The 10YR Yield and SPX Stocks Bull Markets

Stock-Markets / Stock Markets 2016 Dec 03, 2016 - 01:53 PM GMTBy: Tony_Caldaro

The week started at SPX 2213. After a lower opening on Monday the market pulled back to SPX 2198 by Tuesday. An OPEC pact to cut crude oil production helped the market rally to a marginal new high at SPX 2214 on Wednesday. After that the market pulled back to SPX 2187 on Thursday, and ended the week at 2192. For the week the SPX/DOW were mixed, and the NDX/NAZ lost 2.7%. Economic reports for the week were nearly all positive. On the downtick: the Q4 GDP estimate and weekly jobless claims rose. On the uptick: Q3 GDP, consumer confidence, the ADP, personal income/spending, the Chicago PMI, pending home sales, construction spending, ISM manufacturing, auto sales, monthly payrolls, the WLEI, plus the unemployment rate dropped. Fourteen positive and only two negative reports. Next week’s reports will be highlighted by consumer credit, ISM services, the ECB and factory orders.

The week started at SPX 2213. After a lower opening on Monday the market pulled back to SPX 2198 by Tuesday. An OPEC pact to cut crude oil production helped the market rally to a marginal new high at SPX 2214 on Wednesday. After that the market pulled back to SPX 2187 on Thursday, and ended the week at 2192. For the week the SPX/DOW were mixed, and the NDX/NAZ lost 2.7%. Economic reports for the week were nearly all positive. On the downtick: the Q4 GDP estimate and weekly jobless claims rose. On the uptick: Q3 GDP, consumer confidence, the ADP, personal income/spending, the Chicago PMI, pending home sales, construction spending, ISM manufacturing, auto sales, monthly payrolls, the WLEI, plus the unemployment rate dropped. Fourteen positive and only two negative reports. Next week’s reports will be highlighted by consumer credit, ISM services, the ECB and factory orders.

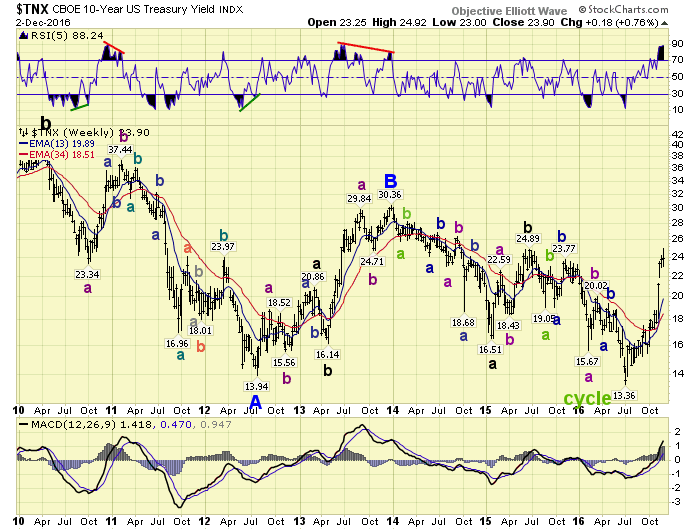

BONDS

Some pundits are concerned at the speed of the recent selloff in the bond market. Especially since the election. Historically, the reasons may be different this time, but we have seen this type of activity many times in recent years.

Currently 10YR bond yields have risen from 1.34% to 2.49% (115 basis points) in just 5 months. To nearly double in such a short period of time seems like a lot. But one has to keep in mind the 1.34% yield represents a 68 year low. In recent years yields have moved up just as dramatically, and from higher levels. In 2013 10YR bond yield rose from 1.61% to 3.04% (143 basis points) in just 7 months. In 2010 10YR bond yields rose from 2.33% to 3.74% (141 basis points) in just 4 months. In 2008/2009 10YR bond yields rose from 2.04% to 4.01% (197 basis points) in just 6 months. And in 2003, 10YR bond yields rose from 3.07% to 4.67% (160 basis points) in just 2 months. The current rise is actually smaller than the previous four surges, and has thus far peaked at a lower high too.

It is also interesting to note that the years in which 10YR yields spiked, bonds sold off, were good years for equities: 2003 +26.4%, 2009 +23.8%, 2010 +13.8%, 2013 +29.6%, and 2016 +7.2% thus far with one month to go. One last point. A rise in long term yields does not usually affect an economy much until there is an inverted yield curve. This occurs when shorter term rates rise above longer term rates. When this occurs borrowing becomes more difficult, and within about one year an economy begins to contract. The last three inverted yields curves occurred in 2006, 1999 and 1989. Recessions followed in late-2007, 2000 and 1990, which were the years of stock market tops too. The current spread is about where it was in 2014 and 2010, and nowhere near an inversion.

