Lindsay Stock Market 12-year Low

Stock-Markets / Stock Market 2017 Feb 13, 2017 - 04:22 AM GMTBy: Ed_Carlson

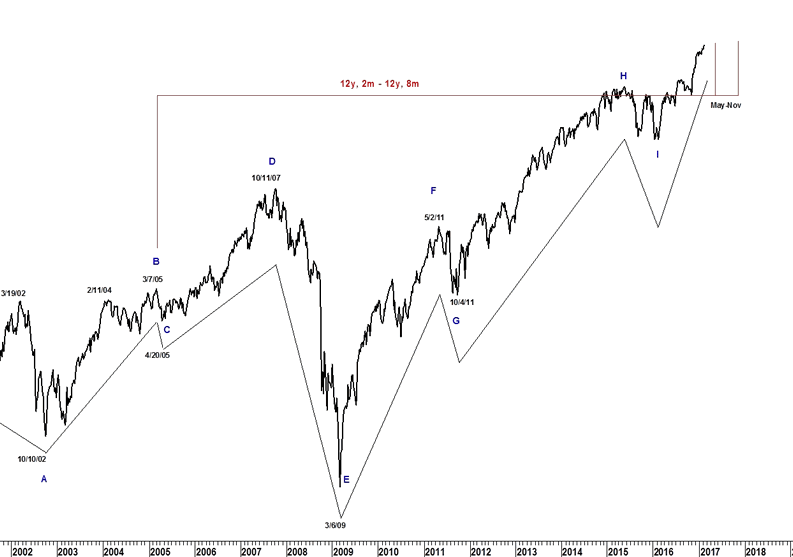

As often noted, the first step in a Lindsay forecast is determining the long-term intervals; 15yr (15yr-15yr, 11mo) for highs and 12yr (12yr, 2mo-12yr, 8mo) for lows. Counting a 12yr interval from point B of Lindsay's Long Cycle on 3/7/05 forecasts a significant low in the period May-November 2017. However, the 1/3/17 Market Update laid out a forecast for a significant high (using both a 15yr interval and Basic Movements) in the period April-August 2017. And to further confuse things, a Three Peaks/Domed House pattern - combined with a Hybrid Lindsay forecast - seem to be pointing to a high within hours of now. How do we reconcile all of this?

While the Hybrid forecasts are fairly reliable (see below) the 3PDh model can be less than precise and it's already fooled us once during this pattern. Odds are the model is pointing to the same high as the April-August forecast. That means either the 3PDh high will be late or the April-August high will be early. Normally my default choice would be the Basic Movements pointing to April-August but sometimes the Standard Time Spans upon which they are based gets run over during the 3PDh pattern. Let's not get bogged down here… We know there is a Hybrid forecast for a high now. We also know that an important cycle low is due near March 21 (1/30/17 Market Update). There isn't enough time for a basic decline to play out between now and March 21 (222 days is the minimum). We will have a much better idea as to the expected path of the Dow once we see if the index can make a higher high before it starts heading down into the 12yr low mentioned above.

Hybrid Lindsay

I continue to look for an important high in the Dow either last Friday (February 10) or early this week.

The last Hybrid forecast for a lowwas published in the 1/9/17 Market Update, Inauguration Low? It forecast a low in the period January 16-20. The Dow traded sideways-to-down following December 20 until a low was printed January 19. The Dow has been pushing to higher highs since that low.

Try a "sneak-peek " this month at Seattle Technical Advisors.com

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2017 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.