SPX Futures Down, TNX down, USD up

Stock-Markets / Stock Market 2017 Jan 30, 2017 - 02:27 PM GMT Good Morning!

Good Morning!

SPX futures are down beneath the Cycle Top support and Trendline support this morning. SPX is on a countdown for a potential low on Wednesday. An extension of the decline may come, depending on the actions of the FOMC.

ZeroHedge reports, “European, Asian stocks and S&P futures all drop after traders were left with a sour taste from the potential fallout of Donald Trump’s order halting some immigration and ahead of central bank decisions from the U.S. and Japan. Markets in Hong Kong, China, Malaysia, Korea, Singapore, Taiwan and Vietnam are all shut due to the Lunar New Year public holiday, leading to a quiet Asian session. Oil rebounded after sliding as much as 0.7%. Gold was unable to hold its overnight gains and has dipped into the red to $1,190 after rising just shy of $1,200 in early trading.”

VIX futures are higher this morning. This indicates that the reversal may be underway. An aggressive VIX buy signal comes above the 50-day Moving Average at 12.53 while confirmation awaits at the breakouts at 13.28-13.63 and 14.68.

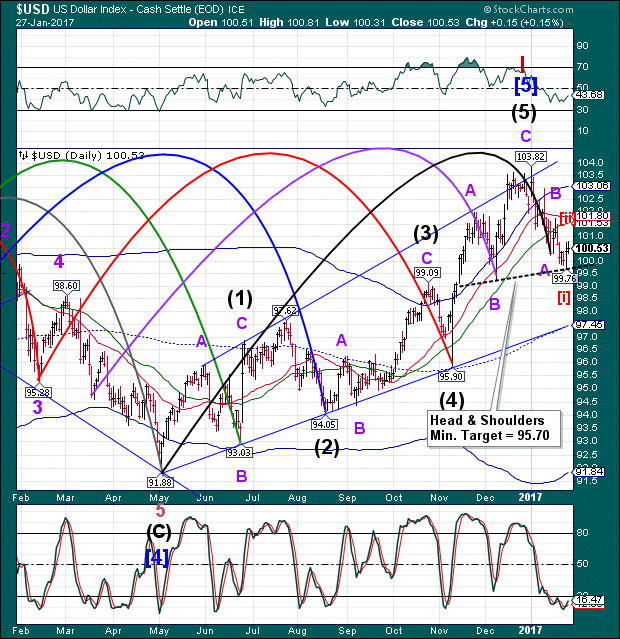

USD futures appear to be finishing their retracement. The retracement has gone as far as 101.01, a 64% retracement of Wave [i]. The start of Wave [iii] in the USD may also enhance the decline in SPX.

A decline beneath 99.76 triggers a Head & Shoulders formation with a minimum target of 95.70. This may break the lower trendline of the Broadening Wedge, with even lower possibilities.

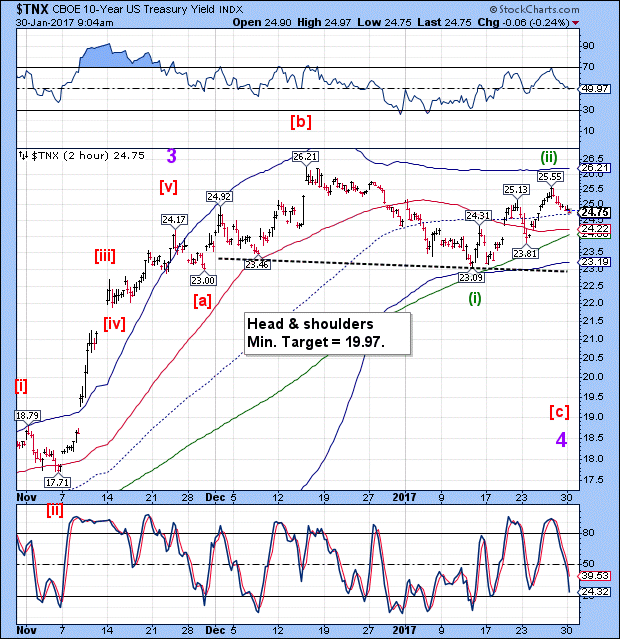

After a brief bounce this morning, TNX appears to be testing its mid-Cycle support at 24.70. It is difficult to say whether that is the entirety of the bounce or just Wave a, so we could see another bounce. However, a decline beneath the 2-hour mid-Cycle support at 24.70 leans toward a completed retracement, however small.

Bloomberg reports, “U.S. Federal Reserve officials were on a roll communicating their intentions to financial markets until December, when even a well-advertised interest-rate hike triggered a big sell-off in the bond market.

As Fed policy makers gather this week, a question for investors is whether that was an isolated incident or the start of a more turbulent cycle.”

The next FOMC meeting is scheduled to end on Wednesday. February 1. Should the TNX Head & shoulders be activated, we may see declining interest rates and declining equites in a highly correlated move. This may pressure the FOMC not to raise interest rates this week.

Finally, China looms large this week, despite their week-long Chinese New Year celebration, which ends February 2.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.