Gold Stocks Leading but Approaching Trump Resistance Levels

Commodities / Gold and Silver Stocks 2017 Jan 09, 2017 - 11:53 AM GMTBy: Jordan_Roy_Byrne

Although we expected a rally in the gold mining sector, we have been surprised by its strength and recent buying pressure. From the lowest ticks, Gold has rallied less than 6% but GDX has gained 25% and GDXJ has soared 36%. This rebound adds to the evidence that the gold stocks are leading the metal. That being said, the gold stocks are approaching some strong resistance levels which coincide with Trump's election victory.

Although we expected a rally in the gold mining sector, we have been surprised by its strength and recent buying pressure. From the lowest ticks, Gold has rallied less than 6% but GDX has gained 25% and GDXJ has soared 36%. This rebound adds to the evidence that the gold stocks are leading the metal. That being said, the gold stocks are approaching some strong resistance levels which coincide with Trump's election victory.

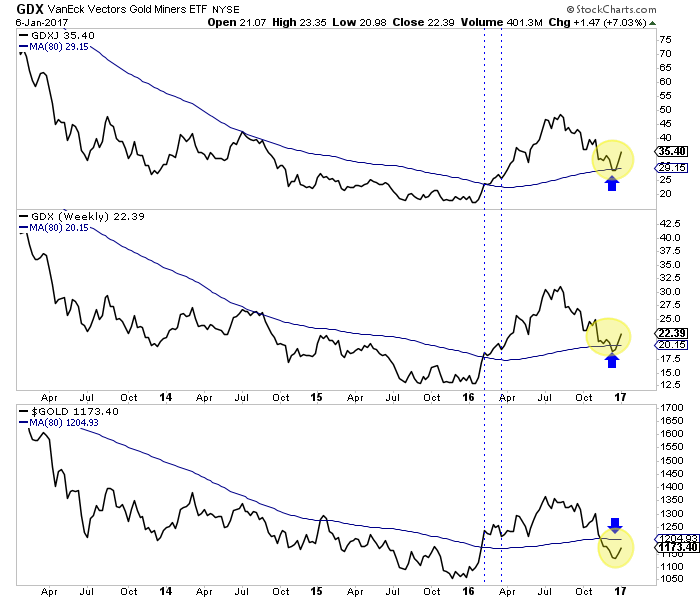

Below we plot the weekly line charts of GDXJ (top), GDX and Gold (middle). The weekly closing price is each data point. Note how both GDXJ and GDX (other than for one week) held their 62% retracement and 80-week moving averages while Gold did not. On the monthly charts (not shown) we find that the miners tested but closed above their 20-month moving averages (in November and December) while Gold closed below its 20-month moving average at the end of both months. Furthermore, note that Gold is some $50/oz below its Q1 2016 levels yet both GDX and GDXJ are trading considerably above those levels.

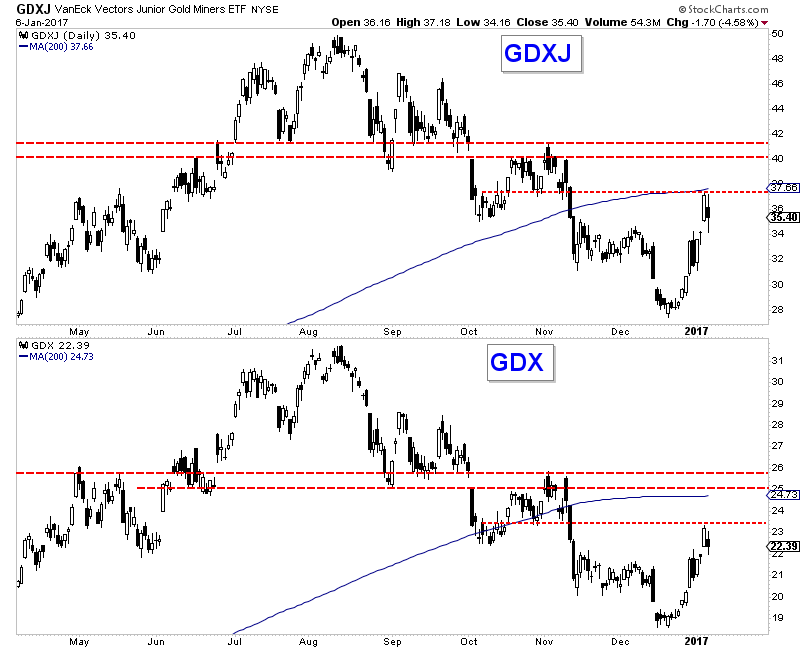

While the gold stocks are showing good progress and have more immediate upside potential, they are approaching strong resistance. The daily candle charts below detail the resistance in GDXJ (at $40-$41) and in GDX (at $25-$25.50). Note the strong selling (thick black candles) immediately prior to and after the election. Also, with respect to GDX, the more widely followed and traded ETF, the 200-day moving average comes into play near $25 and the 50% retracement is at $25.15. You think GDX's advance might stop at $25?

We expect the miners will reach these upside targets soon but a correction will follow, which will inform us quite a bit as to how sustainable this rebound is. If Gold is going to rollover again then the miners could end up retesting their December lows. However, if bonds continue to rally and real yields decline then this rebound could push beyond the Trump resistance levels. We bought a few positions recently but are holding some cash as we suspect there will be more buying opportunities before the gold stocks really takeoff.

For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.