Money Printing to Save Imploding Banking System Will Send Gold Soaring

Stock-Markets / Credit Crisis 2008 Aug 07, 2008 - 06:55 AM GMTBy: Jim_Willie_CB

The path to the printing press is a long one. It is used at first to spread credit indiscriminately in sustaining commerce and funding financial systems. For the United States , that means horribly inefficient usage of credit in commerce, where 5 units of credit produce one unit of business activity. In the twisted bizarre arena that is Wall Street, the financial maze they created has imploded as yet another chapter is written in the standard textbook of boom & bust. They managed to cause the most powerful deflation storm in eighty years, all born from the monetary inflation wellspring, no easy feat.

The path to the printing press is a long one. It is used at first to spread credit indiscriminately in sustaining commerce and funding financial systems. For the United States , that means horribly inefficient usage of credit in commerce, where 5 units of credit produce one unit of business activity. In the twisted bizarre arena that is Wall Street, the financial maze they created has imploded as yet another chapter is written in the standard textbook of boom & bust. They managed to cause the most powerful deflation storm in eighty years, all born from the monetary inflation wellspring, no easy feat.

The Americans think they are immune to the immutable laws of economic nature. They dispatched most of their industry to the Pacific Rim , then Mexico , finally a more complex mix of Asia with China the new center. With that exodus went legitimate income. In its place was the great majority of the US Economy resting atop a housing and mortgage bubble. The heretical US economists, led by the closest thing to Mr Magoo on the planet in the former US Federal Reserve Chairman, endorsed the plan as not only sound, but advanced in risk offset price modeling. Imagine Mr Magoo a knight! Now the entire model is in the process of dissolving, taking down the entire US banking system, including most lending institutions, into the sewer of acidic pits, the wasteland of dilution, or the cemetery for bankruptcy.

Long is the path to the printing press, the ultimate supposed savior of the nation. Current US Fed Chairman Bernanke once said, “But the US government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.” His words are taken out of context, unfair to him. Sue me! The hidden cost is beyond description as huge, like ruin of a national financial foundation. It is a device that kills the host, hardly any solution. When the financial system is totally broken, when allies are totally betrayed, when investors are totally ransacked, when isolation is the spoils of current policy riddled with curried favor, the printing press remains to save the day.

What heresy! Usage of the printing press in large scale volume will earn the certain reward of astronomical gold and silver prices. The decisions to be made will determine whether a return to precious metal supremacy is accompanied either first by very high interest rates and uncontrollable credit derivative meltdowns, or second by suppressed controlled interest rates and total discouragement of savings from artificially low interest rates. Systemic meltdown awaits the first path, while continued pursuit of bubbles the second path. Either way, gold wins! The spoils will be devastation for the first path, but rationing for the second path. Both paths require the most dreaded device to be deployed at the last turn, the printing press. Other alternatives will have been exhausted.

A tragedy is in progress. For three years, my premises have centered on foreign-held debt leading to lost sovereignty, on the inevitable wreckage of the US banking system (first with insolvency, later with bankruptcy, finally consolidation and nationalization, and a long drawn out housing bear market made worse by the extraordinary extension at its peak. That pathogenesis is on course, in progress still, despite supposed rescues, most being horribly designed and full of the same broken devices that Voltaire warned about.

Few people think much about the Founding Fathers of the United States these days. They would be appalled, even say, I TOLD YOU SO. Thomas Jefferson warned specifically about handing over the power and authority over money to private banks, stating in clear terms that if granted, then in time the nation will lose their homes to bankers. We are there. The brilliant second president crafted the Constitution, an ignored document shredded by those who prefer war, fear, and private profit to liberty, free markets, and honest money, while they spout endlessly about freedom, national pride, and foreign threats. The menace is internal.

