SPX may be hit by a double whammy

Stock-Markets / Stock Markets 2016 Dec 19, 2016 - 03:27 PM GMT While the SPX Premarket is slightly positive it has a cluster of Primary Cycle turns starting last Friday and lasting through this week that suggest something remarkable may happen. Friday morning was the terminus of an irregular (truncated) Wave (c) correction. The decline afterwards wasn’t very deep, but enough to cross beneath the trading channel trendline and become trapped beneath it at the close,

While the SPX Premarket is slightly positive it has a cluster of Primary Cycle turns starting last Friday and lasting through this week that suggest something remarkable may happen. Friday morning was the terminus of an irregular (truncated) Wave (c) correction. The decline afterwards wasn’t very deep, but enough to cross beneath the trading channel trendline and become trapped beneath it at the close,

This morning’s positives may fade at the open, although there is room for a further bounce should SPX open above that trendline.

Wednesday is day 258 of the current Master Cycle. A low on that day would give the SPX 6.14 days (43 hours) of decline. The following day (Thursday)) is a Pi date which raises the likelihood of an extension to that date. An 8.6 day decline would carry over until December 28. I am not leaning toward the longer decline at the present, since there are no indications of a significant turn that week.

While the decline may be short, it offers the probability of being intense. First, there is likely to be no corporate stock buying of any significance this week as many companies have entered the blackout period consisting of 30 days prior to their earnings announcements. Second, there is some discord among the Electoral College that may be disquieting to the markets.

ZeroHedge also reports that global stocks are beginning to fade.

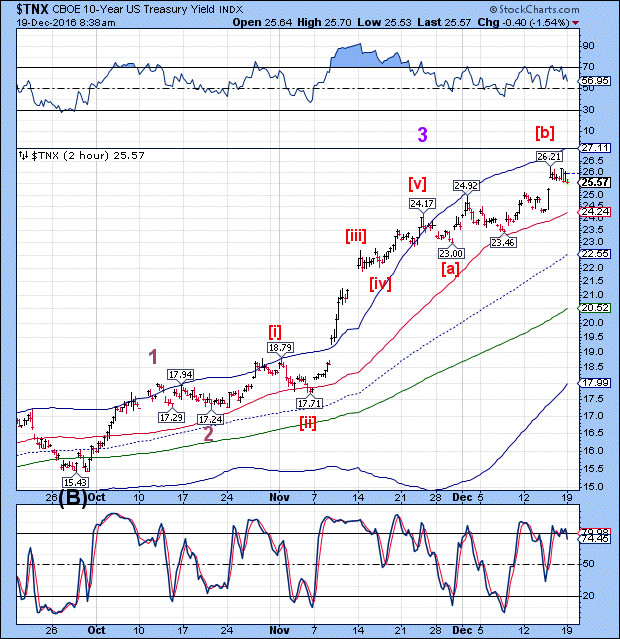

TNX has already made a substantial downward move this morning after completing its Wave [b] correction. It has made a small reversal pattern, but won’t be confirmed until TNX declines beneath 24.24. This currently advocates a partial long position in USB or UST.

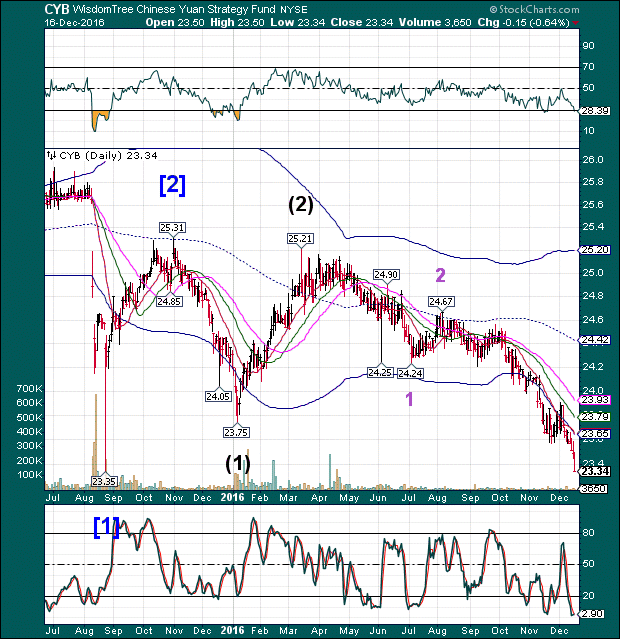

Another source of potential volatility this week is the Chinese Yuan. The Yuan has exceeded its January 7 low and is now challenging its August 24 low. Both lows produced a significant sell-off in the SPX.

China’s FX reserves are becoming critical. ZeroHedge reports, “Two months ago, when looking at an alternative measure of Chinese capital outflows using SAFE data, Goldman found that contrary to official PBOC reserve data, "China's Capital Outflows Are Soaring Again", having hit $78 billion in September.

Over the weekend, and following the latest PBOC data which revealed an outflow of $56 billion in November (which was only $34 billion when FX adjusted), Goldman repeated its FX flow calculation using SAFE data, and found the China continues to mask the full extent of its outflows, which in November spiked to $69 billion, and that "since June, this data has continued to suggest significantly larger FX sales by the PBOC than is implied by FX reserve data", once again suggesting that China is eager to mask the true extent of reserve outflows, perhaps in an attempt to not precipitate the feedback loop of even further panicked selling of Yuan and even more outflows, and thus, even more reserve depletion.”

A look at the VIX futures shows a probable spike in the VIX up to the 50-day Moving Average this morning. This may confirm a buy signal from the VIX. We will wait until after the open to verify this move.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.