Bad News For Stock Bulls.. the US is Sliding Into Recession

Economics / Recession 2017 Feb 07, 2017 - 08:27 PM GMTBy: Graham_Summers

While the financial media was applauding last week’s jobs number, those of us who actually look into the details can tell you that the report was complete fiction.

While the financial media was applauding last week’s jobs number, those of us who actually look into the details can tell you that the report was complete fiction.

The headline number of 227,000 was largely crafted through seasonal adjustments, NOT actual job creation. At a minimum 170,000 of those jobs were created in an excel spreadsheet by bean counters, NOT by businesses hiring.

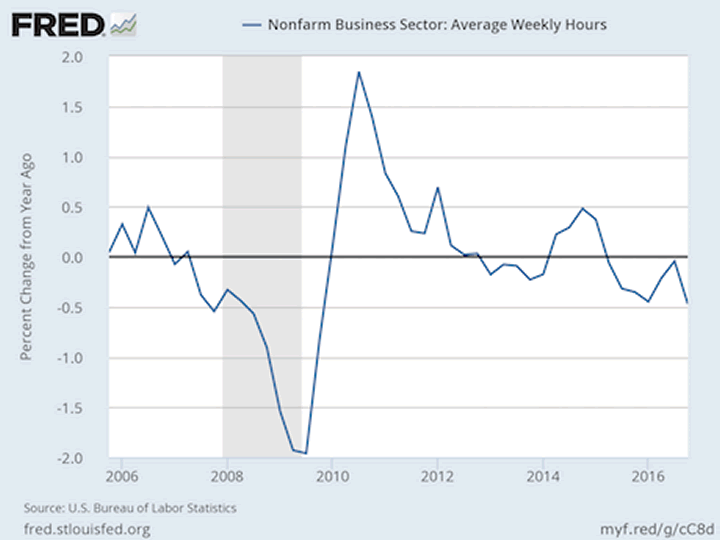

Indeed, a non-massaged metric, average weekly hours fell by the largest percentage since the 2008 recession.

There is simply no way to spin this as a positive.

The fact is that the GDP growth of 4%-5% is not just around the corner. The US most likely slid into recession in the last three months. GDP growth collapsed in 4Q16, with a large portion of the “growth” coming from accounting gimmicks.

Consider the following:

- Tax receipts indicate the US is in recession.

- Gross private domestic investment indicates were are in a recession.

- Retailers are showing that the US consumer is tapped out (see AMZN’s recent miss).

- UPS, another economic bellweather, dramatically lowered 2017 forecasts.

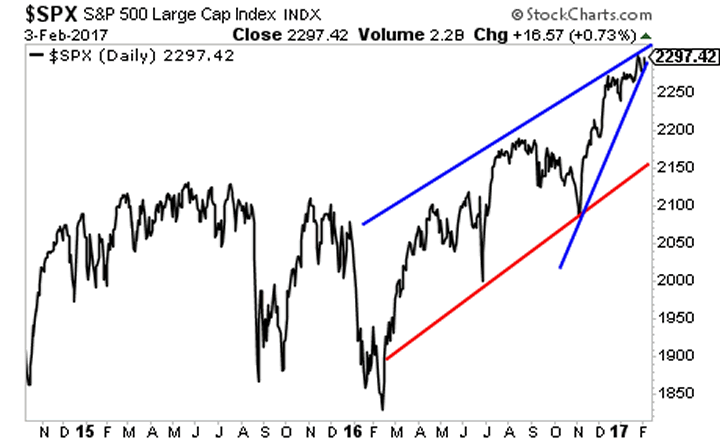

Put simply, the REAL economy is rolling over. But stocks are holding up as if we’re about toe enter an economic utopia.

THAT IS NOT GOING TO HAPPEN. And if you’re investing based on it, you’re in for a LOT of pain.

If you’re looking to profit from the REAL impact Trump’s Presidency will have on the market (and the massive opportunities this situation presents), we’ve put together a Special Investment Report outlining three investment strategies that will produce major returns as a result of Trump’s economic policies.

It’s titled How to Profit From the Trump Trade and we are giving away just 1,000 copies for free.

To pick up your copy, swing by

http://phoenixcapitalmarketing.com/trump.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.