EURO, GBP, AUD, JPY, CAD C.O.T Reports

Currencies / Forex Trading Jan 24, 2017 - 10:03 AM GMTBy: Enda_Glynn

The Commitments of Traders Report is issued by CFTC.

The Commitments of Traders Report is issued by CFTC.

It reports all open positions in futures markets of three main groups of traders:

Commercial Traders – Hedgers

Non-Commercial Traders – Money Managers

Non-Reportable – Retail market

The report breaks down each Tuesday’s Open Interest and gives us a powerful view on what exactly the big guys have been doing in the marketplace and what their plans might be.

It is issued every Friday and includes data from Tuesday to Tuesday. The three days prior to the release date are not included.

This is an essential tool for gauging long term sentiment in futures markets.

In this report, we cover EURO, GBP, AUD, JPY, CAD, and we focus on Non-Commercial traders as an indication of a profit driven bias.

C.O.T Positioning

EURUSD: Bullish

GBPUSD: Bullish

AUDUSD: Bullish

USDJPY: Bullish

USDCAD: Bullish

NZDUSD: Bearish

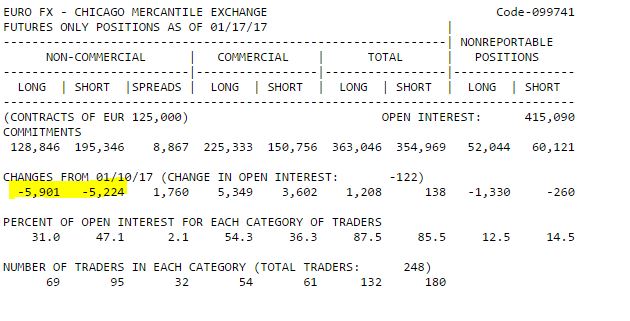

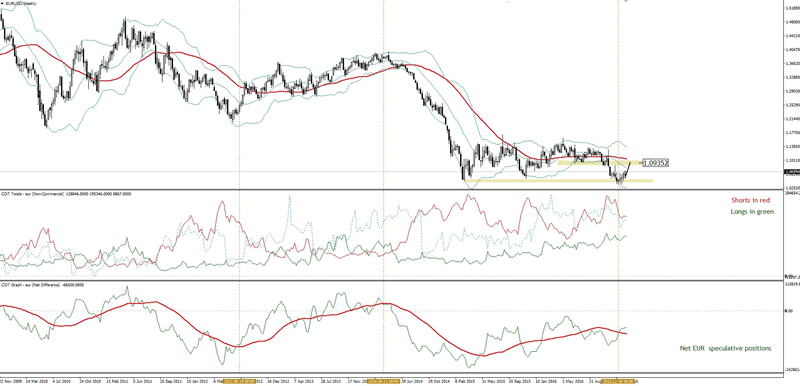

EURO – Euro Futures

My Bias: Bullish EURUSD

EURUSD held onto its gains during the past week. The pair closed at 1.07 last Friday. My bias remains bullish with the 1.0930 area as a next resistance level.

Positions:

Speculators took profit this week. They covered 6K long and 5.2K short positions. The net figure is slightly changed from the previous week (66.500 net short). Open interest was unchanged

Strategy:

