Stock Market SPX 1810 Low Projection Met

Stock-Markets / Stock Market 2017 Jan 30, 2017 - 05:42 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: If the market strength persists, the long-term trend may need to be re-evaluated.

SPX Intermediate trend: SPX intermediate P&F count to 2300 has been reached. A reversal should now occur.

Analysis of the short-term trend is done on a daily-basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

1810 Low Projection Met

Market Overview

The accumulation pattern which formed at the SPX 1810 low gave us 2300 as the most probable projection. It took about a year to get there, but last week, that count was filled. Now what? First, the projection was derived from a 3X10 P&F chart, so there is some potential leeway of a few points. Also, P&F counts are supposed to be approximations and cannot be depended upon to be exact -- although it is remarkable how many turn out to be so! Consequently, there could be an overshoot of a few points. Secondly, reaching a projection target tends to be followed by a pattern of distribution before (or as) a reversal occurs. The basic stock market progression is: accumulation - uptrend, distribution - downtrend! Therefore, we should now expect a zone of distribution to form around this level before a reversal takes place. The longer it takes to form, the greater will be the congestion pattern which will determine the extent of the following decline.

Another way to measure the size of the correction is by making an estimate based on Fibonacci ratios. Most retracements tend to be (about) .382, .50 or .618 of the previous advance. If the P&F count derived from the distribution pattern formed before the decline matches one of these ratios, it will give greater credibility to our expectation.

The uptrend from 1810 had two principal corrections. The first measured just a little over .382, and the second was exactly .618! (That should convince skeptics that the market moves are not random, but follow some mysterious logic!) Therefore if, indeed, we are at the end of the 490-point rally which started at 1810, it would be reasonable to anticipate a correction of about 190 points (.382 of 490), or more.

It is also possible that the 1810 congestion was merely a re-accumulation level confirming the count from the 2009 low which, if correct, would mean that we have arrived at the end of the entire bull market. That, however, is a speculation that will need to be verified by future market action.

Analysis

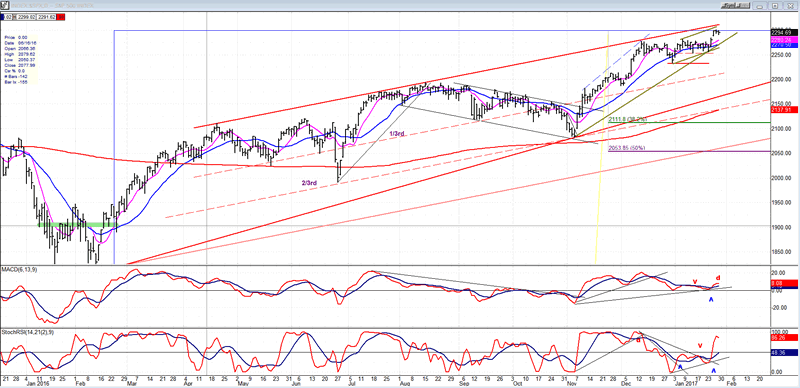

Daily chart

The converging red lines give the uptrend from 1810 to 2300 the appearance of a wedge which, as mentioned before, is a bearish pattern which indicates the end of a move. If that's what it is, it would call for a retracement all the way down to the 1810 level, the point of origin. However, if a parallel to the top line is drawn from the low, it changes the wedge into a legitimate channel which divides itself in three sections. Note that this is validated by the fact that pull-backs have twice found support on the 1/3rd trend line and, also twice on the 2/3rds line. Changing the wedge pattern to a normal channel could modify our analysis of the bull market.

On the chart, I have marked the .382 and .50 retracement levels on the entire uptrend from 1810. If we stop the correction at the first level and regain some upside momentum, it could indicate that the bull market has farther to go. If we continue lower and eventually move outside of the channel line, the opposite would become more credible. But it is too soon to concern ourselves with these prospects. First, we need to see if the uptrend concludes around this level, and if we start to correct.

In the last letter, I mentioned that the indicators were screaming "sell"! With last week's rally, the SRSI has gotten back in a short-term uptrend, but the MACD has hardly improved and still looks awful. The A/D indicator is not shown here, but looks just as bad.

This chart and others below, are courtesy of QCharts.com.

