Will Stock Market VIX Spike Today?

Stock-Markets / Stock Markets 2016 Dec 16, 2016 - 02:32 PM GMT Good Morning!

Good Morning!

The SPX Premarket is up, as would be expected for the close of index options at today’s open. Volatility may spike at the open as options traders settle their trades. What happens after the institutions leave the scene?

ZeroHedge comments, “Quad-witching Friday has arrived, which means that alongside thin, pre-holiday liquidity and a jumpy market, we expect to see sharp, volatile moves for the rest of the day, the first of which was just noted in Europe, where stocks moved from session lows to highs in the span of minutes, in the process sending the Euro Stoxx 50 index 0.8% higher and turning it positive on the year as it reached its highest level since December 2015. The broader Stoxx 600 remains still down 1.8% on the year. Of Europe's indices, the IBEX, FTSE MIB, SMI are still down; while the FTSE 100, CAC 40 are up on the year and the German DAX just hit 2016 highs.”

In another article at ZeroHedge we read, “In August 2015, I tweeted that if Donald Trump were to be elected President of the United States, we would have to “head for the bunkers.”

A Trump presidency was considered highly unlikely back then; but here we are. And while heading for the bunkers might not be the most appropriate response (yet), where we are is undoubtedly a more dangerous world.”

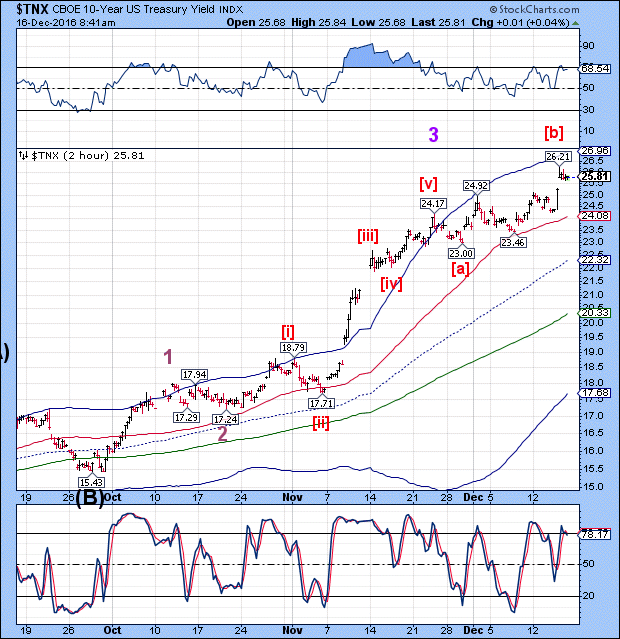

TNX is on “pause” at the open. The Wave [b] pattern is complete, so it is waiting for stocks to begin their decline.

Has the rally in yields above 2.6% triggered the sell-off? Last week Goldman commented that it would be the “line in the sand.”

However, it appears to have modified its tune as this morning ZeroHedge reports, “At the end of November, when the 10Y yield had just cracked 2.3%, Goldman, together with SocGen, JPM, RBC and various other banks, gave its answer to what may be one of the most important questions for the market right now: how high can 10Y bond yields go before they start to hurt equities? Goldman answered that "the equity market is still at a level that can cope with moderately rising bond yields. We estimate that a rise in US bond yields above 2.75% or probably between 0.75-1% in Germany would create a more serious problem for equity markets: at that point we would expect the correlation between bonds and equities to be more positive - i.e., any further rises in yields from there would be a negative for stock returns."

They seem to be saying, “Nothing to see here. Move along.”

However, we are not the only ones with bond issues.

ZeroHedge reports, “One day after China's regulator halted trading in bond futures for the first time ever, Beijing suffered another catalytic bond-market event overnight when it failed to sell all the Treasury Bills on auction Friday, for the first time in almost 18 months, as bids fell short of minimum requirements, according to traders required to bid at the auction.

As BBG reported overnight, the Ministry of Finance sold only 9.57 billion yuan ($1.38 billion) of 182-day bills in a planned 10 billion yuan sale, and 10.85 billion yuan of 91-day notes in a planned 12 billion yuan sale, according to a statement from the bond clearing house. What is notable, is that the Bills on offer paid a hefty yield: the 182-day bills sold for 2.9565%, while the 91-day bills sold for 2.8991%.”

China is the biggest seller of US Treasuries.

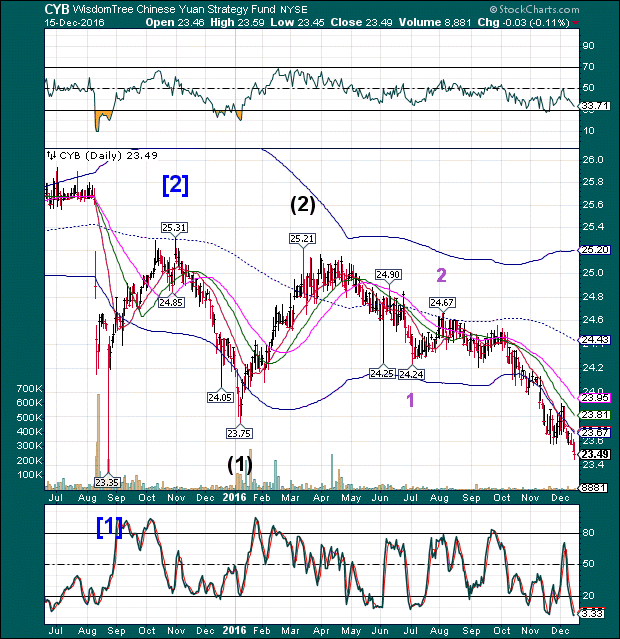

And the Yuan is coming very close to breaking its August 2015 low,, which triggered the market sell-off in both August 2015 and January 2016.

It appears that we may experience a liquidity shortage on a global scale. Yesterday the Shanghai Index came close to breaking a bearish trendline near 3100.00. The failed bond auction may be the final straw that opens the floodgates to another 1,000 point move in that index.

More later.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.