Is it Stock Market Autumn 2007 All Over Again?

Stock-Markets / Stock Market 2017 Feb 22, 2017 - 07:09 PM GMTBy: Graham_Summers

While the financial world continues to delight in Trump Mania, the US economy has rolled over into recession.

While the financial world continues to delight in Trump Mania, the US economy has rolled over into recession.

I realize this sounds completely insane. After all, stocks are at new all time highs and a full 61% of Americans view the economy as “strong.”

Unfortunately, this is perception, not reality. When it comes to the economy today, Americans are like the guy who hasn’t realized the party is over, and keeps dancing while others are already starting to leave.

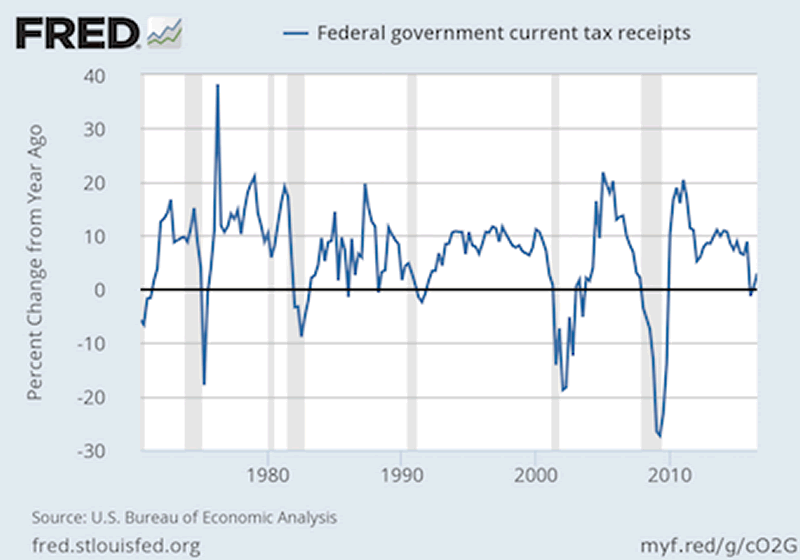

Consider Government tax receipts. This is perhaps the single most objective economic metric on the planet. If the economy is growing, business are being started, jobs are being created, and more people and entities area paying taxes.

However, if the economy ISN’T growing, the growth rate of this metric quickly rolls over.

Feast your eyes on this. Tax receipts have turned negative (Year over Year) for the FIRST time since the financial crisis. And as you’ll note, this has NEVER happened outside of a recession in 40+ years.

Don’t let that little uptick fool you. This is a blip in multiyear downtrend (note tax receipts PEAKED in 2010 and have been trending lower ever since).

The last time this happened was RIGHT. BEFORE. THE. FINANCIAL. CRISIS.

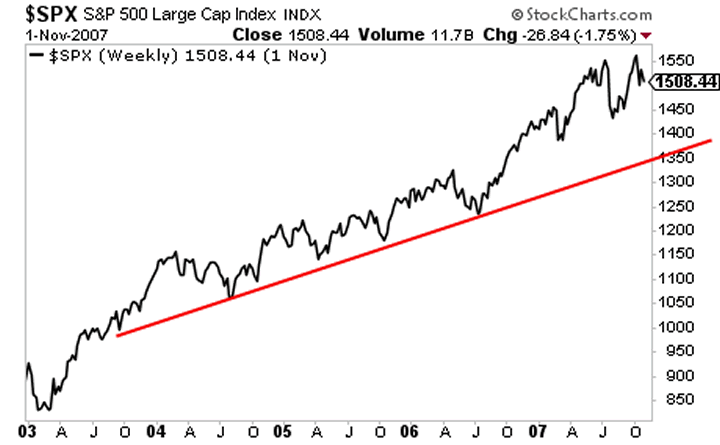

You know what else happened back then?

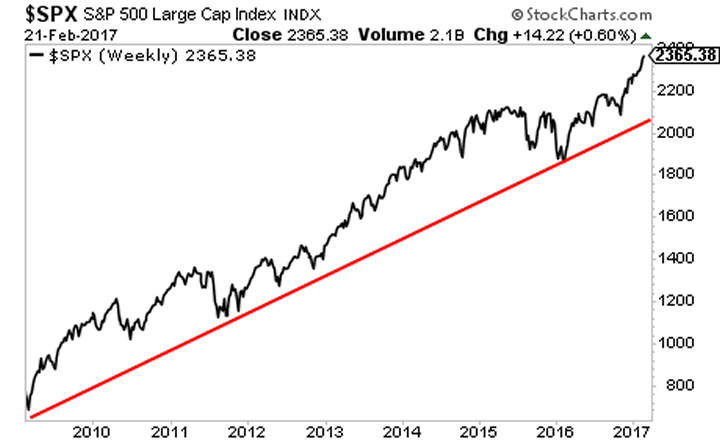

Stocks had just hit new all-time highs, having become overbought and massively overextended from their long-term trendline.

Kind of like today.

This is the sort of environment in which Crashes happen.

And while the odds are low that we get an actual Crash… this environment is more conducive to Black Swan events than any other in the last seven years.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Heck earlier this week, we just closed out an 18% winner this morning.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.