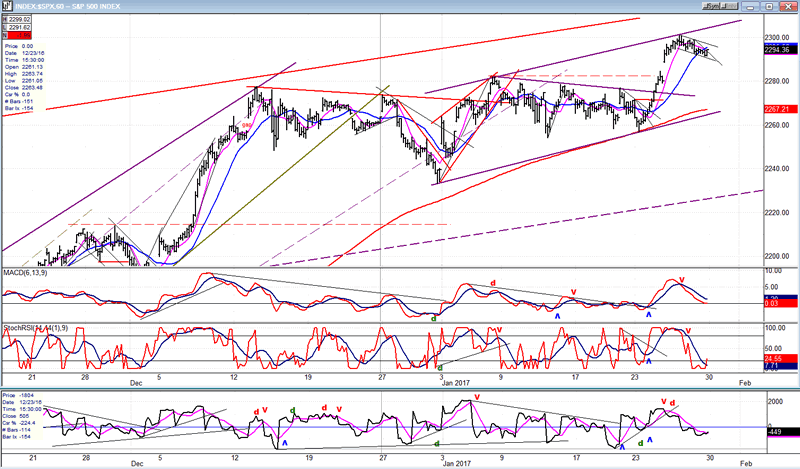

Hourly chart

Only the latest part of the advance from 1810 is shown here, and this is ostensibly its final phase. After touching 1300 last week, SPX has started to correct. The oscillators have all retraced and look as if they could be ready to move up again, but prices should continue to correct until mid-week, when a minor cycle is expected to make its low. After that, more distribution should take place. There is enough support above 2260 to keep prices in a trading range for a little while and when the (red) 200hr MA is penetrated, the correction should begin to gather downside momentum.

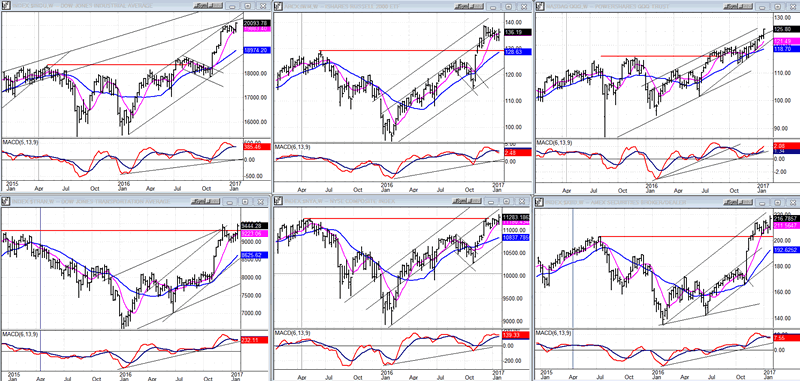

An overview of some important indexes (Weekly charts)

My general view is that we have met the projection from the February 2016 low, and that we should now have a period of distribution followed by a correction. The first leading index to show support for this opinion is the IWM (Russell 2000, top center) which did not make a new high along with the others, last week. It is too soon to draw a solid conclusion from this fact, but should this reputable leading index continue to disagree with the others and favor the downside, it would turn out to be an important warning.

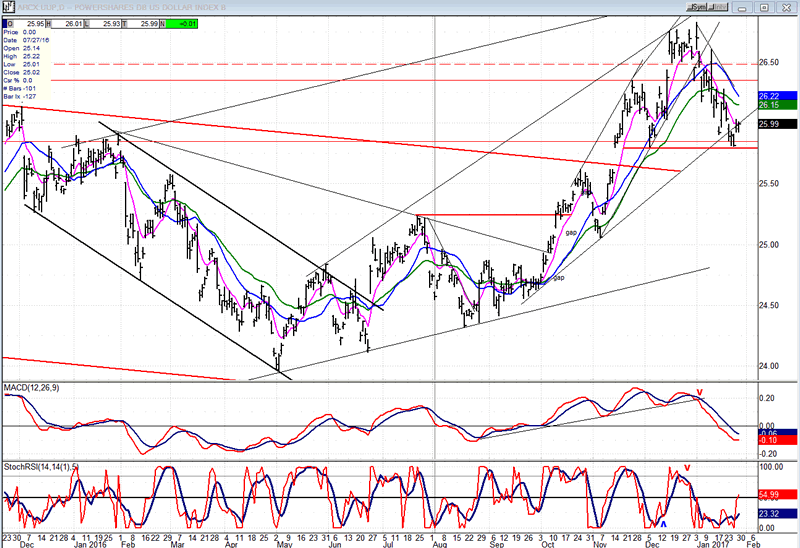

UUP (dollar ETF)

UUP found support where it should have and, if it holds this level for a few more days, it would position its indicators for at least a bounce, and perhaps more.

