According to “Unmassaged Data” the US Economy is Rolling Over

Economics / Recession 2017 Feb 09, 2017 - 05:06 AM GMTBy: Graham_Summers

Yet another “unmassaged” data point has shown that the US economy is rolling over.

If you’ve been reading me for a while you know that one of my biggest pet peeves is the fact that headline US economic data (GDP growth, unemployment, inflation, etc.) is massaged to the point of being fiction.

For this reason, in order to get a real read on the economy, you have to look for economic metrics that are unpopular enough that the beancounters don’t bother adjusting them.

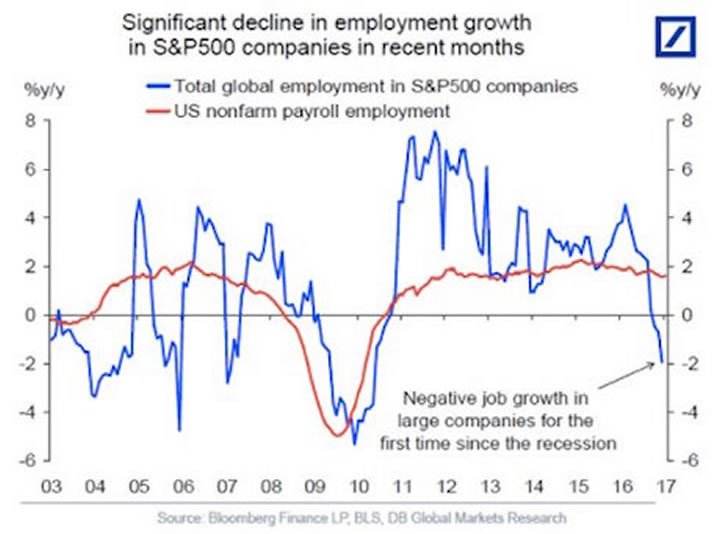

Case in point, look at the latest employment trend for S&P 500 companies (H/T Sam Ro).

For the first time since the Great Recession, employment growth has turned negative at S&P 500 companies. Also note the divergence between this metric and the headline unemployment rate.

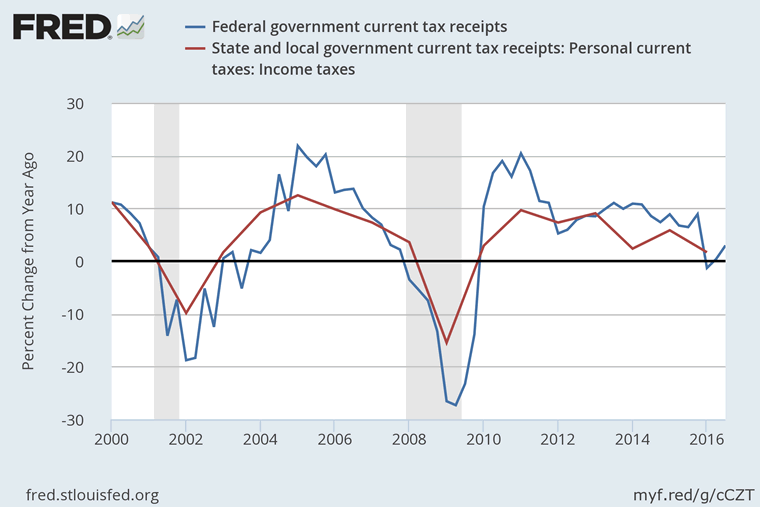

This is confirmed by tax receipts (another unmassaged data point). The argument here is simple: when employment is growing, more people are paying taxes and tax receipts rise. When employment is falling… tax receipts drop.

What is the above chart telling you?

The reality is that the “Trump trade” or the idea that the US economy is about to explode higher based on Trump taking office, is completely and utterly off-base.

At best any policies Trump implements will begin to have an effect 12 months from now. And those investors who are trading as though GDP growth of 5% is here now are about to get annihilated.

If you’re looking to profit from the REAL impact Trump’s Presidency will have on the market (and the massive opportunities this situation presents), we’ve put together a Special Investment Report outlining three investment strategies that will produce major returns as a result of Trump’s economic policies.

It’s titled How to Profit From the Trump Trade and we are giving away just 1,000 copies for free.

To pick up your copy, swing by

http://phoenixcapitalmarketing.com/trump.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.