SPX Rallies. Will Stock Market Make a New High?

Stock-Markets / Stock Market 2017 Feb 07, 2017 - 12:42 PM GMT Good Morning!

Good Morning!

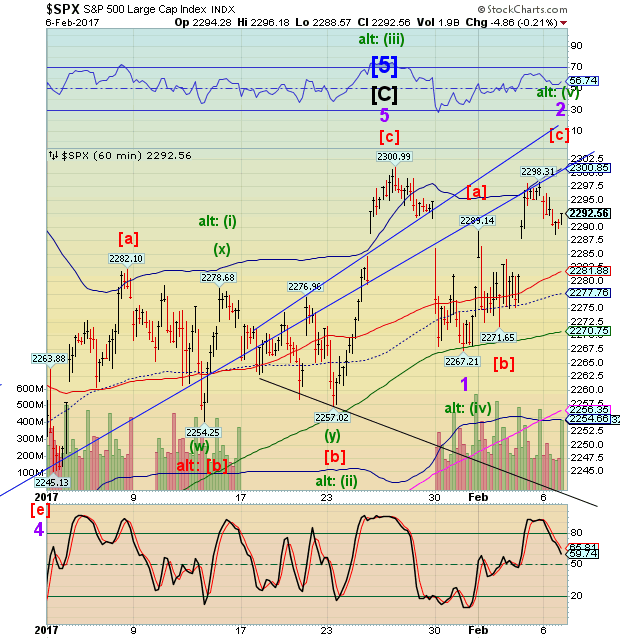

SPX futures are higher this morning, although they have not broken out above last Friday’s high at 2298.31. It has missed that possibility by only 25 ticks, so there is still a chance that we may see a higher print this morning.

Given the rally after what appears to be an a-b-c decline yesterday, the odds are better than even we may see a new high this morning. The Cycles Model suggests it may happen in the first two hours of the day. I have placed the alternate Wave structure on the chart for our consideration. The target may be the “natural” target I gave last week at 2305.00, or possibly higher, should the rally have any strength.

This does not dim the probability that we are in the midst of making the final high. The March 2009 low was 6 days early. The 1987 crash was 12.9 days early. While lows tend to be made faster as a general rule, highs can be drawn out and diffused. The one thing I will say is that the expected Master cycle low may have inverted. If so, this is the first time it has happened since July 3, 2014.

ZeroHedge reports, “The dollar rebounded from a key 200-DMA support level, strengthening against all major peers, pushing S&P futures higher as European shares rose, led by basic resources and real estate, while Asian stocks fall. Gold fell from its highest level since November as demand for some haven assets ebbed while global bonds declined. Oil dipped, pressured by a stronger dollar.”

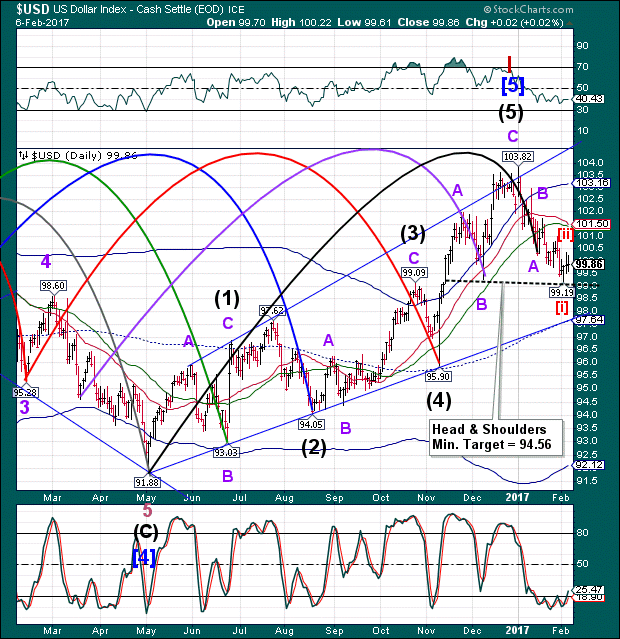

USD futures rallied to 100.69 this morning, making a 59.5% retracement of its decline from Wave B. The retracement appears to be approaching its final thrust, if its hasn’t been made already. The right shoulder elevation is a bit low, yet.The commodity rally is taking a brief rest as the USD bounces.