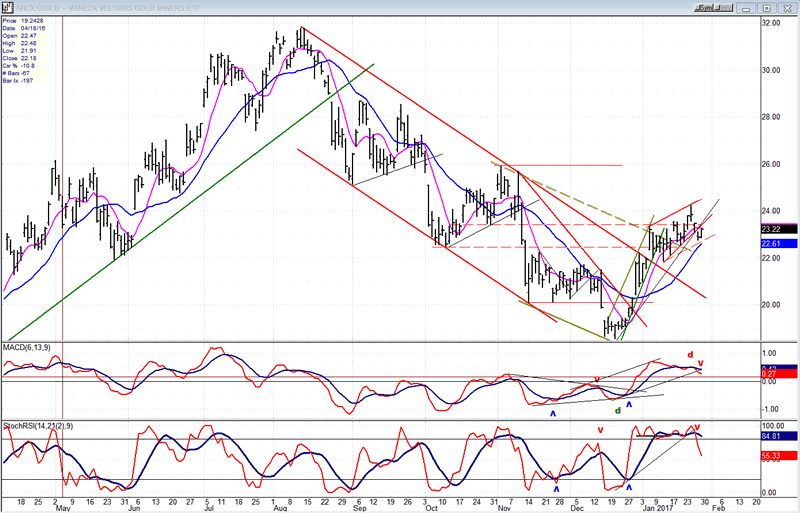

GDX (Gold Miners ETF)

GDX may have made a short-term top at 24.25. Last week's pull-back has turned down its two oscillators and, with an 18-wk low due early next month, the odds favor the beginning of a correction. However, it has not yet given a clear sell signal. To do so, it would have to close below its blue MA, and drop the MACD below the zero line.

Note: GDX is now updated for subscribers throughout the day, along with SPX.

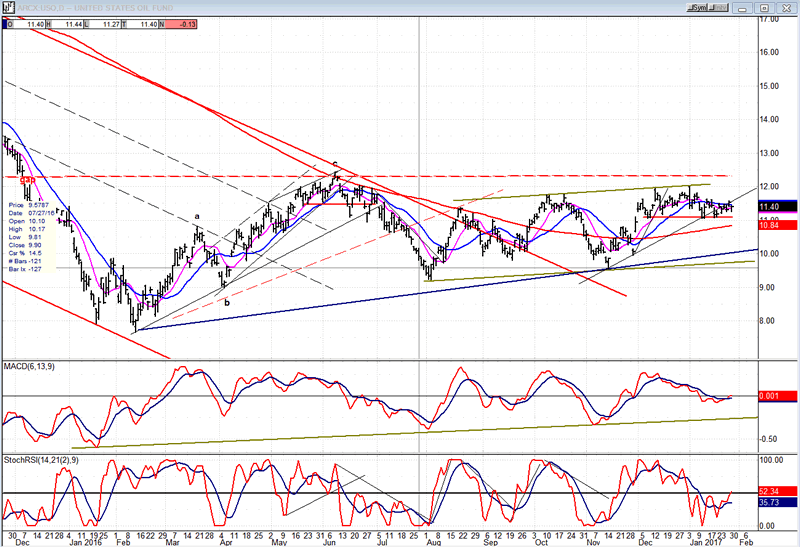

USO (U.S. Oil Fund)

USO has still not decided in which direction to move, short-term. The window of opportunity for a break-out of it base will be closing if it does not soon make a move to the upside. Breaking the red support line decisively would send it back to the bottom of the green channel.

Summary:

SPX has filled the P&F count which was established last February, at the 1810 low. It would now be normal for the upside momentum derived from last week's run-up to 2300 to dissipate, as a distribution top is being created. This, could take a couple of weeks and include the possibility of seeing slightly higher prices in the process. Afterward, we could expect a corrective trend to begin.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.