Stocks and Precious Metals Charts - God and Mammon and Power

Stock-Markets / Financial Markets 2017 Feb 26, 2017 - 04:08 PM GMTBy: Jesse

"The world is ours, we are its lords, and ours it shall remain. As for the host of labor, it has been in the dirt since history began, and I read history aright. And in the dirt it shall remain so long as I and mine and those that come after us have the power.

"The world is ours, we are its lords, and ours it shall remain. As for the host of labor, it has been in the dirt since history began, and I read history aright. And in the dirt it shall remain so long as I and mine and those that come after us have the power.

There is the word. It is the king of words— Power. Not God, not Mammon, but Power. Pour it over your tongue till it tingles with it. Power.”

Jack London, The Iron Heel

"What is good? All that heightens the feeling of power in a man, the will to power, power itself. What is bad? All that is born of weakness. What is happiness? The feeling that power is growing, and that resistance is overcome."

Friedrich Nietzsche, The Antichrist

"No one can serve two masters, for he will hate the one and love the other, or he will be devoted to the one, and be neglectful of the other; and so you cannot serve both God and Mammon."

Matt 6:24

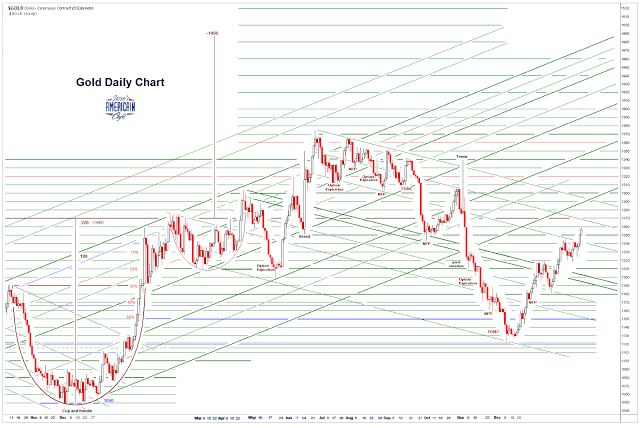

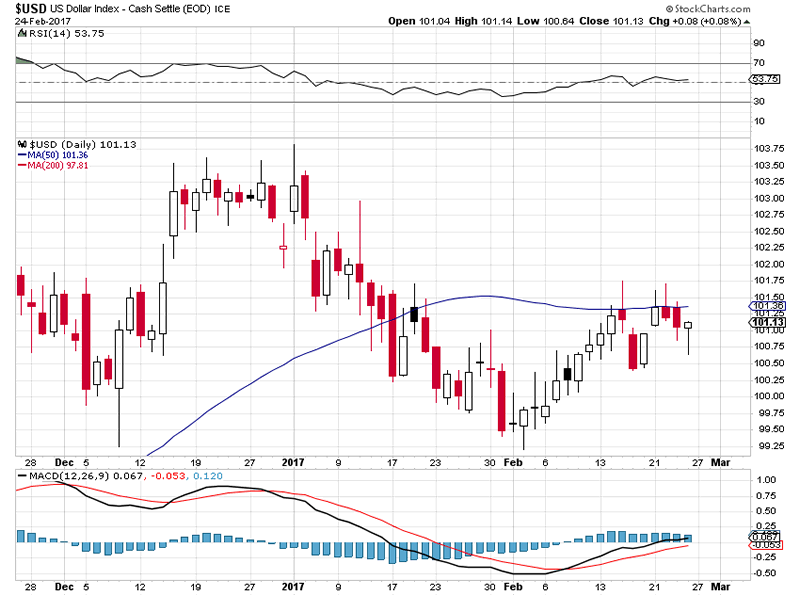

Gold stuck a close over the 1250 mark, largely on dollar weakness.