Even while USD bounces, USD/JPY has taken out 112.00, an important support. ZeroHedge reports, “Having toyed with the key 112 support level for the past month, moments ago the Japanese currency spiked as finally the big stops at the 112 barrier were taken out, sending USDJPY sliding lower by as much as 40 pips.”

This does not spport a higher dollar and suggests a reversal may be forthcoming.

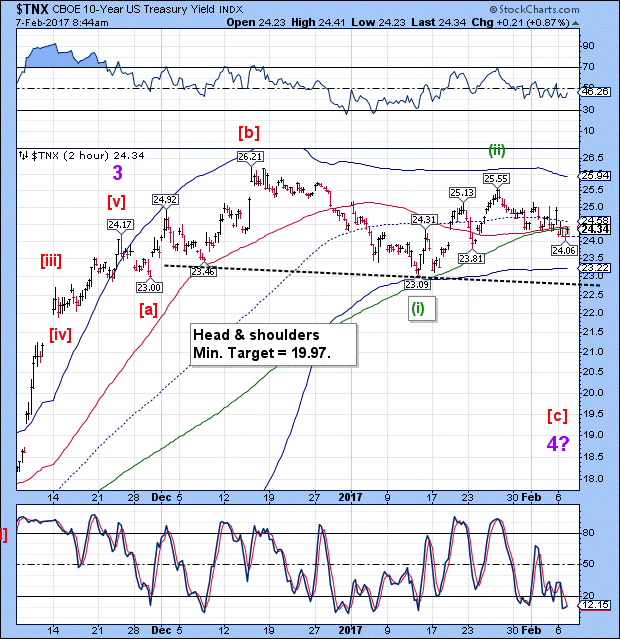

TNX is bouncing to retest its 50-day Moving Average at 24.39. It appears that today’s bounce may be a Wave c, which implies that TNX may go higher. However, should USD turn down this morning, all bets are off.

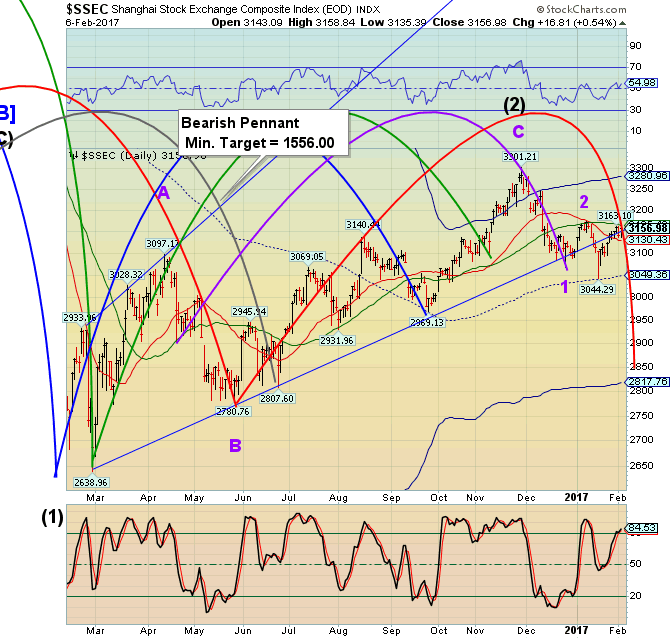

While the week-long Chinese New Year celebration went on last week, many enterprising citizens were likely to have been busy finding new countries in which to deposit their money.

