I Bet We’ll Get Four or More Interest Rate Hikes Next Year

Interest-Rates / US Interest Rates Dec 25, 2016 - 05:38 AM GMTBy: John_Mauldin

BY JARED DILLIAN : The fed funds target is now 0.50%–0.75%.1 Hooray!

BY JARED DILLIAN : The fed funds target is now 0.50%–0.75%.1 Hooray!

The Fed is finally, after eight years, normalizing interest rates.

The timing is awfully interesting, though—what a coincidence that the rate hike comes right after the election!

If they had hiked before the election, they could have affected the outcome of the election. So here we are. Just a few weeks after the election, and we got ourselves a rate hike.

But that wasn’t the big news last week. The big news was that the Fed had previously committed to two rate hikes in 2017—and suddenly, upgraded their assessment of the economy to justify three rate hikes next year.

What a coincidence!

I am betting that we will get more than three rate hikes next year. I am betting that we will get four—or more. It’s possible that fed funds will be close to 2% at the end of next year.

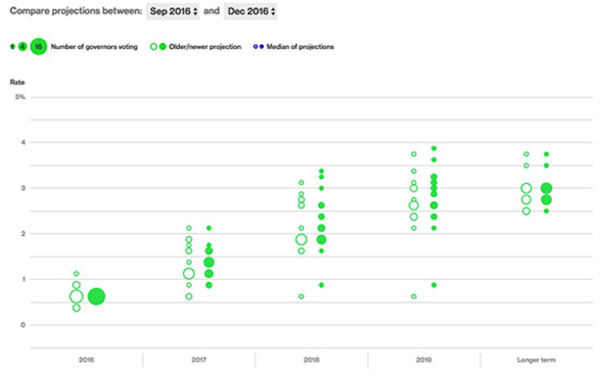

The dots!

Source: @business

Think it’s BS? Not anymore.

A lot of people reflexively call BS at this point, given the Fed’s long track record of overpromising and underdelivering.

Not anymore.

- Trump is president

- The Board of Governors is all Democrats on their way out, and they have nothing to lose

- The economy will legitimately get stronger

- Inflation will legitimately go higher

We could spend ten 10th Man issues talking about point 3 and point 4 in some detail, but I’ll summarize in one sentence: Money velocity is going to go higher.

Source: St. Louis Fed

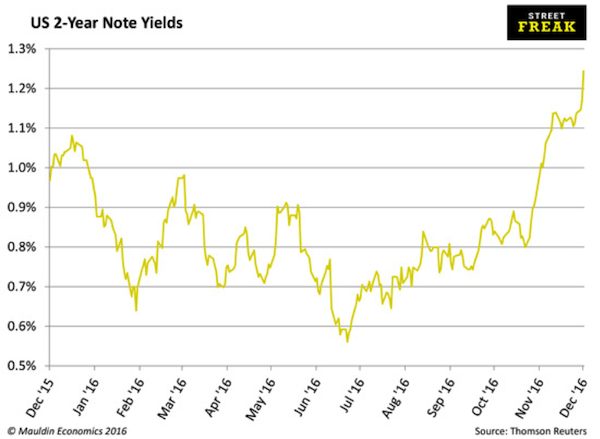

Did you know that twos are now at 1.25%?

That you can get 1–2% on ultrashort-duration funds?

That you can get close to 1% on yieldy money market funds?

That you will soon get interest in your bank account?

It’s a brave new world.

Here is the quick take: In previous issues, we’ve talked about why Trump is good for (most) stocks. In a Fed-free world, you’d expect the SPX to easily exceed 2,500 in short order.

But if the Fed is jacking up rates, not so fast.

And forget about my political conspiracy theories for a moment. Two rate hikes in 2017 is just not hawkish enough. The Fed does care about inflation (even though it explicitly hasn’t in the last eight years).

Things haven’t been this hot in a long time. They’ll hike rates. They’ll take away the punch bowl.

My honest-to-goodness best guess of where the S&P 500 ends up at the end of 2017?

Unch.

Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it’s also truly addictive. Get it free in your inbox every Thursday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.