Buying Gold Into A Fed Hike: As Dumb As It Sounds?

Commodities / Gold and Silver 2016 Dec 12, 2016 - 12:24 PM GMTBy: Bob_Kirtley

The Fed will hike rates this week. The US Dollar is strengthening. Fiscal policy is about to ignite economic growth. The ECB has reduced its rate of QE purchases. It doesn’t sound like now is the time to be buying gold, does it? And yet, the setup is remarkably similar to this time last year, before the yellow metal put in a near 30% rally. What matters most is not what will happen, but what will happen relative to expectations. It is fair to say that the market has some lofty expectations built in at present, which is why it could be a case of buying the rumour and selling the fact over coming months.

The Fed will hike rates this week. The US Dollar is strengthening. Fiscal policy is about to ignite economic growth. The ECB has reduced its rate of QE purchases. It doesn’t sound like now is the time to be buying gold, does it? And yet, the setup is remarkably similar to this time last year, before the yellow metal put in a near 30% rally. What matters most is not what will happen, but what will happen relative to expectations. It is fair to say that the market has some lofty expectations built in at present, which is why it could be a case of buying the rumour and selling the fact over coming months.

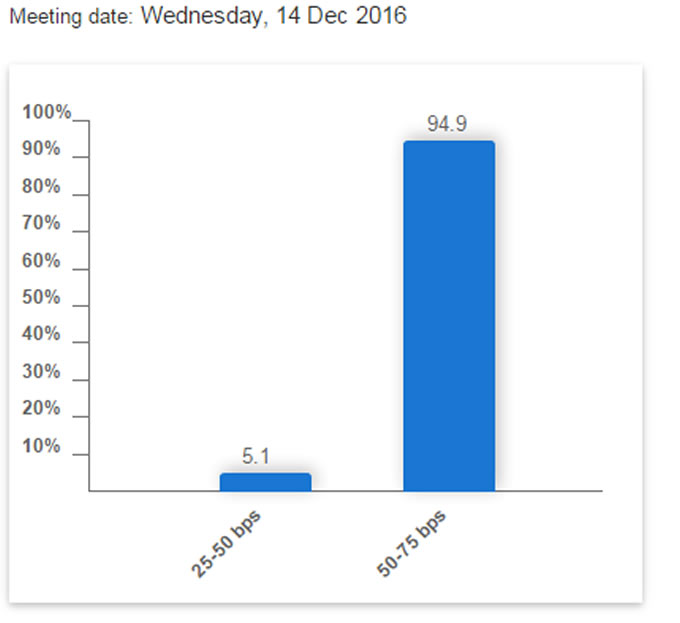

+0.25% This Week Is 95% Done

According to the CME’s FedWatch Tool, a 25bp hike this week from the Fed is 95% priced in, which is near enough 100%. So when the Fed hikes rates, how will the market react?

The hike has been so well signalled, and is so well priced into financial markets, that when it is confirmed it will have little impact whatsoever. So those arguing against being long gold this week as “the Fed will hike” are perhaps not fully considering the extent to which this hike is expected. What matters more is the tone surrounding the hike and the dot plot projection of future rate expectations.

The Fed has been emphasising its extremely cautious, data dependent stance for years now. Stability is one of their key concerns. They have not hiked through all of 2016, so are not about to signal a rapid series of hikes given economic data has been relatively stable. In fact, when the Fed hiked in December last year, the dot plot was lowered from the September projection. Whilst we are not expecting the Fed to lower the dots this time around, we see a very limited chance that the dots are higher. The markets on the other hand have aggressively increased their expectations for future hikes in the last month or so, meaning that no change in the plot could see them bitterly disappointed.

Greenback Rally Dependent On Hawkish Yellen

Gold prices exhibit an inverse relationship with the US dollar, particularly against the Japanese Yen. In order for the USD rally to continue it will take a hawkish Fed that signals further tightening over and above the markets current expectations. If the dot plot is unchanged, this could see the USD weaken and take gold prices higher.

The relationship between gold and USDJPY has become more apparent recently due to the widening interest rate differential between the two. The BoJ has pledged to keep its 10year bond yield near 0%, but US bond yields have risen significantly as the market bets on aggressive tightening from the Fed in response to inflationary fiscal policy next year.

Fiscal Policy Is Not A Light Switch

The market has grown increasingly confident of a sustained uptick in economic data, driven by upcoming “borrow and build” policies from the new administration. However, the market is placing little chance of anything derailing the programs and their impacts. Trump cannot simply flip a switch when he takes office.

Whilst aggressive US fiscal policy can be inflationary, the effects of such policies take time to feed through. Of course such policy still has to be proposed, agreed upon, and implemented. When the Hoover Dam project was announced during The Great Depression, thousands of unemployed Americans flocked to Nevada looking for work, shovels at the ready. They were bitterly disappointed when they learned that it would be years before any labour was required, since the dam still needed to be designed, construction planned, and materials sourced.

There is then yet another lag between the implementation of such projects and their impact being seen in economic data, then the Fed reacting to that data. Yet, the market expects a couple of Fed hikes to come next year – despite the Fed only just getting to its second hike eight years after the GFC.

It’s not about the end result. It’s about the result relative to expectations. Expectations are lofty, and markets are impatient. The market will react poorly to any delays in fiscal and monetary policy changes, but gold will respond positively to them.

Buy The Rumour, Sell The Fact

Last year the December FOMC marked the low point for gold prices. It was a classic case of where “buying the rumour and selling the fact” was the optimal trading strategy. We cannot help but hold the view that this will be the case again. Every time the Fed hikes, the hurdle for the next hike is higher. The level of economic strength required for the first hike is minimal compared to what the Fed will need to see for the third and fourth hikes.

In our view gold is sitting on a key support zone around $1175-$1150 and from this base it is primed for a $150-$200 rally over the coming month or two. To see what trades we are placing to take advantage of this move please visit www.skoptionstrading.com to subscribe.

Go Gently

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

www.gold-prices.biz

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.