America’s Aging Demographics

Politics / Demographics Feb 07, 2017 - 06:04 PM GMTBy: Rodney_Johnson

It was a long time ago, way back in 1950.

It was a long time ago, way back in 1950.

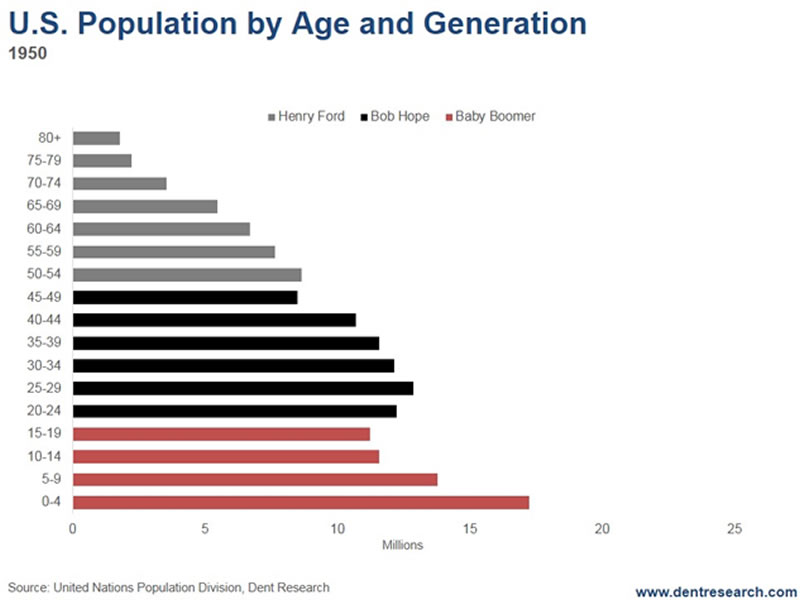

The United States was recovering from World War II while facing down a new enemy, China, on the Korean Peninsula. We were an exporting powerhouse that fortunately escaped the war with all of our production capacity intact. And, our population was experiencing a baby boom.

We were growing our wealth, expanding our military capabilities, and increasing our population. Even after the ravages of war, we had a tremendous group of workers 20 to 49 years old, and an explosion of babies on the way.

We were a strong, young nation. Anything seemed possible.

The picture today is starkly different. Our demographics (and their impact on programs like Social Security and Medicare) are undeniable. We’re an aging nation facing some big problems…

The chart below shows the U.S. population by age in 1950, with generations differentiated by color: Henry Ford (50-and-older, gray); Bob Hope (black); the boomers (red).

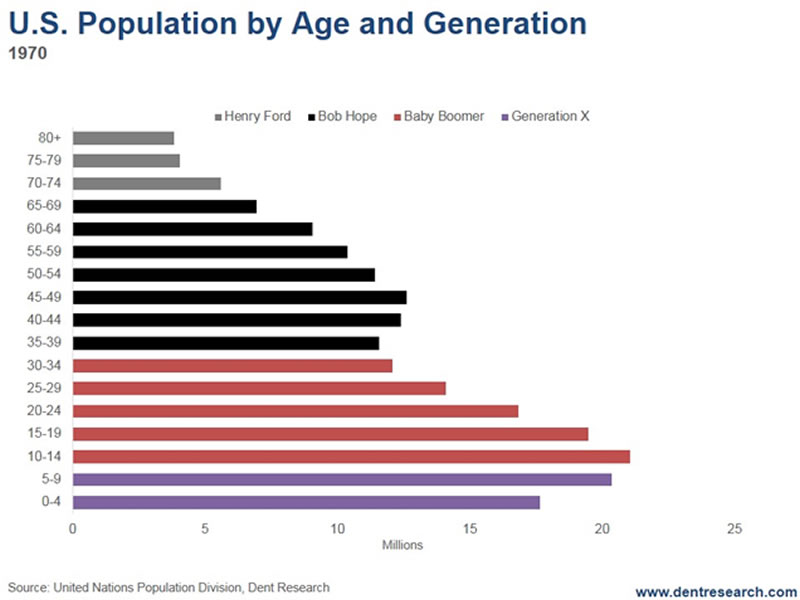

Twenty years later, by 1970, the birth wave was over and had started to recede. The next generation, GenX, shown in purple in this next chart, was on the way, and their numbers were much smaller than the boomers.

