USD in Decline. SPX and TNX May Follow

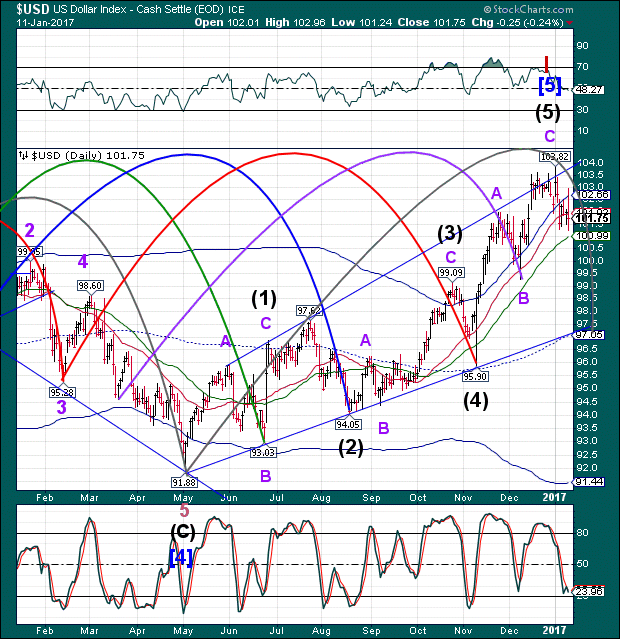

Stock-Markets / Stock Market 2017 Jan 12, 2017 - 02:44 PM GMT The USD is in decline, challenging its 50-day Moving Average at 10.99 by declining to 100.70 this morning. The USD has a high correlation to equities and an inverse correlation to treasuries and gold.

The USD is in decline, challenging its 50-day Moving Average at 10.99 by declining to 100.70 this morning. The USD has a high correlation to equities and an inverse correlation to treasuries and gold.

ZeroHedge points out, “Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding.

"The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing more political uncertainty," said asset manager GAM's head of multi-asset portfolios Larry Hatheway.

The biggest mover, and perhaps the key driver of risk since the election, was the dollar which tumbled as much as 0.8%, falling below its 50DMA for the first time since the election, and back to where it was during the December 14 Fed rate hike announcement, while Treasuries gained alongside commodities, as Donald Trump’s press conference sent a wake-up call to the market about exalted expectations for fiscal stimulus in the U.S.”

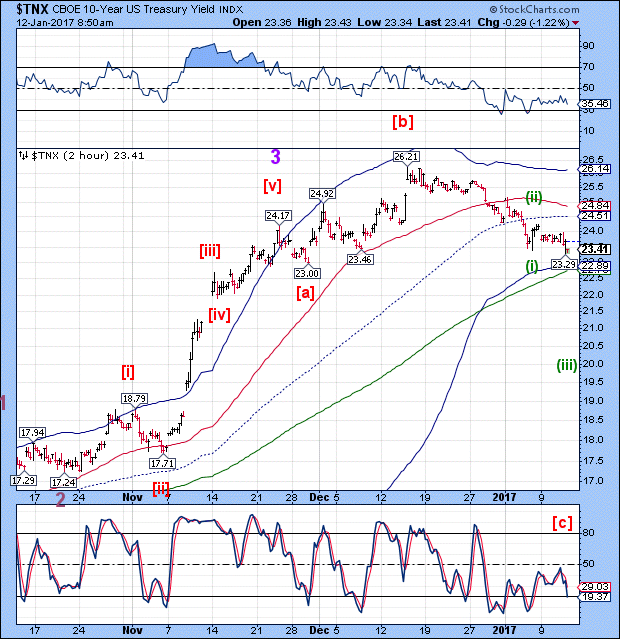

TNX is also in decline that may take it to 21.5 or below. Yesterday’s gangbuster 10-year Treasury auction is a case in point. This indicates at least a temporary reprieve from rising rates.

SPPX futures are down, but hovering above Short-term support at 2263.42 and the Broadening Wedge trendline at 2260.00. Crossing the trendline may trigger the Broadening Wedge formation, which indicates a probable 20% decline may follow.

It’s ironic that, as small business optimism and consumer confidence are at all-time highs, 100,000 more workers are on jobless benefits.

SPX VIX futures are also on the rise, but a breakout does not appear imminent, yet.

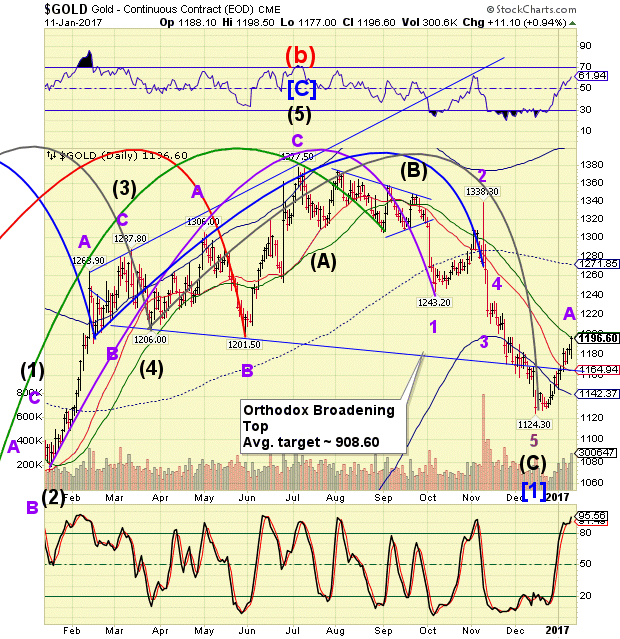

Gold futures have crossed the 50-day Moving Average at 1197.21 and the 1200.00 barrier as this morning’s rally took it to a new retracement high at 1207.05.

The Cycles Model suggests that gold may continue to rise for at least another week, as the period of strength appears to last through options expiration.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.