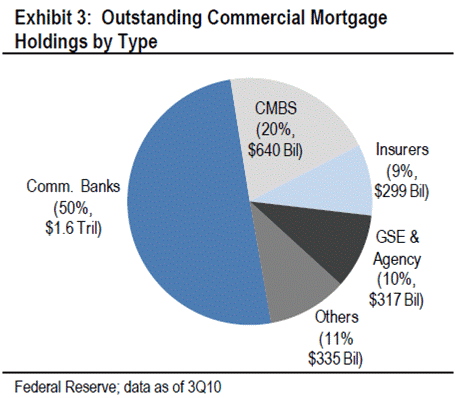

In the US,though banks are both financiers and owners, it is important to realize that the 8-12,000 small banks & credit unions along with Insurance companies, Pension Funds, Endowments, Trusts, Foundations etc are actually the ones "on the hook" for the bulk of US Commercial Real Estate.

WHAT COULD GO WRONG?

Because of the securitization complexity of the industry financed through MBSs, Leveraged Loans, Collateralized Loan Obligations, Synthetic CLOs etc., the risk exposures are immense. The US housing industry imploded via comparably simple securitization product structures such as CDS's, CDO and ABSs. Few professionals would claim they have a grasp or understanding of all the creative and secretive means used to finance these modern multi-billion dollar commercial real estate projects. These projects are based on underlying assumptions of growth, rates, prices, sustained trends etc..

Let's focus as an example on just one of several Paradigm Shift occurring presently, and in just one of the retail commercial real estate spaces, that is US Retailing.

This Paradigm is about the massive technological advancement of the overlapping of the internet, online shopping and robotic kiosks. This change alone is monumental but not yet fully accounted for by those sitting on the trillions of dollars of investment assets who cannot react as fast as the technology adoption is occurring.

- Since 1995, the number of shopping centers in the U.S. has grown by more than 23% and GLA (total gross leasable area) by almost 30%, while the population has grown by less than 14%

- According to Forbes , currently there is close to 25 square feet of retail space per capita (roughly 50 square feet, if small shopping centers and independent retailers are added). In contrast, Europe has about 2.5 square feet per capita. (10-20 times)

- According to the real estate consulting firm of J. Rogers Kniffen Worldwide Enterprises, about 400 of America's 1,100 enclosed malls will fail in the coming years. Of the survivors, about 250 will thrive and the rest will struggle. Likewise as an example, "Macy's probably needs 500 of its roughly 800 existing stores" - Jan Kniffen ,

Over-storing can be traced back to the 1990s when the likes of Walmart, Kohls (KSS), Gap (GPS) and Target (TGT) were expanding rapidly and opening new divisions, according to Ken Perkins, the head of Retail Metrics, a research firm that advises institutional investors on the sector.

“In my opinion, the housing bubble of the mid 2000s allowed consumers to take out tons of cash from their homes and spend robustly even though incomes were stagnant. This masked the over-stored nature of the retail landscape“.

AMERICAN REALITY IN PICTURES

I recently produced a video for MATASII subscribers documenting a trip to a well established local mall in my area. The video is called "A Rapidly Rupturing Retail Reality!" It brings home the stark reality of the above statistics.

If you haven't been to a mall in a while it will shock you. The retail landscape is changing rapidly and dramatically.

The recent closure of all 140 Sports Authority stores in the US is part of a trend showing no sign of letting up any time soon. Consumers continue to shop online like never before, as traffic dwindles in brick and mortar stores.