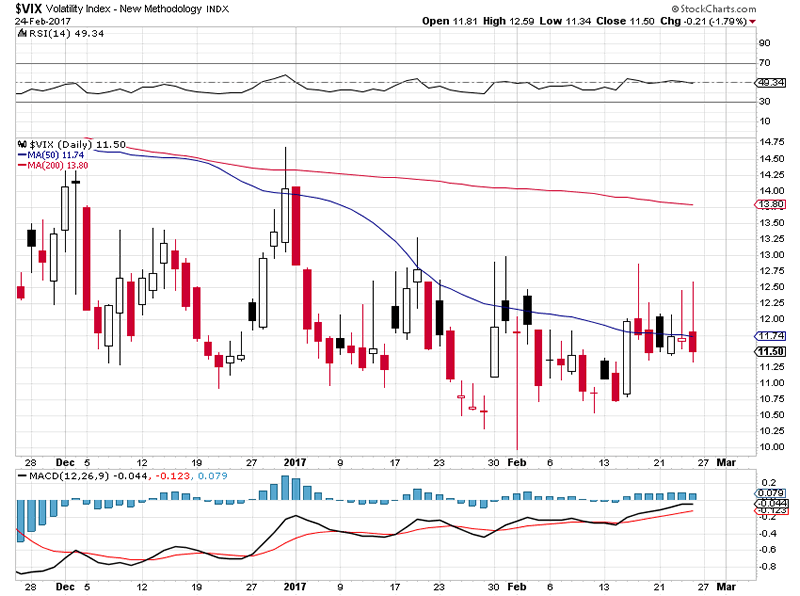

Once perceived volatility starts picking up, I suspect that gold and silver will obtain enough energy to take on the more important downtrend and psychological resistance on the charts, around the 1290 to 1300 level.

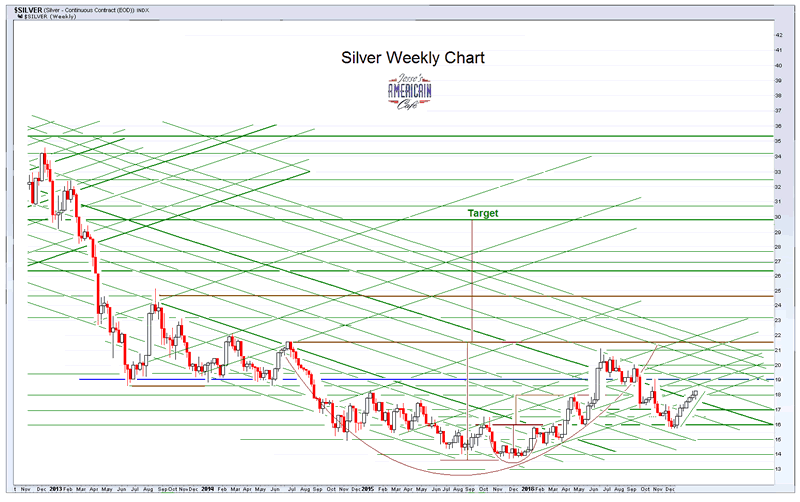

For the higher volatility silver weekly chart, I have an eye on 21.50 to 22. If silver can take out those levels and hold them decisively, then one must look at a potential run to 30.

