Macroeconomic Outlook and Gold

Commodities / Gold and Silver 2017 Mar 03, 2017 - 01:37 PM GMTBy: Arkadiusz_Sieron

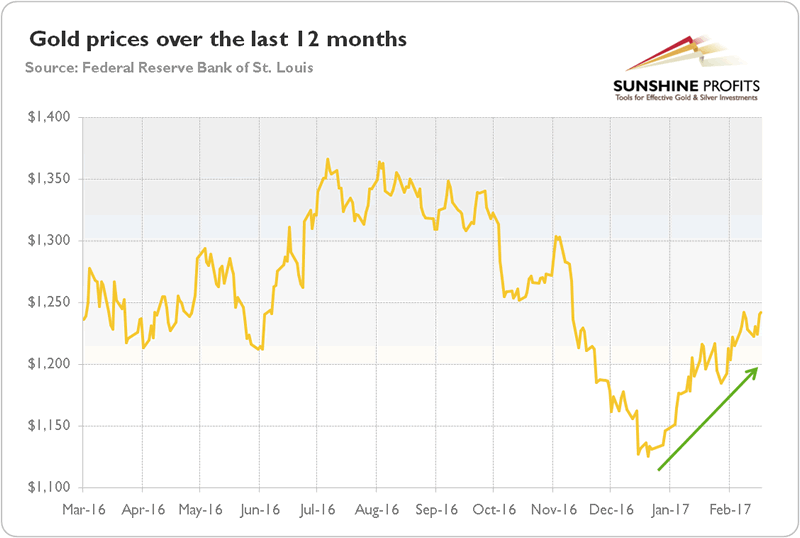

As everyone knows, the aftermath of the U.S. presidential election was a disastrous time for the yellow metal. However, gold rebounded at the beginning of 2017, gaining almost 6 percent in January and rising further in February, as one can see in the chart below.

As everyone knows, the aftermath of the U.S. presidential election was a disastrous time for the yellow metal. However, gold rebounded at the beginning of 2017, gaining almost 6 percent in January and rising further in February, as one can see in the chart below.

Chart 1: The price of gold over the last year (London P.M. Fix).

From the fundamental point of view, there are three main reasons for gold's strength: uncertainty about Trump's policies; the upcoming elections in key European countries; and, finally, the pullback in the U.S. dollar and the real interest rates, as the fear that the Fed will be behind the curve, letting the inflation genie out the bottle. Let's analyze them in detail now.

Surely, the new administration in the United States creates uncertainty for the future, breeding fear and pushing investors into the arms of gold. However, periods of transition always increase the uncertainty, at least temporarily. Ok, Trump's rhetoric may be slightly unusual, but his actions should hardly surprise anyone, since the new president generally fulfills his promises (in contrast to other presidents, actually).

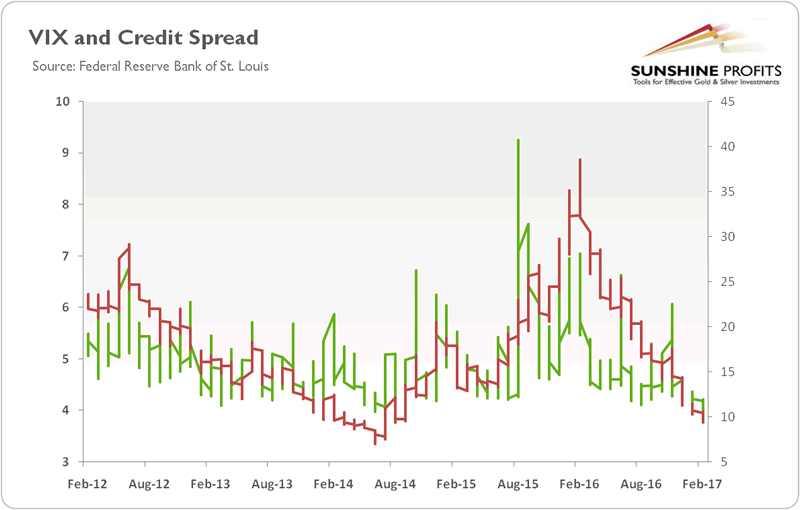

We agree that many geopolitical threats, like elections in the Netherlands, France or Germany, may spur some safe-haven demand for gold. However, when they unfold, the uncertainty should diminish, which implies that the positive impact for the price of the yellow metal will not last long, as it was in case of Brexit. And investors should not forget that although political uncertainty may be quite elevated, the market risk premium stays at a very low level, remaining in a downward trend since the presidential elections, as the chart below shows.

