Lala Land FX Assumptions

Currencies / US Dollar Jan 27, 2017 - 06:08 PM GMTBy: Ashraf_Laidi

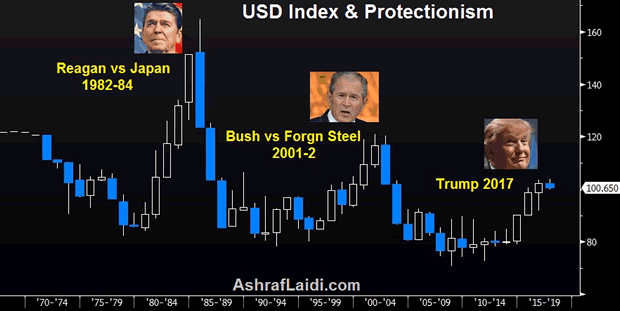

The notion that Trump's planned protectionist measures (tariffs and border adjustment tax) will be USD-positive is founded on an unrealistic world - where Mexico, China and other US trading partners would just sit back and watch without any retaliatory action. We're not in the 1980s or 1990s when US trading partners operated in a closed world, unaccountable to any world free trade bodies.

Historical reminder: Since the 1990s, currency traders have consistently sold off the US dollar at each occasion the US adopted protectionist measures (Reagan vs Japan in 83-84 and Bush Jr with foreign steel).

Parallels with February 2002

It is no surprise that George W. Bush's war declaration on foreign steel in late 2001 aimed at saving the bankrupt Rust Belt in order to boost his Mid-Term election chances coincided with the peak of the USD bull market in February 2002. By the time the WTO fined the US $2 bn in sanctions, the US dollar had lost 12%, before falling into a 7-year bear market.

Next Week: All about the Fed Statement & US Dollar

Considering warnings about USD strength by Trump and Mnuchin, any mention of the USD impact on growth and inflation in next week's FOMC statement could cap the USD's rise and reignite speculation about the end of the strong USD policy.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2016 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.