Goldman Sachs is Talking Nonsense Again: Shale will not affect Global Oil Supply until Price hits $85

Commodities / Crude Oil Dec 16, 2016 - 04:00 AM GMTBy: Andrew_Butter

Latest headline: “Goldman Sachs Warns the Saudis: ‘’U.S. Shale Will Respond’’”

Latest headline: “Goldman Sachs Warns the Saudis: ‘’U.S. Shale Will Respond’’”

http://oilprice.com/Energy/Crude-Oil/Goldman-Sachs-Warns-The-Saudis-US-Shale-Will-Respond.html

Reminds me of when we all used to sing-along the company song ”House Prices Always go up”; and why not? If you could get the suckers to buy that idea, selling them AAA-rated (toxic) collateralized debt obligations concocted by Goldman Sachs, was a synch. Ah...Goldman Sachs...the Divine God’s Workers; now they are experts on shale oil...what next...tropical fish? So now they are telling their customers “shale oil is a buy”, that means presumably, they are long and they are scrambling to unload their positions?

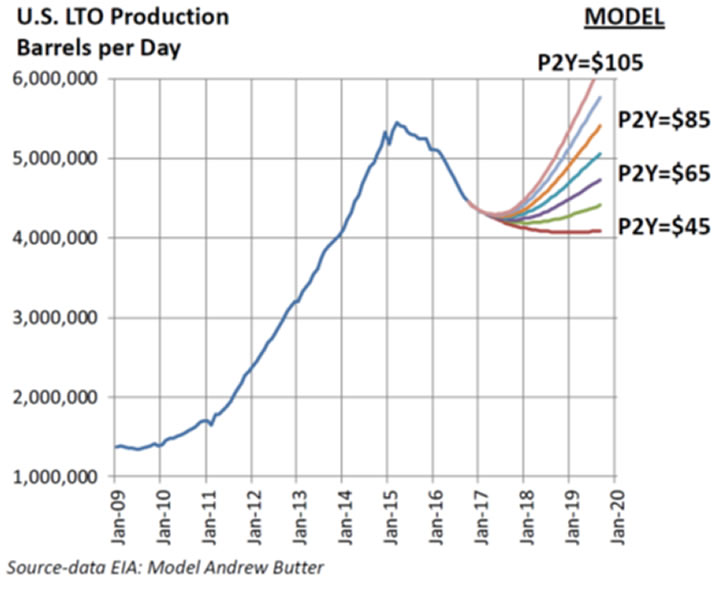

If the oil price hits $60 by Christmas and stays there for two years, this analysis says in two years time U.S. LTO production, condensate and all, will be unchanged from what it is today at about 4.45 Million barrels per day, a cool million barrels or so down from its peak in March 2015.

http://oilpro.com/post/28990/forecast-lto-production-signals-beginning-end-misery-offshore-dri

Don’t forget, legacy loss of LTO runs at 5% per month so you need a lot of new-oil to top that up; with conventional it’s less than 0.1% per month. Currently, in spite of all the hoopla about rigs going back...just so you know, even in the land of tropical-fish-handlers masquerading as divine messengers from God, rigs drill holes, they don’t make oil...total LTO production as shown in the latest DPR from EIA is still falling every month.

The Saudi’s know that, that’s why they are swinging, because they know that at $60 Shale will not roar back; and they know that even if the price stays at $45 that will only suck 200,000 barrels per day out of LTO/Shale in a year, so what’s the point in keep beating the dead horse? Oh but I bet they are all quaking in their flip-flops, now that they have been “warned”.

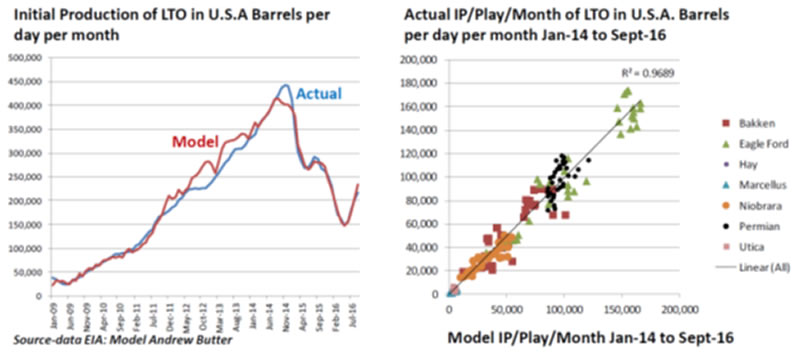

The prediction of zero-change at $60 is based on a model that explains 98% of changes of total LTO production since January 2007....month on month. That’s not Goldman Sachs mumbo-jumbo, that’s arithmetic plus non-linear multivariate analysis, and it takes into account all of the improvements in Initial Production per Completed well (IP/C) that happened over the past two years (mainly in Permian).

Outside of dummy variables on the individual plays the model on the right has just TWO explanatory variables, IP/C and Oil-Price six month trailing average. Not much chance of co-dependence there; and none flagged – I ran the test.

The model is not “conservative”, it assumes that the increases in IP/C over the past year (particularly in Permian), were not just because of “cherry-picking” and the technology can be rolled out elsewhere when drilling re-starts in earnest and then the new wells get completed. That’s the unknown...could be less, highly unlikely to be more.

OPEC plus semi-OPEC are talking about taking 1.8 million barrels per day off the table; if they keep their word, or even 50% of their word; by mid-2017 we will see the start of a spike, because shale (LTO) won’t be able to keep up unless the price goes to $85 or more. This is how the model works out for total production (existing – legacy loss + new-oil) various price scenarios in two years time:

The big question then will be whether offshore drillers can take up the slack, or it will be a case of “here we go again”; problem is they got a five year timeline from when you spud to when you see the oil, and right now everyone is sitting on the beach.

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe. Ex-Toxic-Asset assembly-line worker; lives in Dubai.

© 2016 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.