The Endgame, Trump & Gold

Stock-Markets / Financial Crisis 2017 Jan 05, 2017 - 09:58 PM GMTBy: Darryl_R_Schoon

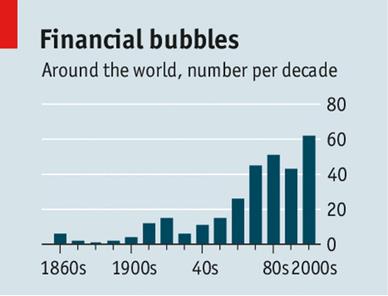

In the bankers’ endgame, slowing economic growth and excessive central bank liquidity forces investor capital into financial markets; driving up the price of stocks, bonds and commodities and creating financial bubbles whose collapse pose a systemic threat in overly-indebted capitalist economies.

http://www.economist.com

DEREGULATION AND THE ENDGAME

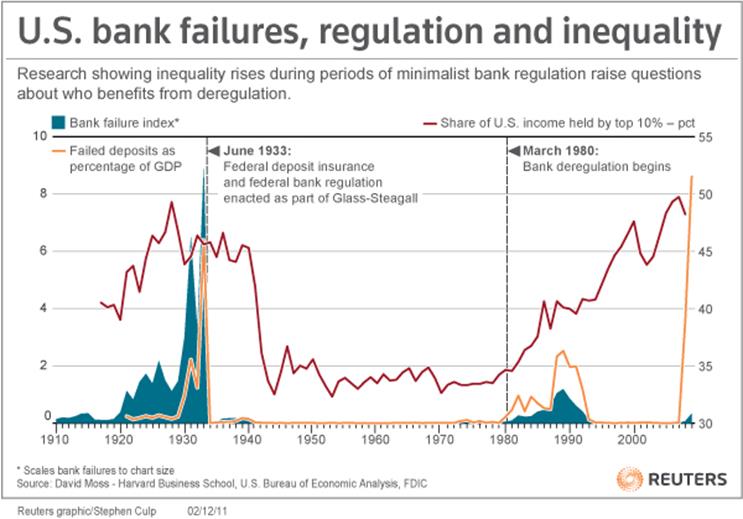

Fundamental and pragmatic banking regulations, which arose from the devastating financial collapses of the Great Depression, for decades strengthened U.S. banks and capital markets, making them the twin engines of American growth and the envy of the world… The systematic dismantling of those same regulations by greedy bankers began in earnest in 1980, peaked in 1999 [with the repeal of Glass-Steagall], and finally climaxed with an insane Securities and Exchange Commission ruling in April 2004, a final decision that paved the way for the implosion of everything regulation was designed to protect.

Shah Gilani, How Deregulation Fueled the Financial Crisis, January 2009

After investigating the causes of the Great Depression, Congress passed the Glass-Steagall Act in 1933 to prevent banks from again betting America’s savings in Wall Street casinos. Beginning in the 1960s, Wall Street banks tried 25 times to repeal Glass-Steagall, finally succeeding in 1999 after spending $300 million lobbying, i.e. buying, politicians’ votes.

In the Senate, 53 Republicans and 1 Democrat voted to repeal Glass-Steagall with 44 Democrats opposed. President Bill Clinton (D), however, sided with the Republican majority and Glass-Steagall was repealed.

Clinton’s Secretary of Commerce was Wall Street profiteer extraordinaire, Robert Rubin, former Chairman and CEO of Goldman Sachs. After the repeal of Glass-Steagall, Rubin was appointed chairman of Citigroup which sold hundreds of billions of dollars of fraudulent subprime mortgages. Rubin made $126 million during the subprime crisis and US taxpayers paid $350 billion to bailout the bank. In 2010, the Financial Crisis Inquiry Commission referred Rubin to the Dept of Justice for possible prosecution for crimes committed during the subprime crisis. The DOJ did nothing.

Deregulated markets allow financial predators, i.e. Rubin et. al., to criminally profit in the absence of oversight and the rule of law

The repeal of Glass-Steagall…was a continuum of the radical deregulation movement. This philosophy incorrectly held that banks could regulate themselves, that government had no place in overseeing finance and that the free market works best when left alone. This belief system manifested itself in damaging ways, including eliminating regulation and oversight on derivatives, allowing exemptions for excess leverage rules for a handful of players and creating dangerous legislation.