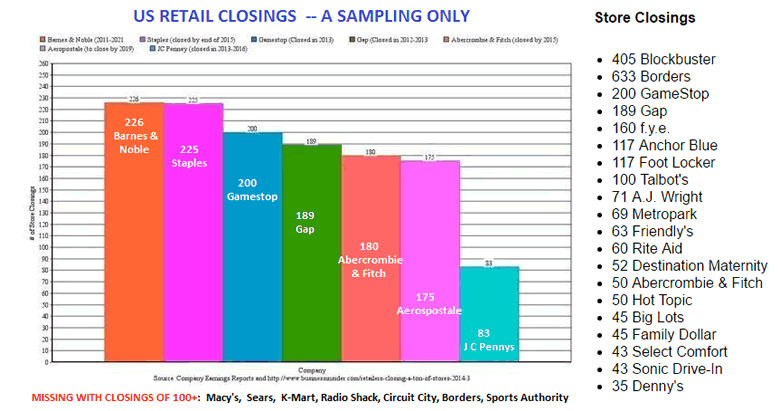

Long-term store closing plans have already been announced by a slew of major brick and mortar retailers, including The Gap (NYSE:GPS), Barnes & Noble (NYSE:BKS), Office Depot (NASDAQ:ODP), Walgreens (NASDAQ:WBA), American Eagle Outfitters (NYSE:AEO), and Aeropostale (OTCPK:ARO). Furthermore, Wal-Mart's (NYSE:WMT) plans include closing 154 US stores, while they currently operate 4,627 US stores as of June 30, 2016. Kohl's (NYSE:KSS) has closed 18 locations with Macy's (NYSE:M) shuttering another 40. The chart below shows an idea of the sheer amount of closures occurring in recent years, as well as the upcoming.

TSUNAMI OF PROBLEMS ON THE HORIZON

Despite all the current market euphoria based on the Trump administration's promises of "dramatically" reduced taxes, fiscal spending and massive regulatory reduction - the stark reality is still:

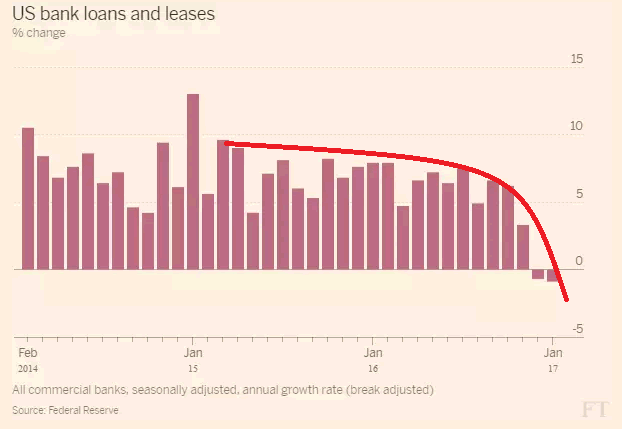

- The US Credit Cycle shows clear signs of having turned,

-

The US Business Cycle is mature and in the Final Stage for this cycle,

-

There is a strong chance of a US Recession in late 2017 or 2018 which is historically long overdue,

-

There is a Coming "Property Tax Wave" based on city and local fiscal requirements,