Buy longs on pullbacks towards 1.0930 resistance

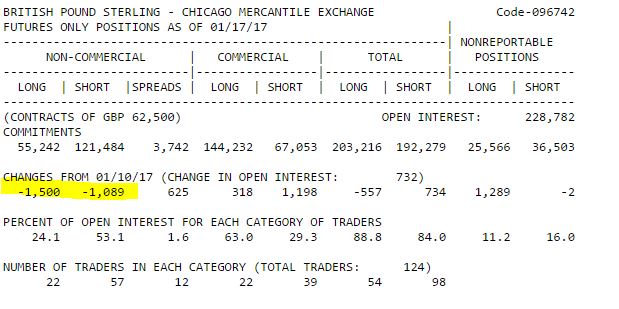

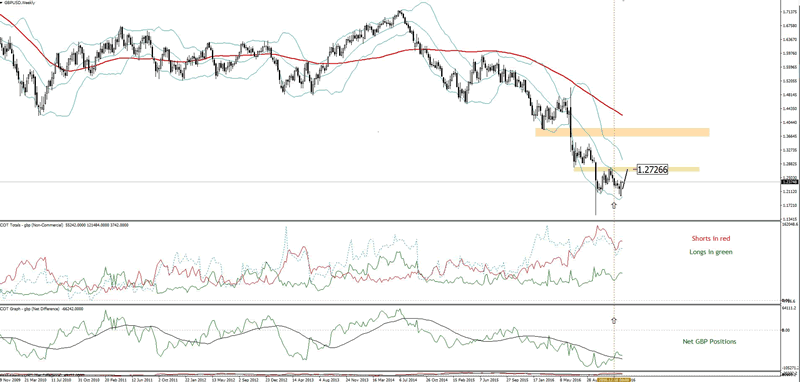

GBP – British Pound Future

My Bias: Bullish GBPUSD

Cable gained despite the negative sentiment. The pair staged a massive recovery last week and finished at 1.2364 on Friday. I remain bullish on this market but will take caution trading it as it is very much depended on Brexit related news.

Positions:

Speculators also took profits in this market. They covered 1.5K long and 1K short positions. They remain 66.2K net short, little changed from the previous week. This is a wait and see game.

Strategy:

Wait for the reversal pattern on daily charts and buy dips.

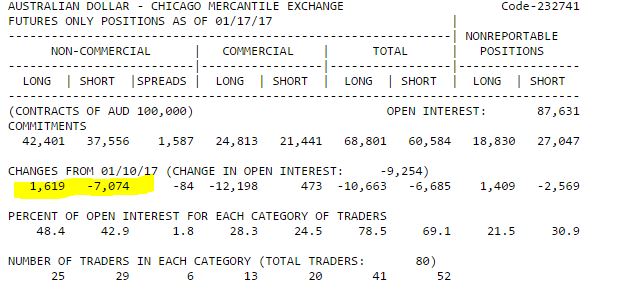

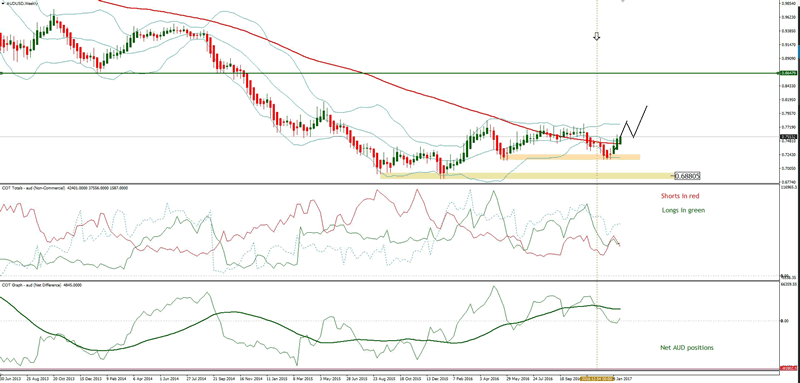

AUD -Australian Dollar Futures

My Bias: Bullish AUDUSD

It looks like the tables have turned in Australian Dollar Futures. Speculators switched from being net short to be 5K positions net long.

Although, speculative net positions are still below 33 weeks moving average, the fact they now hold more long then short positions makes me believe this market is going higher from here.

Positions:

This week speculators added 1.6K new longs and covered 7K short contracts. This is a major shift in sentiment and it puts speculators on the bullish side

Strategy:

The price is due a deeper correction from the current levels. Buying dips would be a valid strategy.

