Infrastructure A Budding Asset Class

Stock-Markets / Infrastructure Dec 08, 2016 - 12:07 PM GMTBy: Richard_Mills

Infrastructure is the physical systems – the roads, power transmission lines and towers, airports, dams, buses, subways, rail links, ports and bridges, power plants, water delivery systems, hospitals, sewage treatment, etc. – that are the building blocks, the Legos, that fuel a countries, a cities or a community’s economical, social and financial development.

Infrastructure is the physical systems – the roads, power transmission lines and towers, airports, dams, buses, subways, rail links, ports and bridges, power plants, water delivery systems, hospitals, sewage treatment, etc. – that are the building blocks, the Legos, that fuel a countries, a cities or a community’s economical, social and financial development.

There is an undeniable, an unarguable connection between the quality of a countries economic competitiveness and its infrastructure.

“Extensive and efficient infrastructure is critical for ensuring the effective functioning of the economy, as it is an important factor in determining the location of economic activity and the kinds of activities or sectors that can develop within a country. Well-developed infrastructure reduces the effect of distance between regions, integrating the national market and connecting it at low cost to markets in other countries and regions. In addition, the quality and extensiveness of infrastructure networks significantly impact economic growth and reduce income inequalities and poverty in a variety of ways.

A well-developed transport and communications infrastructure network is a prerequisite for the access of less-developed communities to core economic activities and services.

Effective modes of transport—including quality roads, railroads, ports, and air transport—enable entrepreneurs to get their goods and services to market in a secure and timely manner and facilitate the movement of workers to the most suitable jobs. Economies also depend on electricity supplies that are free from interruptions and shortages so that businesses and factories can work unimpeded. Finally, a solid and extensive telecommunications network allows for a rapid and free flow of information, which increases overall economic efficiency by helping to ensure that businesses can communicate and decisions are made by economic actors taking into account all available relevant information.” World Economic Forum, The 12 pillars of competitiveness

|

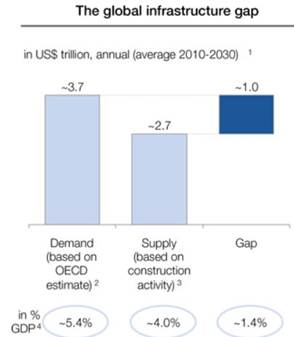

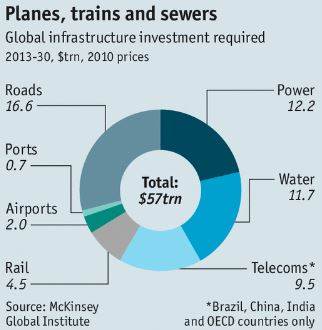

The World Economic Forum estimates a global need for $3.7tn in infrastructure investment each year, while only $2.7tn is invested. McKinsey Global Institute says the G20 nations’ need for infrastructure projects, over the next 15 years, is US$60 trillion. They predict a 60% shortfall in investment money for these projects. Infrastructure, like everything, has a lifespan. In many areas infrastructure is simply too old. Many of the U.S.’s highways and bridges were built 40-50 years ago, many municipalities water lines were laid 100 years ago and both systems are in desperate need for upgrades. |

If infrastructure investment trends in the U.S. stay the same the ASCE estimates ageing and inadequate infrastructure - from power problems to hours lost in traffic jams - will have cost every American family $28,000 in income by 2020 According to the American Society of Civil Engineers’ 2013 report card, the U.S. needs to invest an additional $3.6 trillion by 2020 to upgrade the nation’s infrastructure to acceptable standards. U.S. infrastructure spending makes up 2.6% of the nation’s GDP, the world average is 3.8%. China’s infrastructure spending makes up 8.5% of the nation’s GDP. Every four years, the American Society of Civil Engineers’ (ASCE) Report Card for America’s Infrastructure depicts the condition and performance of American infrastructure in the familiar form of a school report card. Letter grades are assigned based on the physical condition and needed investments for improvement. Below is the latest, the 2013, report card. The overall grade assigned was D+ for 2013. |

|

Urbanization

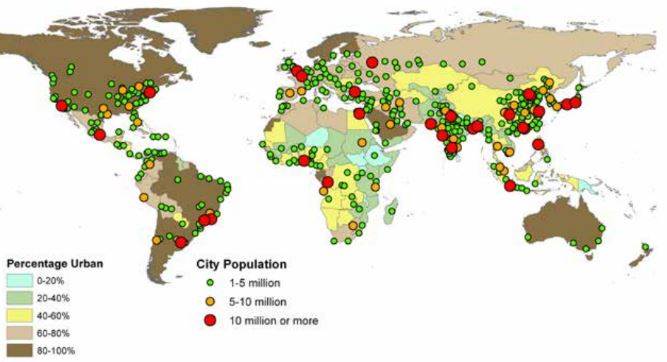

The latest UN World Cities Report has found that the number of “megacities” – those with more than 10 million people – has more than doubled over the past two decades. There were 14 megacities in 1995, that number climbed to 29 in 2016.

