Warning Signs Of Instability In Russia

Politics / Russia Feb 20, 2017 - 02:58 PM GMTBy: John_Mauldin

BY GEORGE FRIEDMAN AND JACOB L. SHAPIRO : Geopolitical Futures forecasted that 2017 will be “an inflection point in the long-term destabilization of Russia.” After just six weeks, there are clear signs that this forecast is right on track. You can read more about GPF's outlook for Russia in This Week in Geopolitics (subscribe here for free).

BY GEORGE FRIEDMAN AND JACOB L. SHAPIRO : Geopolitical Futures forecasted that 2017 will be “an inflection point in the long-term destabilization of Russia.” After just six weeks, there are clear signs that this forecast is right on track. You can read more about GPF's outlook for Russia in This Week in Geopolitics (subscribe here for free).

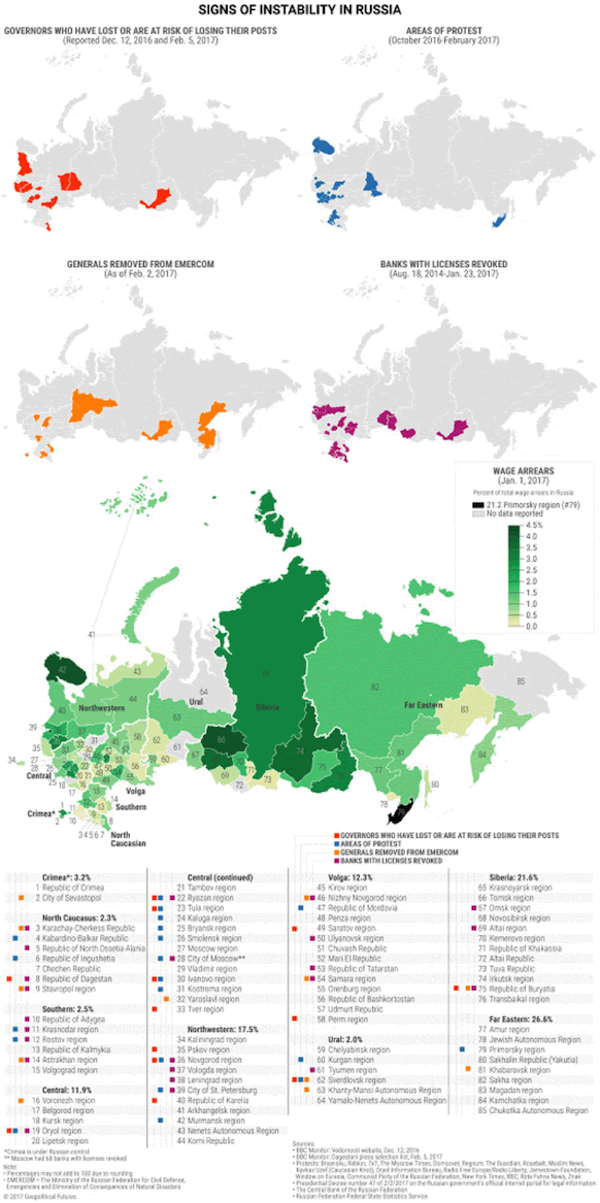

Russia has four areas of instability: the distribution and prevalence of wage arrears, pressure on its banking system, low-level social and economic unrest, and government purges.

The map below shows these developments.

Wage Arrears

The bottom part of the Russia map shows wage arrears by region. “Wage arrears” is a fancy term for workers not being paid. In December 2016 (the last month for which Russia’s Federal State Statistics Service has data), total wage arrears amounted to 2.7 billion rubles (roughly $46.4 million in USD).

There are two regions where this is a big issue. The first is port regions. Primorsky region, whose capital Vladivostok is Russia’s largest port on the Pacific, has the worst incidence of wage arrears. It accounts for 21.2% of the country’s total. The second area is Siberia.

The import of these wage arrears is not their size in absolute figures. It is where Russian workers are not getting their paychecks. This points to a bigger issue.

Russia’s economy is highly regionalized. More than a fifth of Russia’s wealth comes from Moscow and its surrounding areas. The central government keeps the Russian Federation together by redistributing wealth to the interior.

