Financial Markets on the Edge

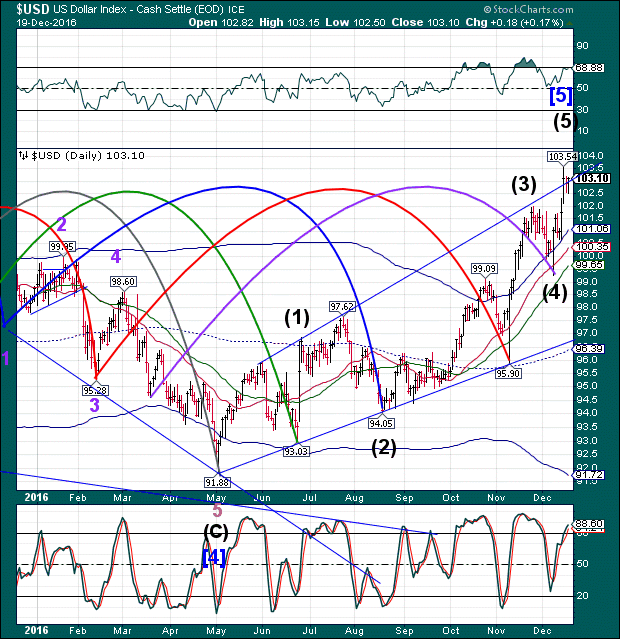

Stock-Markets / Financial Markets 2016 Dec 20, 2016 - 02:40 PM GMT I begin the day by discussing an error in my Elliott Wave structure and how it was remedied. You may recall that on a larger scale, the USD is in some type of Broadening Formation. I figured that Wave (C) of [4] hadn’t completed yet and I had calculated the structure in a way that still gave me upper limits on how far it could go.

I begin the day by discussing an error in my Elliott Wave structure and how it was remedied. You may recall that on a larger scale, the USD is in some type of Broadening Formation. I figured that Wave (C) of [4] hadn’t completed yet and I had calculated the structure in a way that still gave me upper limits on how far it could go.

USD is pressing that limit. In addition, it probed higher in yet another wave that told me that this rally is not corrective, even though the lesser parts appear to be. It has become a Broadening ending Diagonal that may be complete between 103.28 and 104.24. It has achieved that target last week.

If the past two trading days produced a reversal pattern, as it appears, then it may be prepared for a strong decline a early as today. However,

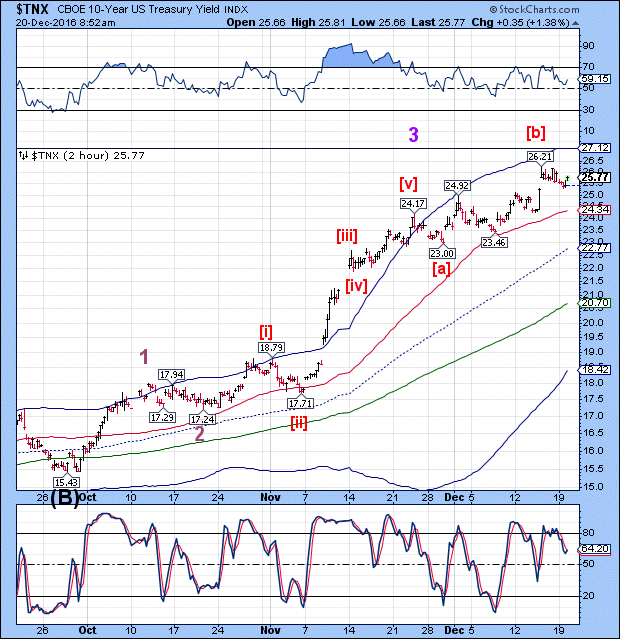

This may be the reason for the hesitancy in the SPX until now. Both indexes appear to have given reversal patterns, but only produced mild declines so far.

Since SPX has held support at the Trading channel trendline, one must always allow for the potential for an additional rally. The maximum limit on SPX is 2285.92. However, should the USD decline today, the SPX is likely to follow it.

TNX is hesitantly higher, but may change on a dime.

Whatever is going on may produce some large moves in the next three days. Let’s see what happens.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.