Major Money Managers Have A Grim Outlook For The US Stock Market

Stock-Markets / Stock Market 2017 Feb 09, 2017 - 01:24 PM GMTBy: Jeff_Berwick

Several months ago we were following closely as billionaire after billionaire warned of financial calamity to come.

Whether they were warning of a downturn, debt jubilee, or taking large positions in precious metals stocks, guys like Stanley Druckenmiller, Crispin Odey, Paul Singer and even the trillionaire himself, Jacob Rothschild, were outspoken in their stark view of the markets.

Now, we have Stanley Druckenmiller again who sold off his entire gold position the night of Trump’s victory, just buy back the same position!

Initially, he thought Killary would end up winning, but according to one interview, after Trump got elected, he thought the Donald would be in favor of lowering corporate tax rates and cutting back regulations. He viewed this as positive for both equities and the dollar and it is the reason he sold his position in the yellow metal.

The fact that he has gotten back into the same trade now shows that the billionaire may be dissatisfied with the way Trump’s policies are moving.

Druckenmiller, who manages his own personal $4.7 billion fortune, isn’t alone. Although his net worth is less than some of his money managing counterparts, Larry Fink the CEO of BlackRock also just turned unexpectedly bearish. BlackRock is the world’s largest asset manager, with control of over $5.1 trillion in assets.

Its CEO was just quoted by Reuters as saying, “I see a lot of dark shadows.The markets are probably ahead of themselves." Fink added that "disruptions to trade are a possibility" and that "we're living in a bipolar world right now.”

He also said that he expects to see the Federal Reserve raise rates this coming June and perhaps once again before the year is over.

If markets are going to react anything like they did the last time the Fed raised rates when the US market subsequently had the worst January in history, we should certainly be taking note.

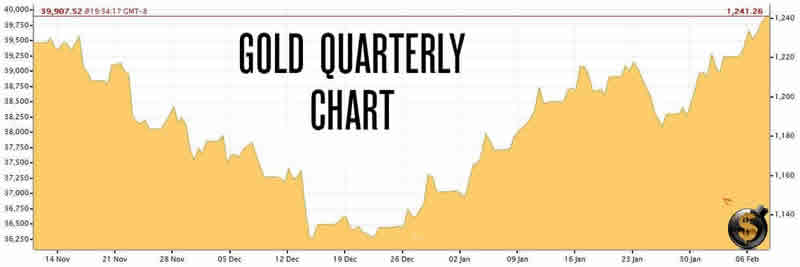

Lately, gold prices have significantly rebounded and hit three month highs.

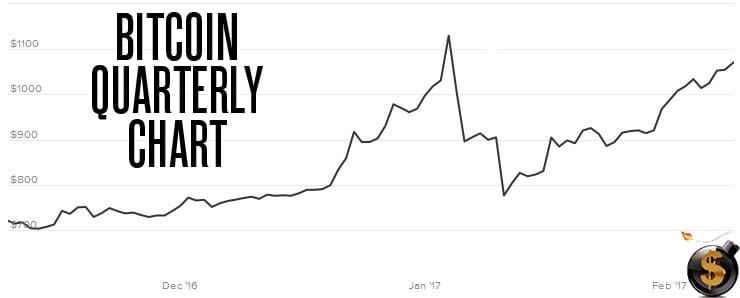

Bitcoin too has jumped back above $1,000 to hit a one month high and is within striking distance of its 2017 high.

Gold and bitcoin are typically used as a safe haven to hedge against a falling dollar or inflationary scenario. Movements to the upside are a good indication that it is time to either add to your position or start a new one if you haven’t already.

With the uncertainty about stocks you will want to get the most updated information on how to protect yourself from a potential downturn through investments in other cryptocurrencies and specific stock picks.

TDV and our Senior Analyst Ed Bugos, provide those via our newsletter which you can subscribe to HERE.

Also, join us this coming February 24th in beautiful Acapulco, Mexico for our TDV Internationalization and Investment Summit. It includes numerous speakers on the forefront of blockchain technology, asset management, precious metals and trading strategy including G. Edward Griffin, David Morgan, Bix Weir and many more. You can see more HERE.

After that, we invite you to stay a bit longer and get a ticket for Anarchapulco, the largest voluntaryist conference in the world HERE. It starts the following day and will be held under the same roof of the five-star Hotel Mundo Imperial and finishes on February 28th with Cryptopulco, an entire day devoted to blockchain and cryptocurrencies with all the world’s top experts.

We look forward to seeing you here in a few weeks!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.