Is A Stock Market Correction Looming?

Stock-Markets / Stock Market 2017 Jan 15, 2017 - 08:03 PM GMTBy: InvestingHaven

All stock market indexes in the U.S. reached all-time highs in the last couple of weeks. It is interesting to observe how diverse opinions have become. Stock forecasters are now even more bullish, while bears are more convinced that a stock market crash is around the corner.

All stock market indexes in the U.S. reached all-time highs in the last couple of weeks. It is interesting to observe how diverse opinions have become. Stock forecasters are now even more bullish, while bears are more convinced that a stock market crash is around the corner.

According to MarketWatch, Brian Belski, chief investment strategist at BMO Capital Markets, confirmed the above viewpoint. He says his clients believe”the stock market is set for a meaningful correction.” CNBC mentioned a leading market strategist who suggests a stock market correction is near because the Trump rally is fading.

One well known bear, Jim Rickards, predicted very recently yet another bearish stock commentary. He suggests a stock market correction is just around the corner, which he already predicted countless times in the last 5 years.

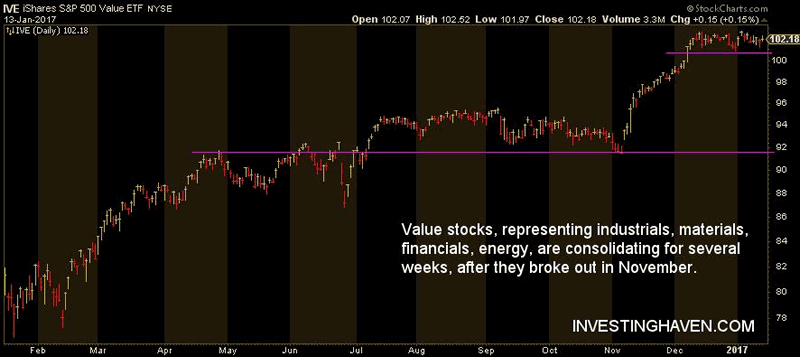

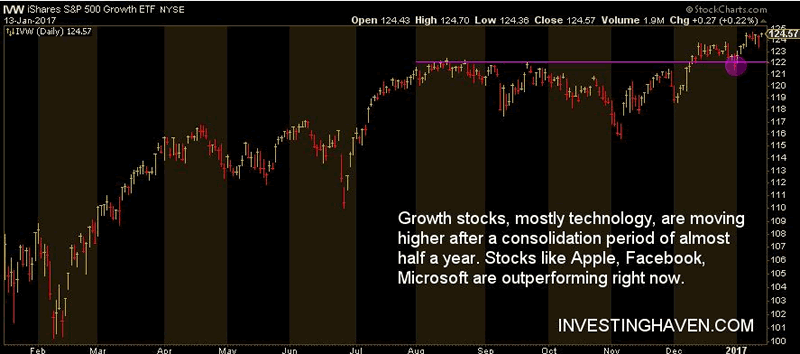

What stands out in all of these articles is that analysts consider the stock market as one marketplace. However, the point is that stocks have several segments. While the “Trump effect” was primarily driving value stocks higher (industrials, financials, energy), investors are now in favor of growth stocks, according to InvestingHaven’s research team.

Stock market correction vs. sector rotation

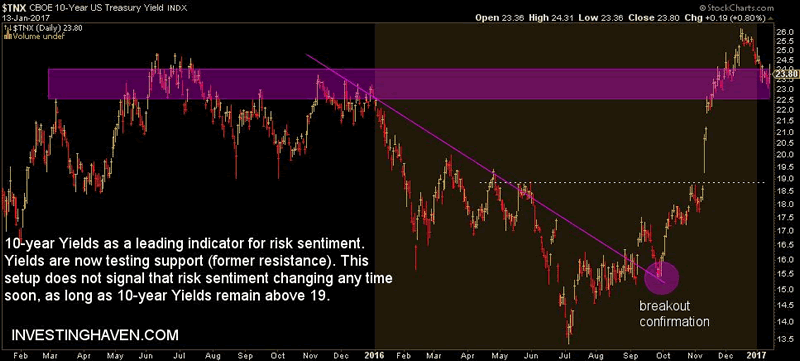

At this point in time, InvestingHaven’s research team does not see a stock market correction looming in the near term. Their call is based on their leading market indicator, the 10-year Yield. As seen on the first chart, there is no reason to be concerned from a technical perspective. As long as there is no breakdown in play, the overarching ‘risk on’ sentiment remains intact. The important levels in the 10-year Yield to watch are 22.50 and 19.

In reality, the stock market is currently going through a market rotation, in the short to medium term timeframe. Value stocks, representing industrials, materials, financials and energy, are now consolidating after they enjoyed a strong rally in the fall of last year.

Growth stocks are bullish now. Growth stocks are mostly representing the technology sector. As seen on the next chart, their technical breakout was confirmed right before year-end.

This article originally appeared on Investing Haven

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.