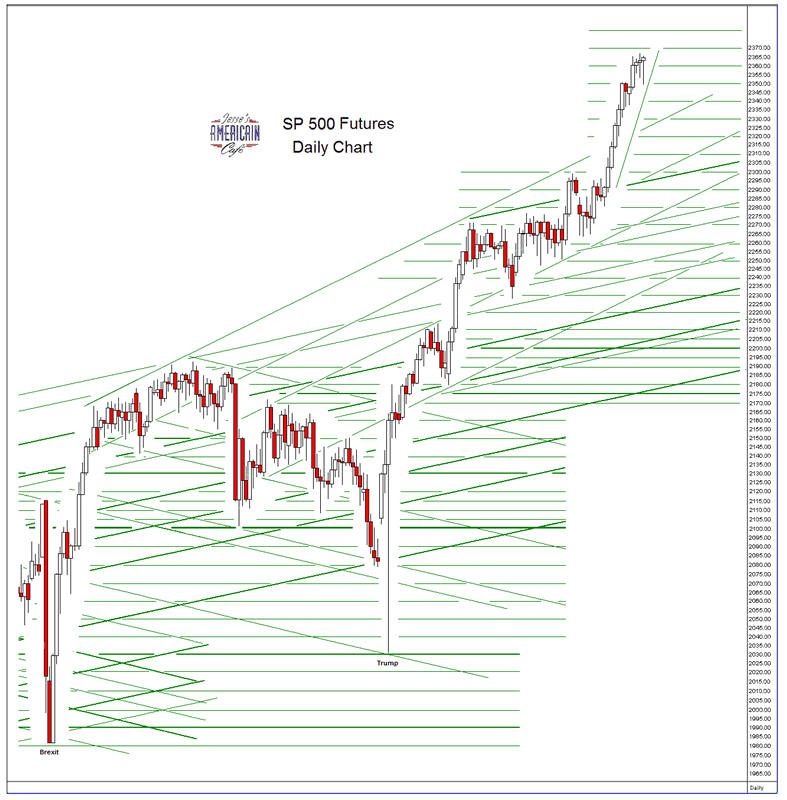

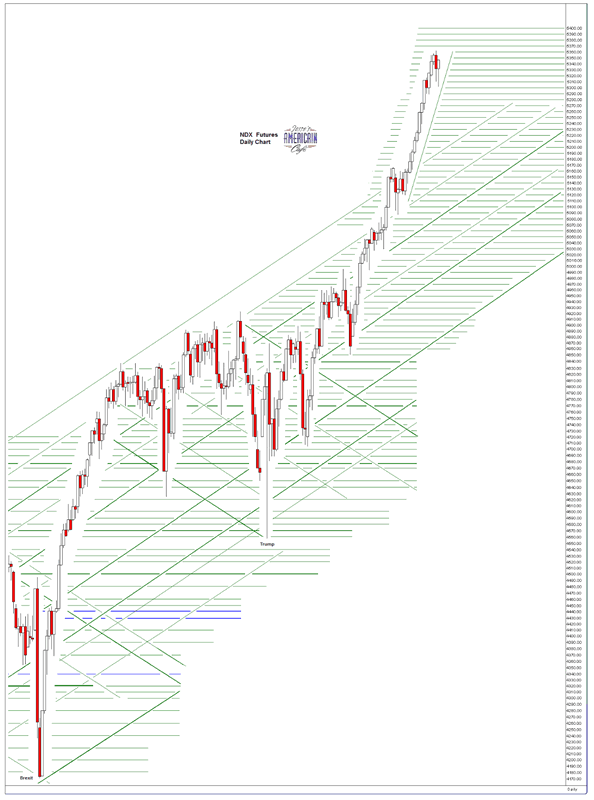

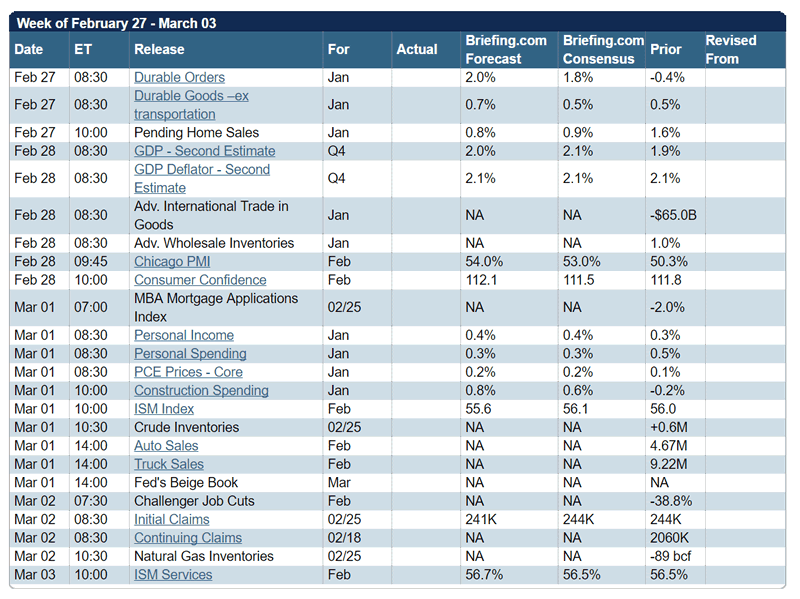

Stocks are pausing here as I had suggested they might. I don't quite see a big downtrend developing yet. I do think a market break is possible in March. If that does happen, then we will have to start keeping a close eye on how the markets and the policymakers react to it, with some potential thoughts towards a bleak October.

But that is far, far ahead of ourselves. For now things seem relatively stable. But there are some clouds on the horizon.

There were few clouds on the horizon here today, as the skies were sunny and blue, and the temperatures were in the high 70's, a surprisingly nice surprise for February.

Try to remember to feed God's creatures, and the poor, and to pray for those poor in spirit, who do not even comprehend their spiritual poverty.

Have a pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2017 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.