Long USD... Another Crowded Trade

Currencies / US Dollar Jan 18, 2017 - 03:24 PM GMTI just sent out a reference from ZeroHedge on the unusual number of VIX shorts there are. In other words, a very crowded trade.

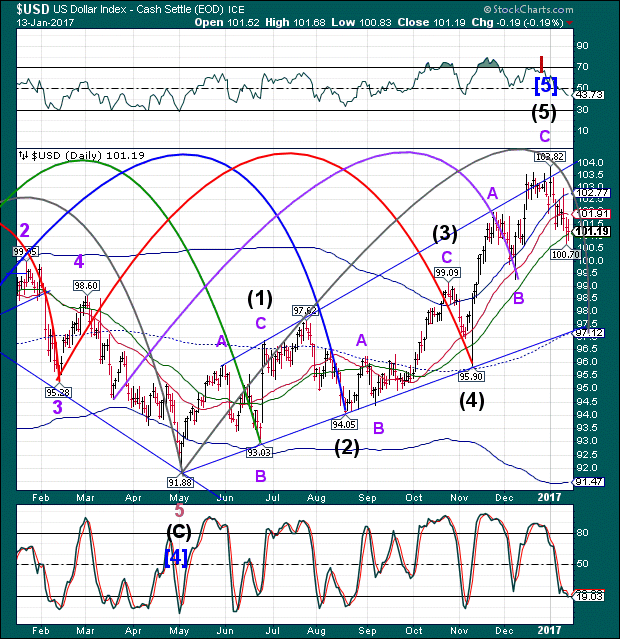

That reminded me that an even more crowded trade is the USD longs.

ZeroHedge had this to say, “Until last night's Trump statement that the US dollar is overvalued, it was smooth sailing for Wall Street's momentum chasers, who happily piled into what until recently was Wall Street's most crowded trade. How crowded?

For the latest answer, we go to the latest just released monthly Fund Managers Survey conducted by BofA's Michael Hartnett who shows that according to Wall Streeters themselves, the dollar is the most crowded trade by orders of magnitude. In fact, in January the number of respondents who said the "Long USD" is the most crowded trade has risen from 35% in December to a whopping 47%, the highest response rate in the last few years of the survey. Far behind, in second and third place, are "short government bonds" and "long high quality/minimum vol" both at 11%.”

Both the short VIX and long USD may blow up spectacularly. Stick around for the fireworks.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.