Chart 2: The market volatility reflected by the CBOE Volatility Index (green line, right axis) and the credit spread reflected by the BofA Merrill Lynch US High Yield-Option Adjusted Spread (red line, left axis) over the last five years.

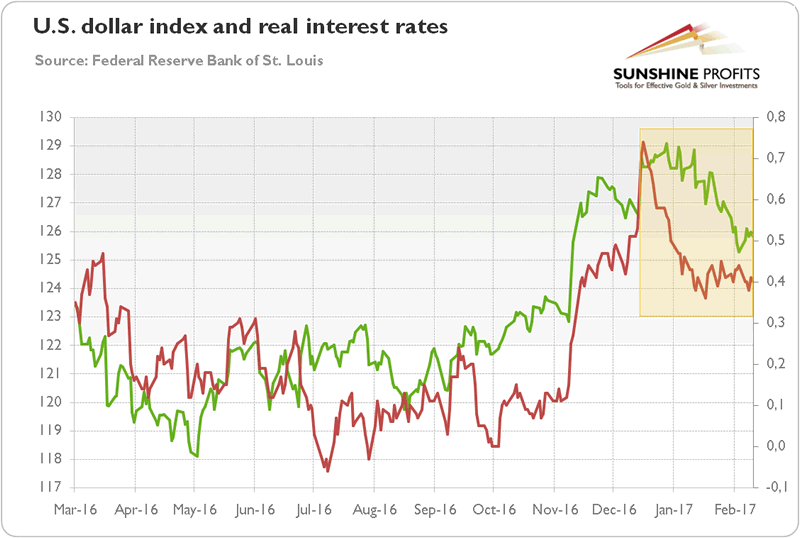

Given the tight correlation between the greenback and gold, it seems that it was the recent pullback in the U.S. dollar and real interest rates which led the price of gold to rally higher.

Chart 3: The U.S. dollar (green line, left axis, broad Trade Weighted Index) and the real interest rates (red line, right axis, 10-year inflation-indexed Treasuries) over the last 12 months.

While these drivers of gold have corrected recently, we do not see a change in their upward trend, yet. This is why we keep our bearish outlook for the gold market in the medium term. The key here is the still-prevailing monetary policy divergence between the Fed and other major central banks. The U.S. central bank will likely continue its gradual tightening cycle, while the BoJ and the ECB will probably maintain their dovish stance. In December, the FOMC members expected three hikes this year. Although they are always too optimistic, two increases look reasonable. For us, the Fed really wants to deliver them, especially since it was sure that inflation “will rise to 2 percent over the medium term” at its February meeting. We expect the first move in the first half of the year, once the Fed is able to assess the impact of Trump's fiscal policy on the economy (unless, of course, negative shock occurs).

To sum up, although gold seems to be at crossroads right now and there are both bullish and bearish arguments for its prospects, we believe that the broad macroeconomic picture remains unpleasant for the gold market. In line with our previous edition of the Market Overview about reflation and gold, we are going to see the uptick in the real interest rates and global economic activity led by the U.S., which would favor the greenback, while being a headwind for gold. The political uncertainty could support the gold prices for a while, but such fear does not last forever. Hence, if the U.S. dollar and real interest rates keep their upward trend, gold will decline. Contrarily, if the reflation narrative is just unwarranted market hype and these trends change, gold should increase further. However, a replay of 2016 is not likely - although there are some similarities (the Fed hike in December and the fading expectations of further moves), the scene is different: the U.S. presidential election and British referendum are behind us, the fear about the negative interest rates policy is gone, and there are early harbingers of global reflation. This is why - unfortunately for gold - we are not exactly where we were in the first quarter of 2016.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.