Stock Market Waiting for the FOMC?

Stock-Markets / Stock Markets 2016 Dec 13, 2016 - 02:31 PM GMT Good Morning!

Good Morning!

The SPX Premarket is higher, but the futures have not made a new high. Yesterday’s decline may be impulsive, but the test is whether a new high is made today or not. In addition, the Wave structure appears to be complete as of yesterday morning. We may see some residual bullishness at the open, but the jury is still pondering the verdict as of now.

You can see even ZeroHedge is bullish as it writes, “Yesterday's brief hiccup in what has been an otherwise relentless rally in global risk assets is all but forgotten this morning, as European and Asian stocks, and US equity futures, all rise in quiet trading ahead of tomorrow's FOMC meeting, with the Dow set to make a 16th consecutive post-election all time high.”

The FOMC begins its meeting tis morning and the typical response of the market is to rally. This may be a “buy the rumor, sell the news” event. The last time this happened, the market wasn’t quite as positive as is normally the case.

In addition, Options Expiration is this week with VIX options expiring on Wednesday.

VIX futures are modestly lower today, The futures do show a new low, while the cash market does not. So, there is a 50-50 probability of going either way. That is, either the VIX makes a new low at or below 11.02 or it breaks out, giving us a market signal. The pattern favors the breakout at the moment.

I’m not sure we will get any resolution until tomorrow, however.

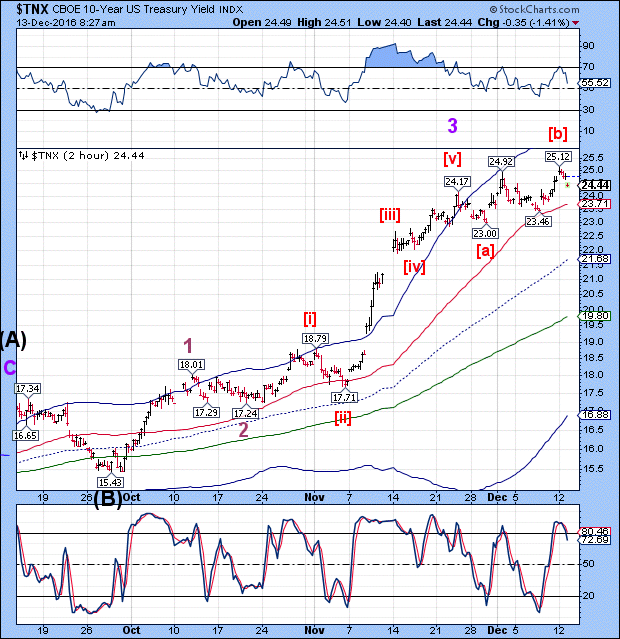

TNX appears to have complete Wave [b] and may be ready for a decline into the same projected Master Cycle low as the SPX. Confirmation comes with the crossing of Intermediate-term support at 23.71.

I will be in conference all morning and may not be back for commentary until this afternoon.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.