IMPERFECTIONS & DECEPTIONS

The Mortgage Relief Bill just signed into law should be regarded as a first pass at governmental rescue actions, the first of many. The first bill always represents the most difficult bill to pass. The succeeding bills will be easier, since the interference has been removed. The nationalization movement in mortgage finance has begun. The benefits will extend ranks to homeowners finally, and not exclusively to the banker elite as seen to the present date. One should note that the elite, primarily shareholders and bondholders, stand in first position of priority in this first bill designed toward rescue and relief. In return for quasi-formal guarantees from the formerly quasi-government agencies, Fannie & Freddie (F&F) will submit to strong reins from a newly created regulator. The Federal Housing Administration will insure up to $300 billion in such mortgage loans, as 400 thousand upside-down homeowners will be lined up for aid, provided loan originators eat a large helping of red ink. Attached to the legislative bill, more like snuck in, was a convenient increase of $800 billion to the US Govt federal debt limit, now at $10.6 trillion.

The bailouts directed to F&F will require at least $1.5 trillion in my estimation, once credit derivative losses are revealed down the road. Regard the Mortgage Relief Bill as a sentinel signal that the US Dollar will indeed fall another 20% eventually, thus propelling the gold price to unexpected heights. A total systemic bank breakdown is close at hand, when the next larger and broader wave of mortgage defaults occurs. They have nowhere near enough capital to offset upcoming losses. Each new package of official government relief measures will be easier to implement, since the crisis has been recognized. Lawrence Lindsey hates the Mortgage Relief Bill, and went into great detail as to why. He regards it is another bailout for the Fannie & Freddie elite, which happens to be what the US Fed lending facilities have been for Wall Street firms so far. The F&F structure remains intact, when clearly faulty if not a shocking failure. It is still not yet nationalized, but heading in that direction. The bill preserves the institution without ensuring its functions. It prevents losses to investors, while saddling the taxpayer with an unlimited liability.

If truth be known, Fannie Mae must be continued in present form, unless its giant hidden credit derivatives are revealed, unless its unspeakable fraud is revealed totaling over $1 trillion in fully accounted tidy form, neatly covered up by the last three administrations. Imagine your own fully funded slush fund for theft with impunity. Keep it going! Call it a boon to homeowners, paving the way to the American Dream. Fannie & Freddie are tour guides, cheer leaders, trail blazer guides on the path to the printing press. Nothing will betray the system more than the F&F main event how, even betray foreigners. A risk actually exists that foreign Sovereign Wealth Funds might eventually own the F&F, lock stock and barrel. So Jefferson 's warning might be even worse, than foreign bankers will own the homes lost by the American people. F&F together own tens of thousands of foreclosed homes. Soon they will see the light, and begin to rent them for income.

The biggest intangible loss in recent months has been in bank executive credibility. This goes parallel to the lost credibility of the central bank at the US Federal Reserve. Nearly every forecast or economic viewpoint or banking perception proved to be totally off the mark. Nearly every promise made by John Thain to investors since he took the helm at Merrill Lynch has been broken. Nearly all his viewpoints have been incorrect. Yet he keeps on talking. Then there was CEO Richard Fuld of Lehman Brothers, whose words proved totally off the mark. Then there was CEO Kerry Killinger of Washington Mutual, whose words proved totally off the mark. Then there was CEO Ken Thompson of Wachovia, whose words proved totally off the mark. Then there was AIG head Martin Sullivan, whose words proved totally off the mark. At least bankers from the top down through the ranks are consistent. To be otherwise would cause confusion.

MORE BIGGER BANK LOSSES DEAD AHEAD

Opinions are arriving surprisingly fast onto the analytic scene, that bank losses have not peaked. In fact, they will be much larger and broader in the next year. Banks have suffered $480 billion so far in stated losses, a figure that moves like a clock racking up more red ink each hour. Meredith Whitney of Oppenheimer believes Wall Street firms have yet to cut operating costs significantly, and have yet to meaningfully write down portfolio assets in stated losses. These once powerful firms forecast only a 20% to 25% fall in housing prices from peak to trough, a delusional viewpoint to use as an accounting foundation, let alone corporate planning. Check inventory levels and foreclosure figures.