At this point, our demographics and social programs were still balanced. President Roosevelt introduced Social Security in the 1930s, which relied on workers paying for retirees. With so many workers in the system, the program ran a surplus.

Medicare, introduced as part of President Johnson’s Great Society in the 1960s, tacked on healthcare for the elderly. Again, the program relied on current workers paying for retirees, and like with Social Security, the age structure of the country made the program go… for a little while.

As the boomers flooded the job market, a lot of extra cash sloshed around in our entitlement programs because they collected a percentage of wages. But by the 1980s, our long-term social program problems were coming into focus.

We had fewer children in the late 1960s and 1970s, so eventually there’d be fewer workers to support a bulging number of retirees. Longer lifespans made the problem worse. Congress fiddled with Social Security in the early 1980s, but the reforms just put off the pain. They didn’t solve the problem. And there was no attempt to fix the issues with Medicare.

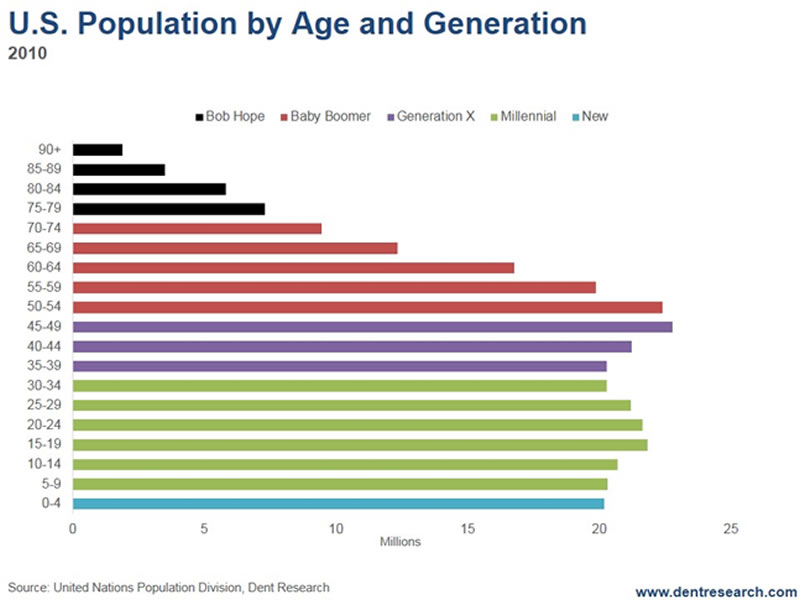

Fast-forward to 2010.

By then our triangle-shaped society was morphing into a rectangle, as you can see in the next chart. We added the millennial generation in green, and even the first years of the next, unnamed group in blue. Notice that the shape is almost straight-edged for every group 54 and younger, which is much different than the age structure of the nation in the previous decades.

Clearly, we’re no longer a nation teeming with strapping young workers who far outnumber the older generation. We don’t have younger people who can bear the burden of their elders with a modest payroll tax spread across many workers per retiree.

Instead, we’re a nation full of aging adults, whose employment statistics reveal more than meets the eye. We look at the younger group with trepidation. With the cost so high, will the millennials be able to pay the taxes necessary to provide the benefits that boomers have coming to them, just as the boomers did for their parents?

And what exactly can, or will, a Trump presidency do in this demographic reality?

Rodney

Follow me on Twitter ;@RJHSDent

By Rodney Johnson, Senior Editor of Economy & Markets

Copyright © 2017 Rodney Johnson - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.