Barry Ritzholz, Washington Post, 2012

The repeal of Glass-Steagall in 1999 was followed by the 2008 financial crisis when Wall Street banks bet billions on suspect subprime mortgages, banks collapsed and taxpayers were forced to bailout the very bankers that had dismantled the regulations intended to prevent another collapse.

Today, banking regulations enacted after the 2008 financial crisis are about to be repealed as Trump and his coterie of Goldman Sachs bankers—Steve Mnuchin (former Goldman Sachs partner), now Trump’s nominee for Secretary of the Treasury, Steven Bannon (former Goldman Sachs managing partner), now Trump’s chief strategist and senior counselor, and Gary Cohen (president and chief operating officer of Goldman Sachs), now Trump’s top economic advisor—give Wall Street’s criminal cabal even greater access to what remains of America’s wealth, bringing the nation and the world closer to a catastrophic financial collapse.

THE COMING CRISIS

The new crisis will be of unprecedented scale…Since we have vastly increased the scale of the financial system since 2008 with larger banks, greater concentration of banking assets in fewer institutions, larger derivatives positions, and $70 trillion of new debt, we should expect the next crisis to be much worse than the last…policies to avoid a systemic catastrophe include reinstatement of Glass-Steagall, breaking up big banks and banning derivatives. The odds of any of these policies becoming law are close to zero because of the power of bank lobbyists.

James Rickards says Donald Trump can’t stop the next financial crisis, Marketwatch, 12/27/2016

Jim Rickards in his latest book, “The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis,” predicts in the coming crisis the banking system will be frozen by banking authorities until the crisis is over.

The crisis, however, will be unlike any other because the banking system can’t be fixed. Today, the bankers’ edifice of credit and debt is beyond repair; and because the crisis will be so extreme, the government’s response will be even more extreme than during the Great Depression when banks were closed, triggered by a run on gold.

…the New York Reserve Bank’s gold reserves had fallen below the legal limit. Reserve Banks were required to maintain gold reserves equal to 40% of the paper currency they issued, but foreign and domestic holders of US currency were rapidly losing faith in paper money and were redeeming dollars at an alarming rate.

…on Monday, March 6 [1933], President Roosevelt issued proclamation 2039 ordering the suspension of all banking transactions..The terms of the presidential proclamation specified that “no such banking institution or branch shall pay out, export, earmark, or permit the withdrawal or transfer in any manner or by any device whatsoever, of any gold or silver coin or bullion or currency or take any other action which might facilitate the hoarding thereof; nor shall any such banking institution or branch pay out deposits, make loans or discounts, deal in foreign exchange, transfer credits from the United States to any place abroad, or transact any other banking business whatsoever.”…For an entire week, Americans would have no access to banks or banking services. They could not withdraw or transfer their money, nor could they make deposits…

Robert Jabaily, Bank Holiday of 1933, Federal Reserve Bank of Boston, November 22, 2013

Today, Jim Rickards recommends Americans keep gold and silver and other hard assets outside the banking system because all “digital assets”, e.g. stocks, bonds, money market funds, etc.” will be subject to a banking freeze in the coming crisis.

Rickards also recommends that 10% of assets should be put in physical gold or silver to protect against the coming attempt by governments to inflate away unpayable levels of sovereign debt, the cause of the Weimer hyperinflation in the 1920s.

The next crisis will be a game changer. It’s not merely the end of the bankers’ ponzi-scheme of credit and debt, it’s a paradigm shift of historic proportions; and when the crisis is over, nothing will be as before, including humanity.

To survive a transformative crisis, institutions, nations, and individuals must all change.

Those who do, will. Those who don’t, won’t.

THE ENDGAME, GOLD AND GOLDMAN SACHS

In the endgame, the greater the systemic distress, the lower the price of gold.

In the bankers’ endgame, to disguise increasing levels of systemic stress, bankers force the price of gold lower to dissuade investors from fleeing risky paper assets for the safety of gold. When Europe’s sovereign debt crisis was spiraling out of control, the bankers manipulated gold’s then rapidly rising price from $1920 (September 3, 2011) down to $1160 (December 31, 2016). Today, the price of gold is still falling indicating monetary and systemic stress is still rising.

We expect that gold prices will continue to trend lower over the coming five years and introduce our long-term gold price of $1,200/oz from 2018 forward.