Their only claim to power nowadays is their control of the US Govt, US Fed , US Dept of Treasury, debt rating agencies, regulators, and press networks. Heck! That is power indeed! To be a banker in the Untied States nowadays requires a certificate in fraud or stupidity, perhaps both, a firm grasp of heresy, and surely a degree from the School of Charlatan . Once again, Wall Street executives have no business except to manage their demise from choking on their own feces and toxic waste. They are victims of their own fraud and greed. Their stock and bond issuance has virtually vanished. Their own corporate stock values are supported by criminal restrictions to shorting rules, along with intimidation. Some opportunities await the intrepid investor, as the bank sector has shot its wad in August.

After raising cash from capital sale to replenish core assets and to revive balance sheets, Wall Street firms and big US banks will be unable to do so during the next big round, due this autumn, next winter, and spring. THAT IS WHEN ONE SHOULD EXPECT NATIONALIZATION OF THE US BANKS, FROM USGOVT BAILOUTS AND TOTAL ASSUMPTION OF DEBT OBLIGATIONS. This event will coincide with the nationalization of the US mortgage finance industry (see Fannie Mae & Freddie Mac) and the US car industry (see GM, Ford, Chrysler). As for the airlines, look instead for Emirate Airlines and Qatar Airlines to take plenty of American routes, at top dollar prices, since they have deep pockets and can obtain jet fuel on the cheap. The trio of banks, mortgage finance, and car industries will compose the core of the Nationalized US Economy foundation. Our turkey leaders will then boast of stability restored, when actually bankruptcy will be shared, institutionalized, and its bitter fruit made available for all to sup at the dining room table. One should beware that nationalization is a highway, a really wide path to the printing press, wide enough for all to walk, very slowly, and with limited opportunity.

Standard methods have been used that are totally broken for valuing US banks generally. The price/earnings ratios do not work, price/book values do not work, and debt/asset ratios do not work. All fail for the simple reason that no profits exist, book value is negative, and bank insolvency puts the third ratio into a truly dark place where continued operation is almost impossible. A bank does not lend money when it is broke! Instead, it fakes its solvency and fights to con investors into donating money into a black hole in exchange for equity without control. Their congame has blossomed.

Last midsummer in 2007, in the Hat Trick Letter reports, a warning was given that prime adjustable rate mortgages (ARM) would begin to default in one year. That is now, and the fabled Exploding ARMs, called officially Option ARMs, have indeed begun to default. The schedule of prime mortgage price began the reset process late last year, but have moved into high ground only this year. A few aspects are alarming, most importantly their size, at five times greater in volume than subprime's and Alt-A home loans. Price resets involve monthly costs rising at least 50% per month. In cases where triggers are hit for negative amortized loan balances having grown to 10% or 15% above the original balance, past interest and penalties are stacked atop new principal contributions to make for often a double or triple in monthly payment requirements! Default usually results, and for some, that prospect has led to some to abandon the homes, or even to halt making payments altogether.

In all, almost a half a trillion$ of ARMs will reset this year, vastly eclipsing the subprimes. Far too many are defaulting even before any adjustments, enough to scare the crapp out of bankers! Thoughts of banking system recovery and stabilization periods are pipedreams. The worst has yet to come, dead ahead. The bank losses will be at least triple the nearly $500 billion that has been suffered to date.