-

Interest Rates Rising,

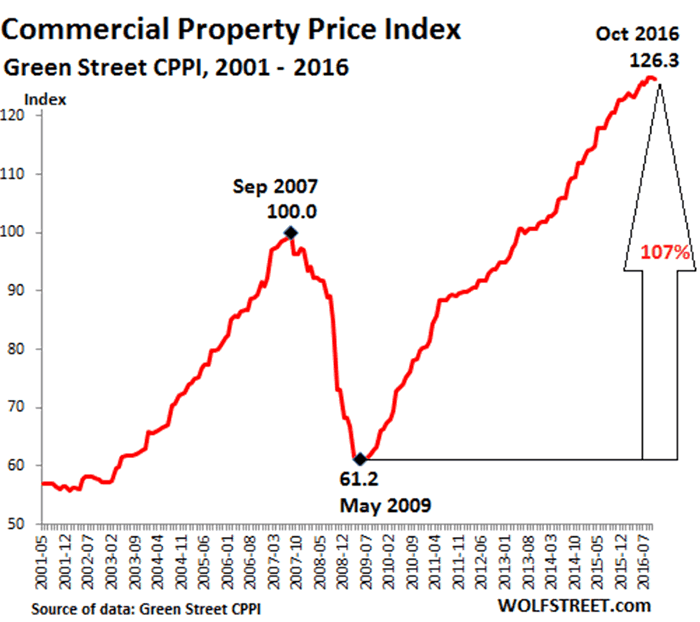

- Part of what’s been driving the recovery in property investment sales, in addition to improving fundamentals, has been the availability of cheap debt, as the Federal Reserve has kept interest rates at historically low levels. But the era of cheap money can’t last forever and if interest rates begin to climb up, especially if they shoot up quickly and unexpectedly, that can put a damper on investors’ interest in commercial real estate assets.

-

10-Year Loans Coming Due,

- The industry will also be facing a timing issue as approximately $188 billion in commercial mortgage loans reach maturity between 2015 and 2017. Researchers at ratings firm Fitch estimate that unless interest rates rise at a quicker-than-expected pace, borrowers on most of those loans will be able to refinance. But in some cases, especially with under-performing assets or assets in tertiary markets, borrowers may be forced to come up with extra equity to cover valuation gaps.

-

-

CMBS Underwriting Deteriorating,

- After several years of minimal CMBS issuance, everyone is happy to see conduit lenders back in the market. But with the competition heating up between banks, life insurers and conduit shops to lend money to real estate borrowers, underwriting standards have started to loosen. A little of that dynamic may be healthy, but if underwriting quality deteriorates more and more the industry may find itself back where it started, in 2007/2008. After all, this is a cyclical business.

-

TRIA Extension,

-

The Terrorism Risk Insurance Act (TRIA), which was signed into law following the destruction of the World Trade Center on September 11, is set to expire at the end of this year. If it’s not extended it will force property owners to seek terrorism insurance in the private market, where insurance companies have not been especially keen to agree to cover losses for events that are truly unforeseeable and that can result in billions of dollars’ worth of damage.

-

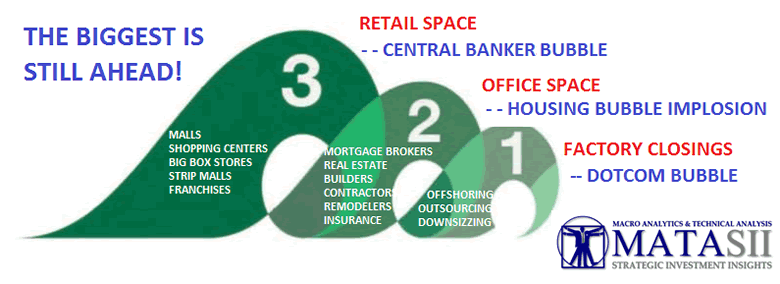

THREE WAVES

Those who live close to the ocean know that waves often come in sets. Many things come in sets of three with the third wave being the biggest and worst.

This is likely what lies ahead as the US Retail Commercial Real Estate (CRE) wave soon washes ashore!

Most fundamentally, the reason for this occurring is:

- The De-Industrialized of America and a resulting "gutted middle class" that is now economically "tapped out",

- Demographics have a older generation that historically starts spending less as well as an overall shrinking working age population,

- The impact of the internet and robotics on job destruction.

THE COMING FINANCIAL IMPLOSION IS NOT GOING TO BE ABOUT THE BANKS!

The coming financial implosion is not going to be about the large international banks. It is going to be dominated by Insurance Companies, Pensions Plans, Trusts & Endowments and small banks & credit unions. These are the institutions with the bulk of their invested assets in some form of US commercial real estate!

The potential for this Third Wave is much different and more profound than any previous financial crisis we have yet (or likely to ever) experience!

Signup for notification of the next MACRO INSIGHTS

Gordon T. Long

Publisher - LONGWave

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2017 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.