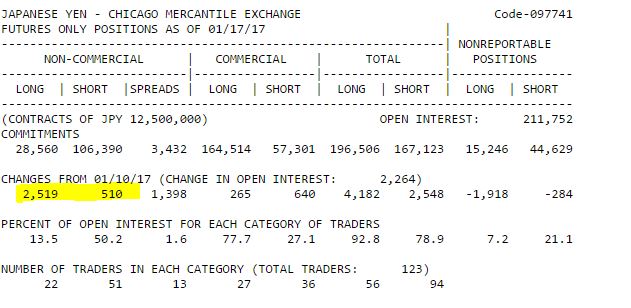

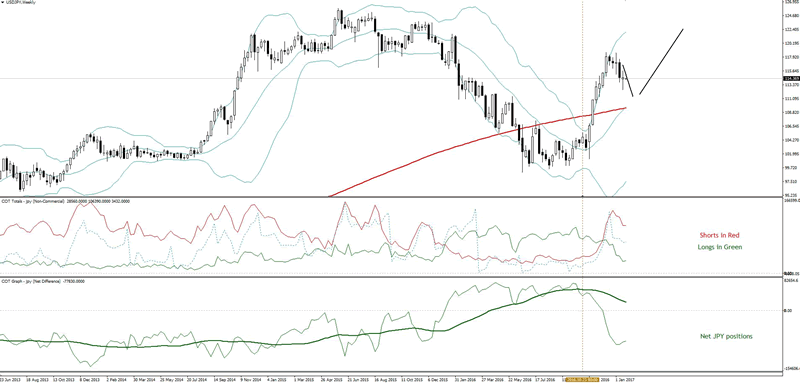

JPY -Japanese Yen Futures

My Bias: Bullish USDJPY

It might be that USDJPY has now completed its seasonal decline or it could put a double bottom around 112.50. The pair rallied substantially after hitting the bottom at 112.50. It closed the week at 114.56. The current level is a major resistance and a former support. It is likely to find some fresh sellers but it might as well stage another leg up. My bias remains bullish USDJPY. I would like to see 112.50 once again to buy it.

Positions:

Speculators added 2.5K new longs and only 510 new shorts. Clearly the pace they have been adding shorts has slowed down.

Strategy:

Deeper correction expected. Buy USDJPY on dips.

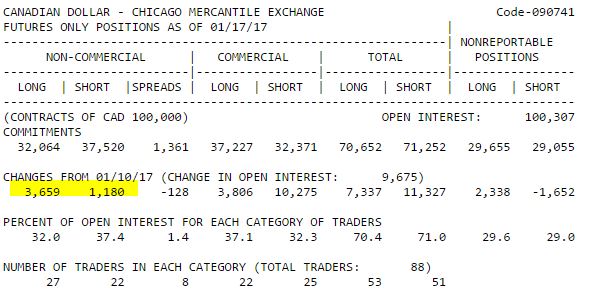

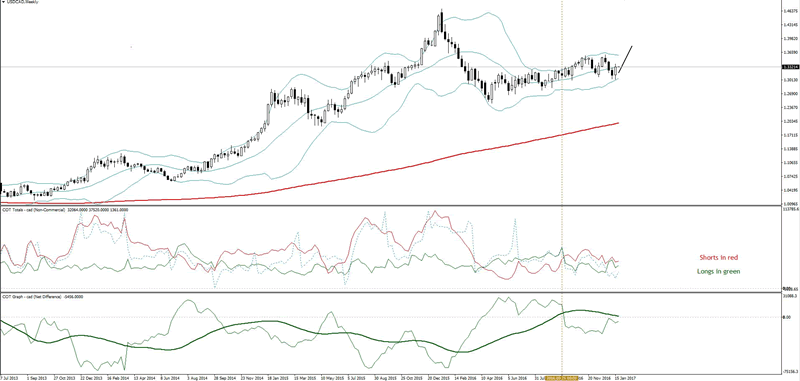

CAD – Canadian Dollar Futures

My Bias: Bullish USDCAD

USDCAD rallied and closed the week at 1.3320. The pair moved up very quickly on BOC news and didn’t give us a chance to catch it. My bias remains bullish USDCAD

Positions:

This week speculators added 3.6K new longs and 1.1K new shorts. They were 5.4K net short, down from 8K in previous week. I remain net long USDCAD as long as speculators are net short in CAD futures.

Strategy:

Buy dips on bearish reversal patterns.

By Enda Glynn

http://humbletraders.com/

© 2017 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.