European Financials take a Hit

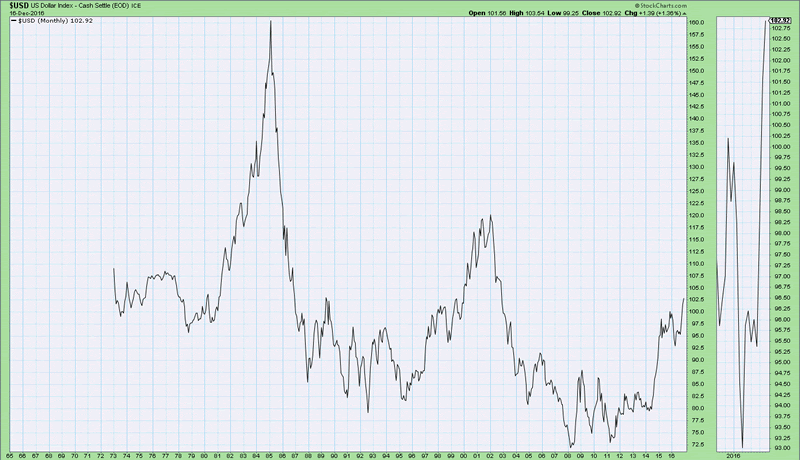

Stock-Markets / Financial Markets 2016 Dec 21, 2016 - 07:39 PM GMT This is the longest-term USD chart that I can find. The structure leads me to believe that it is on a giant retracement pattern that may have an ultimate target of 131.00 at a 61.8% retracement of the decline starting in 1984. I will be making minor revisions in my daily and weekly charts to reflect that outlook.

This is the longest-term USD chart that I can find. The structure leads me to believe that it is on a giant retracement pattern that may have an ultimate target of 131.00 at a 61.8% retracement of the decline starting in 1984. I will be making minor revisions in my daily and weekly charts to reflect that outlook.

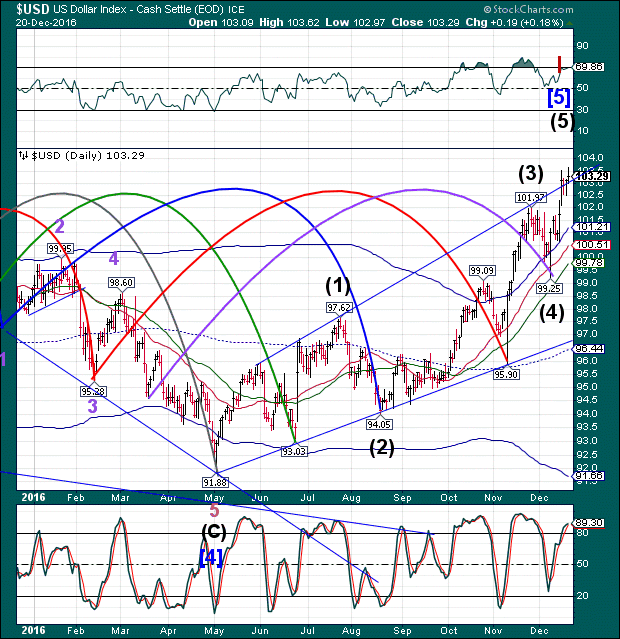

USD has completed an impulsive rally to 103.62. It has declined beneath its Broadening Wedge trendline to 102.81 this morning, putting it on a sell signal.

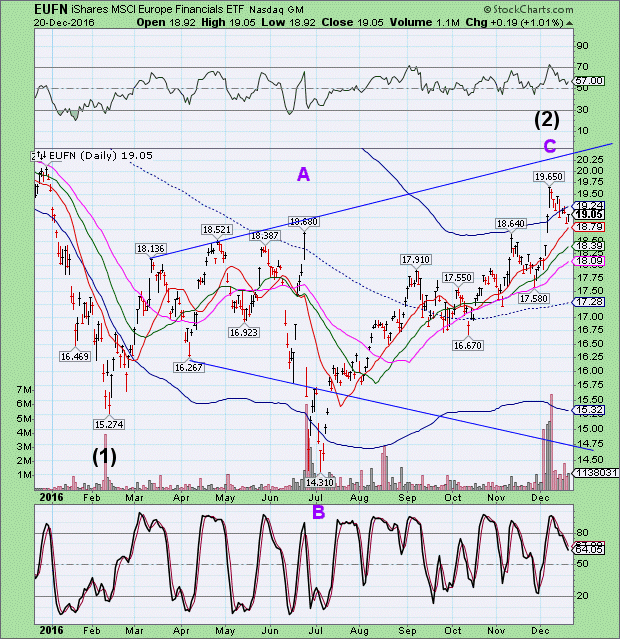

European financial stocks are taking hits as rumors spread about potential bailouts...or not.

ZeroHedge reports, “Total chaos reigns in European banking stocks this morning as Monte Paschi shares crash, soar, and plunge amid on-again, off-again bail-in, bail-out headlines (and stocks and bonds hit record lows). However, Italy is now not alone as Spanish banks are also bloodbathing following a European Court ruling on mortgage fraud went against them.”

The SPX Premarket remains calm thus far. ZeroHedge reports, “US equity futures and Asian stocks were unchanged while European stocks declined after touching the highest level in almost a year, as Italian and Spanish banks dragged indexes lower. The dollar eased back from 14-year highs as bond yields fell on Wednesday and oil extended its advance in increasingly thin trading.”

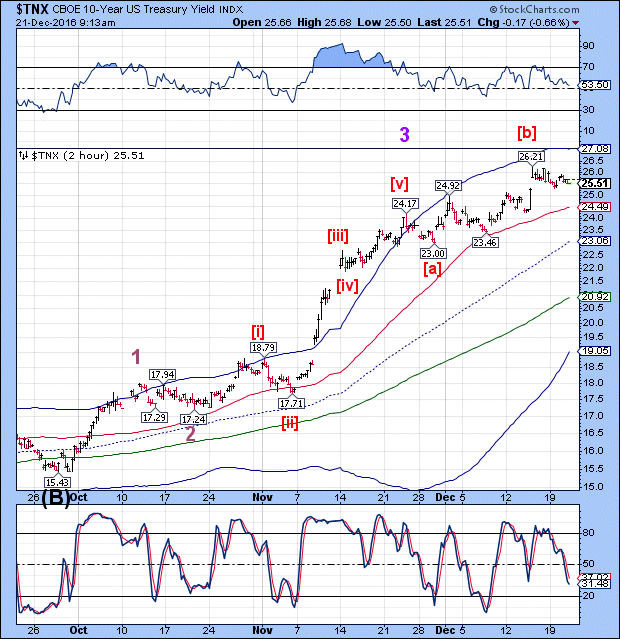

Yields are declining again, although not significantly. According to the 2-hour chart, yields may dip as far as the Cycle Bottom support at 19.05 in just a few days. It is expected to see a Master Cycle low by Friday.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.