The first places to expect economic trouble are port and interior regions. The port regions will struggle because trade is the oxygen that port cities need to breathe. (And Russia’s main export, oil, is facing prolonged low prices.) The interior will struggle because the central government will have less money to allocate.

This forces a lose-lose choice for Moscow: austerity or cuts to military spending

The wage arrears map is an indication that GPF’s model for Russia is accurate. If the model is accurate, the probability of the forecast coming to fruition greatly increases.

Russia’s Banking System

The decline in the price of oil has had a negative effect on the Russian banking system. Incidents of Russian depositors applying for deposit insurance have greatly increased. And some regions are suffering from banking crises.

In Tatarstan, for example, the region’s leading bank suspended operations in December. This deprived both individual depositors and businesses of access to funds. As a result, workers weren’t paid and bankruptcies increased. It also required intervention from the central government.

The map points out regions where over 100 banks have had their licenses revoked. By itself, this does not present a clear picture. Russia’s banks could be under severe pressure. The fact that the main fund used by Russia’s Deposit Insurance Agency has decreased in value by 75% in two years gives this argument some weight.

Russia could also be cleaning up its banking system. This would mean shutting down banks involved in illegal or irresponsible activity. But in view of the other negative indicators, the former is more likely.

Protests in the Countryside

Economic difficulty can lead to social unrest. In the Russian countryside, small-scale protests have been observed. Small incidents have also occurred in major cities like Moscow and St. Petersburg. The map plots these areas of protests.

There are two points worth noting. First, none of these protests have shown any sort of wider national organization. Second, they are relatively small (often in the low hundreds). They’re important but should not be overstressed. The Russian countryside is not singing the songs of angry men, nor is it close to doing so.

There are, though, clear signs of discontent bubbling to the surface. These signal a frustration with salary cuts, unpaid wages, and social services that have been reduced by Moscow. Small events are the canary in the coal mine… and spell trouble for the Russian government down the line.

Purges

The last two items on the map show political and security purges ordered by President Vladimir Putin. Russian media have described these moves as a “major political reshuffle.” That is a euphemism for what it really is.

The point of a purge is to get rid of potential rivals and install loyalists in their place. On Feb. 6–7, two governors from Perm and Buryatia regions were forced to resign. Vedomosti, a leading Russian-language business daily, reported that more resignations and removals are expected in the regions identified in the map.

Unlike wage arrears, these purges are not confined to any one geographic area. Some are in Siberia, some are in the regions toward the Caucasus, and others are in the immediate vicinity of Moscow. That Putin feels unsure enough of his position to carry out these kinds of political changes reveals a great deal.

Presidential elections are coming for Russia. They will likely be held in 2018. Like President Xi Jinping in China, who is using “anti-corruption” as a pretense to remove rivals ahead of his reappointment at this fall’s Communist Party Congress, Putin is securing his political position in the name of fighting corruption.

The purges are not limited to governors who hold power in the Russian Federation’s political system. Putin has also removed generals from the Interior Ministry as well as the Ministry of Civil Defense, Emergencies and Elimination of Consequences of National Disasters. These ministries are responsible for forces that are used to control domestic social order and quell protests.

Ensuring the loyalty of such ministries is essential and must be done before serious problems emerge. A total of 16 generals have been removed, according to RIA Novosti, and two of those were also removed from military service.

Writing on the Wall?

It is not GPF’s forecast that the Russian Federation is in danger of imminent collapse. None of these data points by themselves indicate that GPF’s forecast has been confirmed. They simply highlight Russia’s underlying weakness. They also explain why Putin, who just a few months ago was strutting on the world stage, has gone somewhat quiet

Prepare Yourself for Tomorrow with George Friedman’s This Week in Geopolitics

This riveting weekly newsletter by global-intelligence guru George Friedman gives you an in-depth view of the hidden forces that drive world events and markets. You’ll learn that economic trends, social upheaval, stock market cycles, and more… are all connected to powerful geopolitical currents that most of us aren’t even aware of. Get This Week in Geopolitics free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.