Populism; the Danger? What About Debt?

Politics / Global Debt Crisis Jan 19, 2017 - 04:06 PM GMTBy: Doug_Wakefield

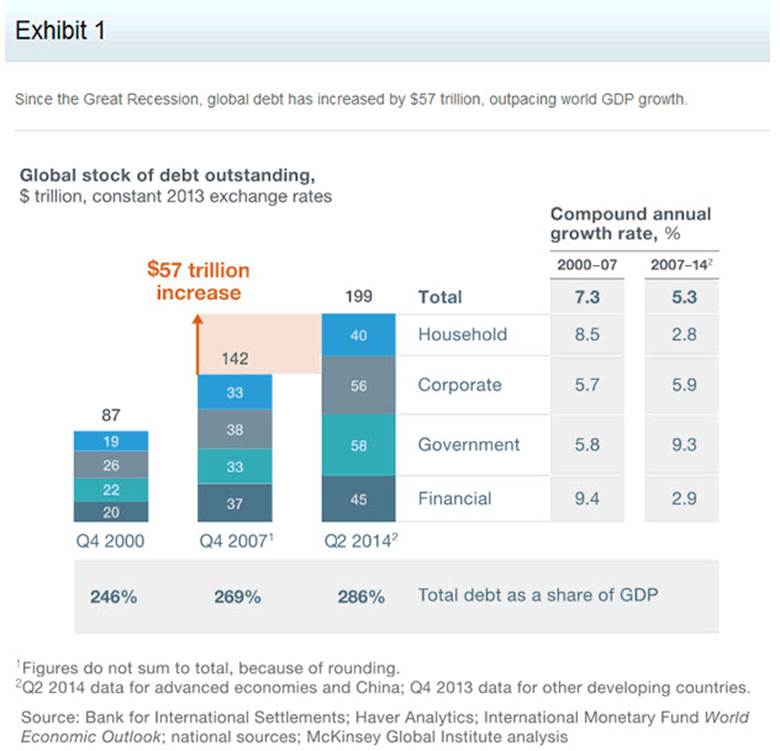

In the spring of 2015, I placed the chart below on global debt levels at the opening of the article. Notice the value of global debt in 2000, 2007 and then half way through 2014.

In the spring of 2015, I placed the chart below on global debt levels at the opening of the article. Notice the value of global debt in 2000, 2007 and then half way through 2014.

Now jump forward to last fall, when the following statement was made by the International Monetary Fund.

“The world is awash with $152 trillion dollars of debt, according to the IMF, an all-time high which sits at more than double the balance at the start of this century.” [ Global Debt Balloons to All-Time High of $152 trillion, IMF Warns, CNBC, Oct 6 ‘16]

You may think this article will challenge the substantial difference between the figure reported by the McKinsey Global Institute after Q2 2014 and the International Monetary Fund number from Q4 2015. It is not.

Instead the focus will be on why the media headlines and global elites have become so focused recently on populism being the great risk to markets, instead of the record debt levels, recent record losses in global bonds, and US stocks at record highs.

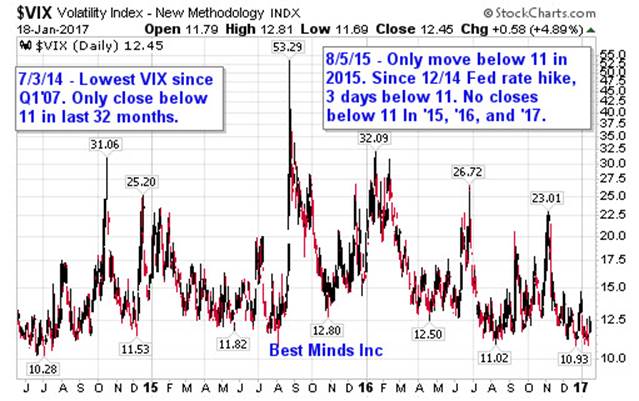

With commercial hedgers holding their largest net LONG position on record in US Treasuries this month, and their largest net SHORT position on record right before the second-rate hike by the Federal Reserve (Dec 14), I believe traders and investors should be more focused on these extremes, rather than what appears to be the “narrative” being fed to the public as “the reason” the global financial bubble was hit with a “correction”.

Populists Key Risk to Globalism; Discussed at Globalist Club

If you did not receive your invitation to the exclusive World Economic Forum, don’t worry. This is a very select club for those at the highest levels of the global politics and finance.

If you did not receive your invitation to the exclusive World Economic Forum, don’t worry. This is a very select club for those at the highest levels of the global politics and finance.

In David RothKopf’s book, Superclass: The Global Power Elite and the World They Are Making (2008), we learn that this small group is certainly at the “top of the global game” for influencing the global economy. Jeff Faux of the Washington Economic Policy Institute states, “Davos is the most visible symbol of the virtual political network that governs the global market in the absence of a world government.” (pg 266)

Rothkopf, clearly a supporter of global power clubs, states that calls the World Economic Forum the “biggest of the world’s elite club”.

Since the WEF is meeting at Davos, Switzerland between January 17th- 20th as Trump is sworn in as the next US President on January 20th, it seems a good time to ask, “Why all the emphasis on populism being a huge negative to the global economy?” There have been huge risks across global markets discussed by the IMF, OECD, World Bank, BIS, and others for more than 2 years now, so why the increased attention to the “populism risk” right now? From watching recent comments and headlines, it is clear someone wants the public to see populism as a huge risk to the most complacent US equity markets floating at record levels.

Davos Elite Seeks Fixes to Defend the System from Populists, Bloomberg, Jan 18 ‘17

“Squeezed and Angry: How To Fix the Middle Class Crisis” – A panel lead by IMF Chief Christine Lagarde at Davos.

"Populism is the No. 1 economic issue that market participants should be watching, more important than central banks. I want to be loud and clear—populism scares me." – Ray Dalio, Head of the world’s largest hedge fund at Davos.

World Economic Forum: Inequality, Divisions Are Primary Risk to Global Economy, WSJ, Jan 11 ‘17

The problem the retail investor has with being the least bit concerned about a change from globalism to nationalism from Brexit to Trump to Italy and across many areas of the world in 2017, is that without constant “assistance” to world equity and risk on trades, the is no experience with anything remotely telling them to prepare for a large sea change.

So ask yourself, when the stock bubble pops again like 2008, was it the "middle class" who flooded trillions of debt across the global financial system at the lowest interest rates on record? Will global central planners and elites finally admit their ideas are what brought us to the top of the latest bubble, and lead to the next major bust?

One think is for certain whether populist or globalist. To ignore rising risk for so long, the tens of trillions lost in capital during the next bust phase are not going to be popular.

Do You have a Plan for the Next Big Shift?

Best Minds Inc has a new website and blog. Check out www.bestmindsinc.com for free and paid services. 2017 is already set up to bring huge changes. There will be significant opportunities and significant losses.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.