Goldman Sachs, January 2013

Like a serial killer who cannot help but give clues to his next crime, the accuracy of Goldman Sachs’ prediction is due not to prescient analytical insight but to its manipulation of the gold price; and while Goldman Sachs is a principal in the bankers’ ongoing manipulation, plans don’t always go as planned, especially in the endgame

Goldman Sachs manipulates gold through its commodities subsidiary, J. Aron & Co. J. Aron’s role was noted by Swiss banker Ferdinand Lips in his book, Gold Wars. Lips was a co-founder and former managing director of Rothschild Bank, Zurich.

On February 6, 1996 I visited J. Aron & Co, a well-established bullion firm in London…The conclusion drawn was..central banks were controlling the [gold] price…I realized that..J. Aron & Co...were the people who actually advised the central banks…and so I found out..who had the biggest interest in keeping the gold price down..It was not the central banks – it was the bullion banks.

Ferdinand Lips, Gold Wars, 2002

Rolling Stone writer, Matt Taibbi, in The Great American Bubble Machine, wrote, J. Aron & Co,”a Goldman-owned commodities-trading subsidiary received an exemption from the CFTC in 1991” to speculate in commodities it did not possess, allowing J. Aron to short gold it didn’t have and forward sell it at a below-market price, driving the price of gold lower.

Additionally, J. Aron alerts traders to upcoming attacks on gold by submitting a lower ask price than the bid, a bid/ask anomaly that signals astute traders that gold is coming under attack, allowing traders to ride gold lower and profit in the process.

Trump’s chief economic advisor, Gary Cohen, was a silver trader at J. Aron & Co. before moving to Goldman Sachs where he is now president and chief operating officer. Lloyd Blankfein, a gold trader at J. Aron, is now Goldman Sachs’ CEO.

One of the interesting things about J. Aron, which I’m sure attracted it to Goldman Sachs, is that they have a policy of not taking positions in commodities, preferring to act as merchant bankers and brokers [see Ferdinand Lip’s above quote]. Thus, Goldman Sachs need not worry about sudden surprises.

Thomas Russo, Wall Street lawyer, quoted in New York Times, October 30, 1981

Since Trump’s election, the price of gold has fallen and bank stocks have risen, i.e. Goldman Sachs’ stock price is up 33% and gold is down 12%. Expect this trend to continue until the next banker induced crisis shakes gold loose from the bankers’ tight grip.

Goldman Sachs’ storied run at the table of luck about to end. More than any other bank, Goldman Sachs has profited from the bubbles that have plagued America since the 1920s; and, according to Matt Taibbi, Goldman Sachs is not only a beneficiary of such bubbles but their architect, enriching itself as well when they collapse, see The Great American Bubble Machine.

Goldman positions itself in the middle of a speculative bubble, selling investments they know are crap. Then they hoover up vast sums from the middle and lower floors of society with the aid of a crippled and corrupt state that allows it to rewrite the rules in exchange for the relative pennies the bank throws at political patronage. Finally, when it all goes bust, leaving millions of ordinary citizens broke and starving, they begin the entire process over again, riding in to rescue us all by lending us back our own money at interest, selling themselves as men above greed, just a bunch of really smart guys keeping the wheels greased. They've been pulling this same stunt over and over since the 1920s — and now they're preparing to do it again, creating what may be the biggest and most audacious bubble yet.

Matt Taibbi, The Great American Bubble Machine, Rolling Stone Magazine, April 5, 2010

In 2006 and 2007, Goldman Sachs group peddled more than $40 billion in securities backed by at least 200,000 risky home mortgages, but never told the buyers it also was secretly betting that a sharp drop in US housing prices would send the value of those securities plummeting.

http://www.mcclatchydc.com/news/politics-government/article24561376.html

That Goldman Sachs bankers are members of Donald Trump’s inner circle is a warning sign that another banker induced crisis is coming. That it will come with Goldman Sachs sitting at the head of the table is somehow appropriate. Goldman Sachs needed $10 billion in outside loans to survive the catastrophic 2008 crisis. Next time, God willing, Goldman Sachs won’t survive.

2017 – 2027: A Hard Rain’s A-Gonna Fall, my youtube video, explains why the next ten years will be both difficult and significant, see https://www.youtube.com/watch?v=nE1Fr1KszTE. In the next decade, America’s destiny will be determined by our choices. Right now, it doesn’t look good.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.