Few analysts have factored in prime loan losses, let alone commercial loan losses, both next, both assured given the sickening rise in defaults. Focus must be given to how the 30-year fixed mortgage rates are now higher than when the US Fed began to cut the funds rate in September 2007. Take this as a signal of rejection to monetary policy and failure by the central bank to reverse the risk environment. Meanwhile, evidence mounts on loan distress. Comparisons can be easily made. The subprime loans are in the 16% neighborhood on default, setting the standard. The Alt-A percentage of loans in arrears and the prime loan delinquencies are high enough to cause alarm to bankers. Bank analysts have noticed, even Jamie Dimon of JP Morgan. Details of the banking system, reset schedule for prime adjustable mortgages, foreclosures, peak for bank losses, FDIC watch lists, FDIC vulnerability, California update, and more are in the August Hat Trick Letter due out this weekend, possibly Monday.

BETRAYALS GALORE

Eventually investors who stepped into the previous rescues felt betrayed by huge losses. They were suckered. See Blackstone. See Citigroup. See Merrill Lynch. Asians and Arabs have been the principal benefactors so far. They have been burned. The first long round of bailouts for US banks was not sponsored by the US Fed, but rather by foreign Sovereign Wealth Funds (SWF). These face 40% to 50% losses. For this privilege they were granted no voting rights, no seats on the Board of Directors, still second class citizens, yet in the driver's seat for the corporate survival of desperate financial firms. On the next round of bailouts, foreign SWFunds will demand better terms. Heck! They might eventually demand a seat at the prestigious G-7 Meetings, where finance ministers for the world's largely bankrupt Western nations plus Japan conduct meetings. The last one was a total waste, discussing greenhouse emissions when the global banking system burned from the Western edges. The next rounds will surely grow more contentious. Eventually, foreigners will have had their fill.

The Untied States must finally relinquish some important ground, like granting bank licenses to foreign banks with Chinese and Arab names. When the US leaders tire of selling control to foreign entities, they will turn to their trusted self-destructive mechanism. At last resort, the printing press will be relied upon to restore cash to the depleted balance sheets. They think it will be money, but it is just paper, the most corrosive paper on the planet. It is far more corrosive than any industrial chemical. It kills entire industries, and millions of jobs. It even kills independent statehood. It opens the door to international carpetbaggers.

A systemic failure is in progress, in a painful ultra-slow excruciating process. People have finally begun to see the failure, often as something terribly wrong in vague terms. But they are still asleep as to causes and perpetrators. If they comprehended the depth of the problems, they would refuse to grant further control to perpetrators of the bank destruction. Deceptive banker reports still come, like the total charade by Wells Fargo. By extending their definition of loan default to 180 days or so, from the standard 90 days, they were able to write off far less in credit portfolio losses. Investors bit hard on the bait, and bid up their stock by over 20% on that day. What idiots! Wells Fargo has $84 billion in home equity loans in their portfolio. They are first to be killed off in home loan defaults, well before the senior first mortgages.

Bank insolvency is out in the open nowadays. The trend has become crystal clear, as successive quarters reveal incrementally larger bank portfolio losses. The worst lies ahead. A tip of the hat to Nouriel Roubini from New York University . He has the stones to tell Wall Street that the US banking system faces between $1 and $2 trillion in accumulative losses. During a recent interview, the anchors who interviewed him were in minor shock, and did not dish out their usual cocky disrespect. They might realize that Roubini is 90% correct for his forecasts placed publicly over the last two years. They might realize that Wall Street executives and US Fed members have been 90% wrong.

On the world stage, a tragedy has become apparent in recent weeks. THE ENTIRE ANGLOSPHERE BANK & ECONOMIC SYSTEMS ARE IMPLODING. The built economies atop housing bubble foundations, the common lethal transgression. The United States , the United Kingdom ( England ), Ireland , Australia , and New Zealand are suffering from critically wounded banking systems, led by housing markets. This was another longstanding forecast here. The latest nation to come to my attention for implosion is Northern Ireland , which runs on the pound sterling currency, being rooted as a British satellite. They have an even more damaged bank and economic system than Ireland (the central nation to the south), which is euro-based in currency. Geopolitical implications from the Anglo Sphere vicious decline are beyond description, as power shifts from West to East. The main problem is that military might is centered in the West, but wealth is centered in the East, while financial institutions are dominated by the West. Conflicts and compromise comes, even as sovereignty is yielded.