Globally, about 1.5 million people are added to the urban population every week.

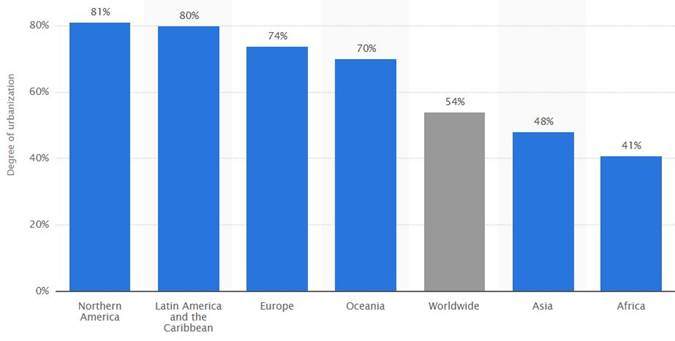

By 2045, the number of people living in cities will increase by 1.5 times to 6 billion, adding 2 billion more urban residents. As cities become more crowded, there will need to be additional spending in infrastructure sectors such as water, power, telecommunications and transportation.

Statista.com

A budding asset class

Insurers, pension funds, endowments and sovereign-wealth funds are all desperate to find infrastructure investments. Yet an annual trillion dollar deficit currently exists and, as we’ve seen, trillions of future dollars are needed for the US$53 trillion OECD called for infrastructure investment by 2030.

The Economist, in an article titled “A Long and winding road” says:

“Long-term investors such as insurers and pension funds are eager to plough money into infrastructure, as are endowments and sovereign-wealth funds. These financial titans have over $50 trillion to invest. Nobody is suggesting that their entire pile should be used to fill the $57 trillion hole. But only 0.8% of their assets are invested in infrastructure projects. That seems too low, given the natural match between the long-term liabilities of such investors and the long-term cash flows that come from these projects.

Better yet, returns from debt secured against real assets are high relative to similarly rated corporate or sovereign bonds. Financial instruments linked to infrastructure are typically hedged against inflation and offer stable returns, with low volatility and little correlation with other asset classes. They are illiquid, but that is of little concern if you are intent on holding on to stuff for decades.”

Unfortunately while governments come out with wish list after wish list of projects they want to get done, they continually fail to do enough to convince investors that projects will happen, or will make investors the returns they need. The result is easily predictable – potential investors keep their money, projects remain un-built and the infrastructure deficit widens year after year.

There seems to be two obstacles to getting investments in infrastructure into private hands;

- How do governments convince investors that their projects will happen, or will make them the returns they need?

- Can any government convince voters to pay a toll or ‘use charge’ for something that once upon a time was free and not suffer at the polls?

The Pay back

Of particular concern to the U.S. economy is that labor force participation among prime-age men peaked in 1954 and the share of prime-age men (ages 25-54) who are neither working nor looking for work has doubled since the 1970s.

“For more than sixty years, the share of American men between the ages of 25 and 54, or “prime-age men,” in the labor force has been declining…This fall in the prime-age male labor force participation rate is particularly troubling since workers at this age are at their most productive; because of this, the long-run decline has outsized implications for individual well-being as well as for broader economic growth.” Office of the President Of The U.S.

Among the 34 members of the Organization for Economic Co-operation and Development (OECD) the United States has the third lowest labor force participation rate.

“One of the biggest challenges facing America’s economy is low workforce participation. While the latest jobs report showed the private sector adding over 150,000 jobs for seven consecutive months, the labor force participation rate keeps declining. The civilian labor force participation rate has dipped to 62.8%, the lowest level in nearly 30 years. Excluding the unemployed who are looking for work, the share of the population that is actually employed is an even lower 59.7%. Far from a temporary blip, the decline is projected to continue. A recent Federal Reserve study predicts labor force participation will drop to 61% by 2022 – a low not seen since the 1970s.” Forbes, The Concerning Drop In Workforce Participation

The most pressing economic challenge for the global economy is how to provide a satisfactory living standard for those without the basic essentials most of us take for granted and to provide essential services for the billions to come.

Consider:

- By 2030, global demand for energy and water is expected to grow by 40 and 50 per cent respectively.

- Over 1.3 billion people, almost 20% of the world’s population, still have no access to electricity.

- About 770 million people worldwide lack access to clean water.

- 2.5 billion don’t have adequate sanitation.

- By 2045, the number of people living in cities will increase by 2 billion.

Trillions of dollars, most of it private money, spent on toll infrastructure that provides a steady and safe, decade after decade return for investors could very well solve the global, and U.S. economies, most pressing problems.

Conclusion

Fixing the global infrastructure deficit, securing funding for future infrastructure builds, job creation, and a rising standard of living, a road not yet taken, should be on all our radar screens. Is infrastructure on yours?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2016 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.