2 Charts That Debunk the Bullish Case for Stocks

Stock-Markets / Stock Markets 2016 Dec 25, 2016 - 05:48 AM GMTBy: John_Mauldin

There’s compelling evidence that US stocks are overvalued. Yet just in the last month, we saw investors react to the US election by bidding the benchmarks up to new all-time highs.

There’s compelling evidence that US stocks are overvalued. Yet just in the last month, we saw investors react to the US election by bidding the benchmarks up to new all-time highs.

This implies they expect even higher prices next year. Can it happen?

Louis Gave of Gavekal took on that question in a lengthy and masterful presentation last week titled “Something’s Gotta Give” (article is behind paywall).

The prime question, says Louis, is whether the US economy is a “coiled spring” ready to bounce higher based on the new political environment. We know changes are coming.

Are they the kinds of changes that will help the economy, and so corporate earnings will grow enough to justify sharply increased stock prices in an already overvalued stock market?

Louis doesn’t have a firm answer, but I think it’s fair to say he is dubious. I’ll share with you just two of his 63 slides.

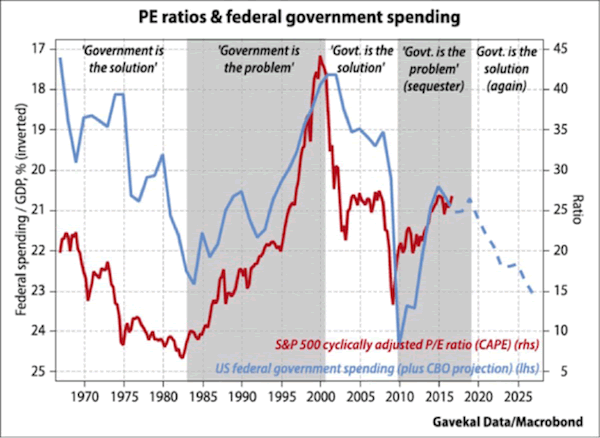

Government spending effect on stocks is overblown

The first one concerns government spending. Part of the present rally comes from expectations that Trump and the Republican Congress will launch an infrastructure stimulus program and also raise defense spending.

That’s not a sure thing. Even if it were, Louis points out that higher government spending historically correlates with lower P/E ratios.

Some people will dispute this. You can argue that the higher spending is a response to the lower growth that caused the low P/E ratio.

But if you believe that government is by nature less efficient than the private sector, then higher government spending will mean more capital misallocation, which is not good for stock valuations.

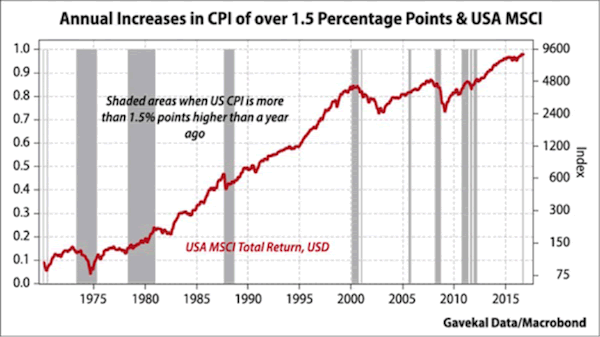

Higher inflation isn’t positive for stocks

A second justification for the current rally is that new policies and perhaps delayed Federal Reserve tightening will mean higher inflation. People say this will be positive for stocks. With this chart Louis again says, “Not so fast.”

The vertical shaded areas are periods of rising inflation. Other than 1979–1981, we see stocks falling in those periods, not rising. Louis says this is because inflation misallocates resources. Companies must hold more inventory, spend more on payroll and benefits, and otherwise take their eyes off more important goals.

Time will tell

Of course, the Trump administration will do more than just raise spending. Trump intends to reduce taxes, roll back excessive regulation, and otherwise make the US more business-friendly.

He will go about it differently than other Republicans would. His intervention in the Carrier outsourcing indicates that this is not going to be a conventional GOP White House.

We’ll see how well his approach works, and whether other changes can outweigh the drag caused by higher spending and inflation.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.