QUICK CONCLUSION

The Untied States will soon find itself cornered, isolated, having burned the hands of those who offered timely aid and rescues. It is heading down a path to nationalize Fannie Mae, its broken and corrupt insolvent mortgage centrifuge. When just a few decent sized banks fall, the Federal Deposit Insurance Corp will go begging to the same US Govt window, one located far lower than any spot in the dry hot Mojave Desert . The FDIC will be resupplied by more US Govt funds, maybe even from banks healthy enough to cough up a few bucks. Far more banks are troubled than the 90 on the FDIC official watch list, which did not include IndyMac.

The amount of uninsured funds in US banks is over $2 trillion. Hundreds of US banks are destined to go bust, according to less biased bank analysts, given in detail in the August report. The next rounds will include prime and commercial loans, whose volume will certainly push out almost $500 billion in more losses. At least double the current bank losses! The US financial system is a viper pit of interconnected collusion. The US Fed, the Dept of Treasury, Wall Street firms, US Govt regulators, the debt rating agencies, the Securities & Exchange Commission, the Commodity Futures Trading Commission, and major financial networks are so tight, that when they speak, their buttocks squeak, since the nether region is where their words emanate from.

When the US runs out of sources of money to tap, runs out of fools, hits the wall on handing away its national sovereignty, it will resort to the printing press. It is a device that kills the host, hardly any final solution. Ironically, US Fed Chairman Bernanke has not resorted much to date in its usage for rescues. He has overseen the ruin of the US Fed itself, accepting toxic assets from the mortgage world. He was won praise for this action. Such is the penalty for regulatory laxity by his predecessor. He will eventually turn to the print press that he once boasted about, boasted to be a national advantage. Instead, it is the noose around the neck of the US Dollar, and the catapult cord for the gold price. Some big bank liquidation events are planned soon, like in the next several weeks, maybe sooner.

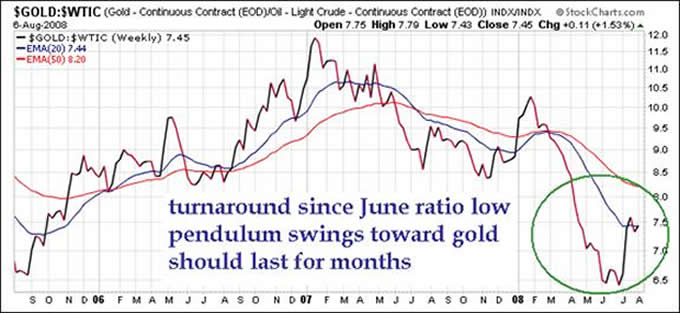

The Boyz took gold down again, as the US Dollar has seen surprisingly resilience. They want the gold price down as much as possible before the fireworks clouded by desperation this autumn. The gold price resembles what was seen one year ago, suppressed immediately before a big push up, a scary push up, a 25% rise. The financial sector bounce is 95% cooked done finished. Time for gold to take back the spotlight. In fact, the pendulum has begun to swing from crude oil to gold. Some might view this transition as a small consolation. Not here.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“I just subscribed to your services and must say that your insights are so eye-opening that it is like having a window to the future. I never thought that they would in so much detail encompassing the entire world. With all that is going on, I still wonder how you are so in touch with it all.” (ChrisB in Australia )

“The latest Hat Trick letter is great work. I am still reading and absorbing, but this is just great analytical work. Truly inspired. I would say you produce a very sophisticated, detailed product that is the best of the bunch. Truly. You help keep me very focused on current events and help me keep my eyes on the distant horizon.” (RichardB in Texas )

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” - (RobertN in Texas )

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street .” - (GeorgeC in Minnesota )

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.