ZeroHedge reports, “Beijing surprised China-watchers this morning, when the PBOC announced that in January, China’s foreign-currency reserves dipped by $12.3 billion, below the key "psychological level" of $3 trillion, or $2.998 trillion to be exact, declining for the 7th consecutive month, and dropping to the lowest since early 2011. Consensus had expected a drop of $10.5 billion to just above $3 trillion.”

In addition, the Peoples Bank of China has been busily selling US Treasuries to prop up their own currency reserves, which are noticeably shrinking. Yesterday the Shanghai Index retested its own 50-day Moving Average in an attempt to regain lost elevation since the December decline. Should it fail its current supports, it may anticipate a 1000-point decline. The Cycles Model suggests a probable master Cycle low may be expected in the next week.

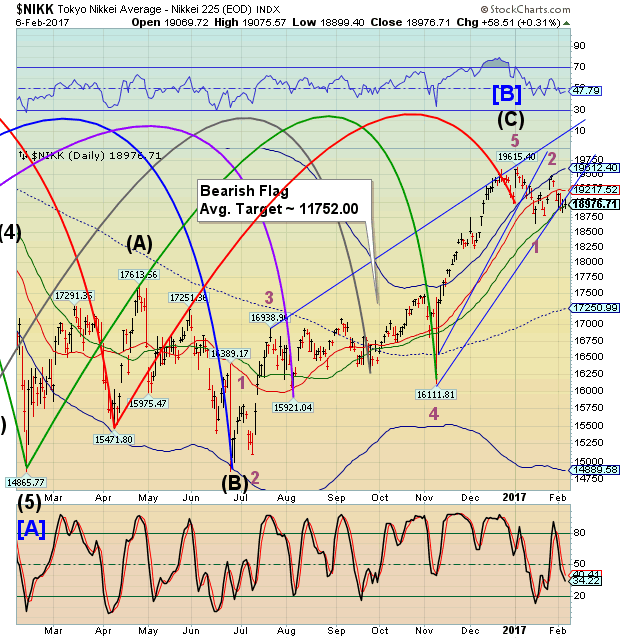

The Nikkei Index is in decline after having broken through its Ending Diagonal trendline and its 50-day Moving Average at 18950.39 this morning. The USD/JPY breaking support, as noted above, is not helping the Nikkei.

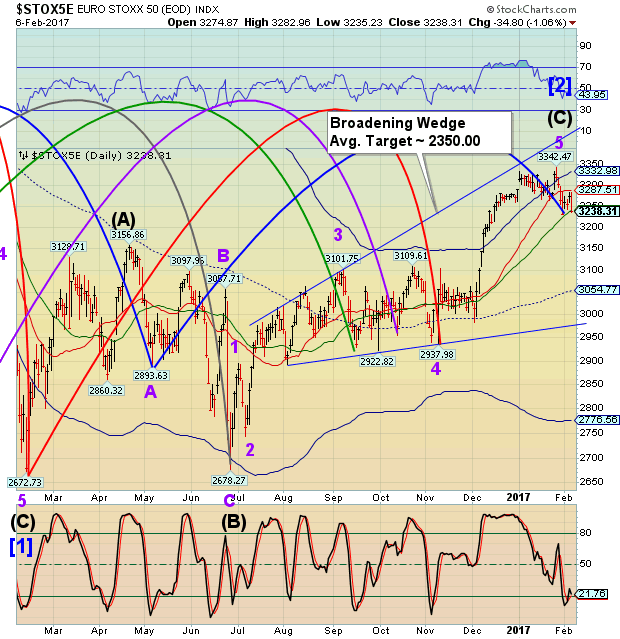

The EuroStoxx50 Index challenged its 50-day Moving Average at 3249.44 yesterday after s surprisingly short retracement. Today is appears to be bouncing to retest the 50-day. A resumption of the decline may spell trouble for other indices worldwide as they all are on the same (declining) Cycle.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.