Stock Market Exciting Day Ahead

Stock-Markets / Stock Markets 2016 Dec 14, 2016 - 03:19 PM GMT SPX nearly maxed out yesterday as it approached 2285.92, which is the limit of this wave structure. That’s not to say that it absolutely cannot change its form again. However, we’ll address that issue if it comes. Right now, it is overdue for a decline and a measure of the decline will tell us what may come after.

SPX nearly maxed out yesterday as it approached 2285.92, which is the limit of this wave structure. That’s not to say that it absolutely cannot change its form again. However, we’ll address that issue if it comes. Right now, it is overdue for a decline and a measure of the decline will tell us what may come after.

The Premarket is modestly down. There may not be a lot of activity until after the FOMC announcement at 2:00 pm.

The weekly chart shows the SPX may have exceeded the upper trendline of two Orthodox Broadening Tops, the second of which can be seen in the weekly chart. However the SPX closed at or near the trendlines and it appears that it may open beneath it. In cases such as this, I use the 3% rule, which states that when a trendline is exceeded by more than 3%, something else is happening. In this case it exceeded it by .3%.

ZeroHedge writes, “European stocks slipped from an 11 month high, Asian stocks and S&P futures were flat as caution pervades global markets before the Federal Reserve’s expected interest-rate hike on Wednesday. Crude dropped to session lows near $52 after API data showed U.S. stockpiles increased, and after a Manaar Group consultant said Iraq won’t cut output by 180k b/d-220k b/d as it committed to do under Nov. 30 OPEC agreement.”

The Mises Institute put out an article this morning outlining the possible options.

VIX had another up day yesterday as the SPX rolled over. The headline on the VIX chart appears not to have been updated for yesterday’s activity. The data page shows yesterday’s high at 13.42, however.

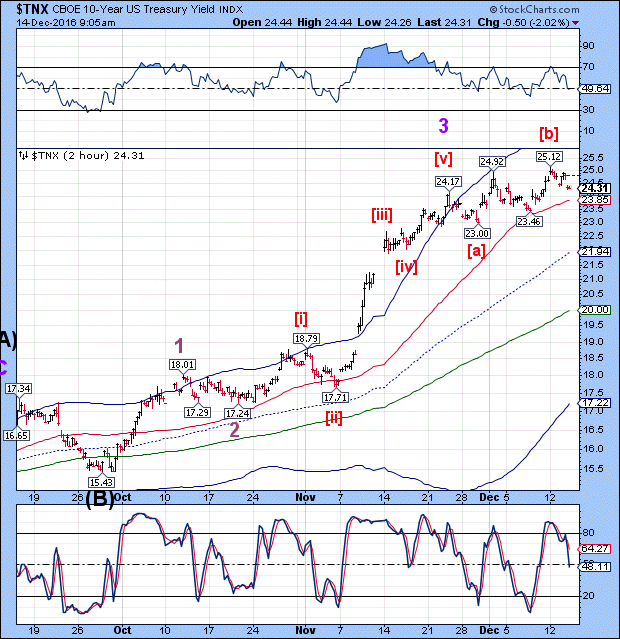

This may be considered an aggressive buy (SPX sell) signal, but there is yet no confirmation from the SPX, the Hi-Lo nor the TNX. We would look for these confirmations to build before taking any substantial short positions. There is rarely, if ever, a clear signal at the very top. We need confirmation after all the false alarms in the past two weeks.

TNX opened down, but hasn’t crossed its Intermediate-term support at 23.85 where a sell signal may be confirmed.

ZeroHedge reports, “Commercial traders are net long more bond contracts than at any point since 1992other than in the spring/summer of 2005 according to the latest data from the Commodity Futures Trading Commission.”

Who’s right may make a very large difference, since if the commercials are right, the investors on the “other side” of the equation may have to unwind positions making a very strong decline.

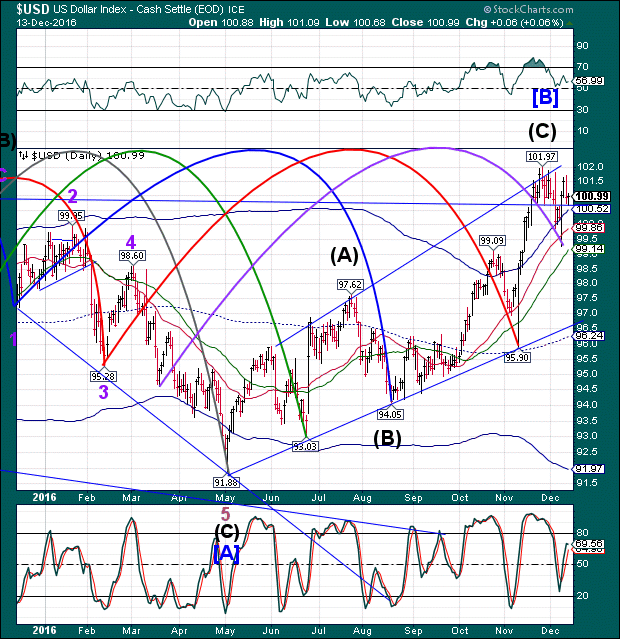

USD is hovering above its trendline this morning. However, it may have completed its first impulse from the top, implying a decline may be at hand.

There appears to be a Master Cycle low on December 8, which normally would give USD a two-to-three-week rally. A failed rally at this point would be very bearish.

Today may be a pretty exciting day.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.