Art Market Bubble Bursting – Gauguin Value Collapses 74% To $22 Million

Commodities / Gold and Silver 2017 Mar 01, 2017 - 03:35 PM GMTBy: GoldCore

– Art Market Bubble Bursting?

– Art Market Bubble Bursting?

– Russian Billionaire Takes 74% Loss On “Investment”

– $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008

– Christie’s auctioned the work at its evening sale in London

– Global art sales plummet, but China rises as ‘art superpower’

– China soon to dominates global art and gold market

– Art price volumes doubled since 2009

– As currencies debase super rich seek out stores of value

– Gold remains accessible store of value for all

– Stocks, bonds and many assets at record prices

– Gold half it’s real price in 1980

Russian billionaire Dmitry Rybolovlev paid €54 million or $85 million for a landscape by Paul Gauguin in a private transaction in June 2008. Yesterday, he incurred a whopping 74% loss on his store of value “investment” as reported by Bloomberg:

Gauguin’s 1892 landscape “Te Fare (La Maison)” fetched 20.3 million pounds ($25 million), including commission, at Tuesday evening’s sale of Impressionist and modern art at Christie’s in London. Rybolovlev will net about $22 million based on the hammer price. The auction house had estimated the value at $15 million to $22.4 million. The buyer was a client of Rebecca Wei, president of Christie’s Asia.

The Gauguin was one of four Rybolovlev pieces offered for sale on Tuesday. Another work, a Mark Rothko painting, will be auctioned March 7.

Rybolovlev — with a fortune of about $9.8 billion according to the Bloomberg Billionaires Index — invested about $2 billion in 38 works, from Leonardo da Vinci to Pablo Picasso. They were procured privately by Swiss art dealer Yves Bouvier, known for creating a network of tax-free art storage warehouses in Singapore and Luxembourg.

Two years ago, Rybolovlev sued Bouvier, alleging he was overcharged by as much as $1 billion, Bloomberg reported. Since then the Russian fertilizer magnate has been unloading works he acquired, some at record prices. He has already sold three for a loss totaling an estimated $100 million. The five works at Christie’s, all estimated below their purchase prices, were expected to deepen the loss.

The art industry is closely watching the London auctions running this week and next as the year’s first test of the global market following a significant contraction in 2016. Christie’s sales fell 17 percent to $4 billion pounds ($5.4 billion) last year, while Sotheby’s reported a 27 percent decline to $4.9 billion. Both houses saw steep declines in their two biggest categories: Impressionist and modern art, and postwar and contemporary art.

In May 2015, we warned about the bubble in the the fine art “investment market or indeed the Hyperinflation in Art Investment Market after a Picasso sold for $179 million.

At the time, we pointed out that ultra high net worth and family office buyers may be viewing the fine art market as a form of super safety deposit box and as a way to protect their wealth from market crashes, systemic risk and the risk of bail-ins and deposit confiscation today.

Since then global art sales plunged in 2016 as the number of high-value works of art sold dropped by half, while China regained its status as the world’s top market according to an annual report recently released by Artprice. Art auctions worldwide totalled $12.5 billion (11.8 billion euros) last year, down 22 percent from $16.1 billion in 2015, the report said.

The world’s biggest database for art prices and sales, working with Chinese partner Artron, attributed the drop to a plunge in the number of works worth more than $10 million each – from 160 in 2015 to just 80 last year. “On all continents, sellers are choosing a policy of ‘wait-and-see,’” Artprice CEO Thierry Ehrmann said.

In recent years, very wealthy art buyers may have believed art was less risky than holding increasingly debased digital currencies in banks that may be subject to deposit bail-ins.

As a diversification, art has some merit as it is not correlated with financial assets, but only as a very small part of an overall portfolio.

Given the scale of risks facing investors and savers today we are advising clients to increase allocations to gold from the standard 5% to 10% allocation to higher allocations of as much as 25% to 30%.

Most investors and savers cannot afford a Picasso or a Gauguin but the proven, timeless store of value that is physical gold remains accessible.

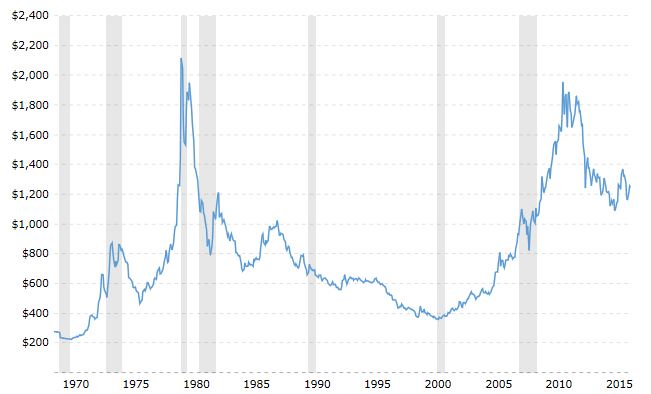

Gold in USD Adjusted for Inflation 1970-2017 – Macrotrends.net

Not only is it accessible but it remains relatively cheap from a long term perspective, at nearly less than half its real price high of $2,200 price in 1980 when adjusted for the considerable inflation of the last 37 years.

Gold is also relatively cheap compared to most stock, bond and property markets, many of which are at all time record highs. These highs are in large part due to quantitative easing (QE), zero and negative percent interest rates and global currency debasement on a scale never seen in history.

Access Breaking News and Research Here

Gold Prices (LBMA AM)

01 Mar: USD 1,246.05, GBP 1,007.18 & EUR 1,182.50 per ounce

28 Feb: USD 1,251.90, GBP 1,006.90 & EUR 1,180.79 per ounce

27 Feb: USD 1,256.25, GBP 1,011.16 & EUR 1,187.41 per ounce

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

22 Feb: USD 1,237.50, GBP 994.21 & EUR 1,178.22 per ounce

21 Feb: USD 1,228.70, GBP 988.86 & EUR 1,166.16 per ounce

Silver Prices (LBMA)

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

22 Feb: USD 18.00, GBP 14.47 & EUR 17.14 per ounce

21 Feb: USD 17.89, GBP 14.41 & EUR 16.97 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.