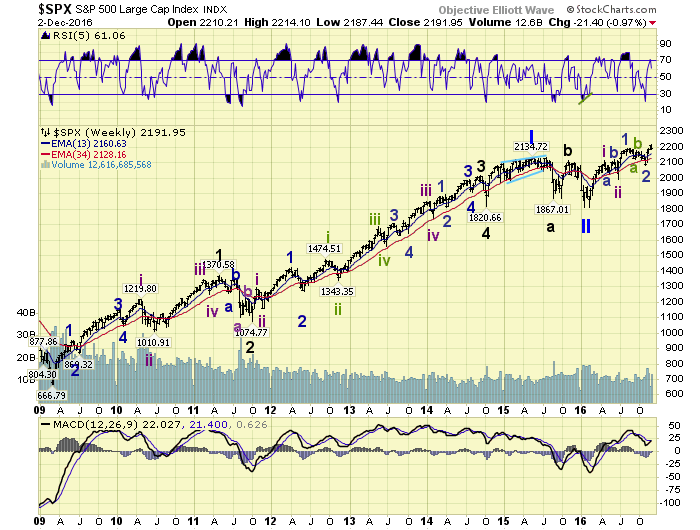

LONG TERM: uptrend

We continue to gain more confidence in our long term count with each passing week. Since the February SPX 1810 low, uptrends have gone to new all time highs, and corrections have been prolonged and shallow, i.e. 5.6% and 5.0%. Not even the bull market in the USD, nor the bear market in 10YR bonds have rattled the market. The OPEC production cut, along with proposed infrastructure improvements, should have a stabilizing effect on commodities. Which should eventually help improve market earnings and hopefully the GDP in the quarters ahead. A secular shift appears underway from crisis to growth. Last seen during the Truman/Eisenhower era.

While we do not expect many to agree with us. We do see a multi-decade Cycle wave [1] underway since the 2009 SPX 667 low. During the last Super cycle (1932-2007) Cycle [1] lasted only 5 years, and Cycle waves [3] and [5] lasted 31 years and 33 years respectively. This Super cycle (2009-xxxx) appears to be starting off with an extended wave first. If this were not occurring the SPX would have already revisited 1100/1200/1300 by now. Cycle wave bull markets unfold in five primary waves. Primary waves I and II completed in May, 2015 and February, 2016 respectively. Primary III appears to be currently underway.

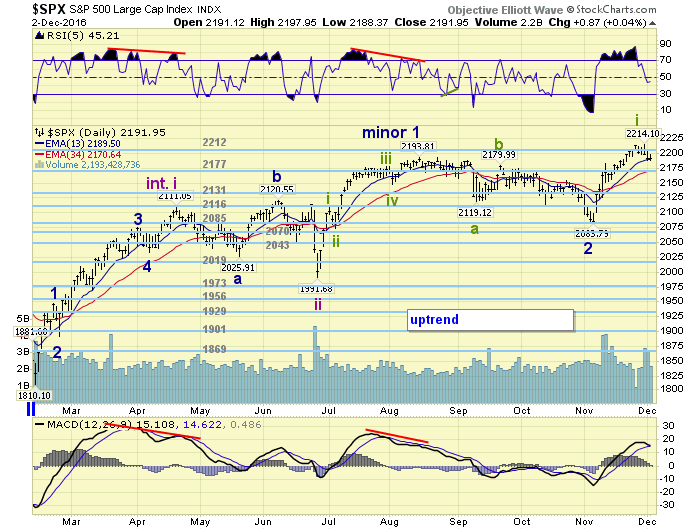

MEDIUM TERM: uptrend

The current uptrend, Minor wave 3, began just two trading days before the presidential election on November 8th. Despite the fact that Wall Street’s favored candidate lost, the market has rallied to all time new highs anyway. The first wave up, Minute i of five Minute waves, SPX 2084-2214 (130 points), has fit perfectly within the range (117-137 points) of the first waves up of the previous two uptrends. Suggesting this uptrend is following the characteristics of this new Primary III bull market. All bull markets have their own characteristics.

After the uptrend high at SPX 2214 on Wednesday the market appears to be now in a Minute wave ii pullback. When it concludes, probably in a day or so, the uptrend should resume with Minute waves iii, iv and v to much higher highs. Our questimate is that this uptrend will travel about the length of the first uptrend, which was 301 points. This projects an uptrend target within the SPX 2380’s. The SPX is currently just under 2200. Medium term support is at the 2177 and 2131 pivots, with resistance at the 2212 and 2270 pivots.

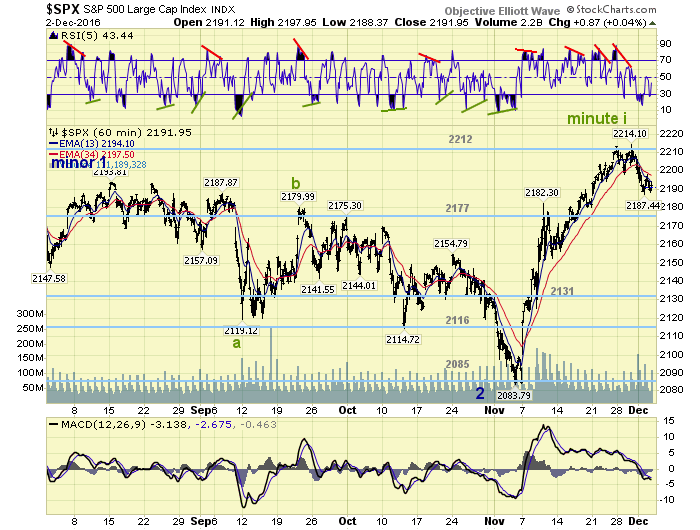

SHORT TERM

Thus far this uptrend has advanced from one pivot (2085) to another pivot (2212) to end its first wave up. And now appears it should find support for its second wave at another pivot (2177). If trading could only be that simple. We counted 27 small waves on the way up from SPX 2084-2214. Difficult to label as noted last weekend. For the Minute ii wave pullback we see support at SPX 2184 (0.236 retrace), SPX 2177 (OEW pivot) and SPX 2164 (0.382 retrace).

However with Sunday’s Italian referendum anything is likely to occur heading into Monday’s open. Short term support is at the 2177 and 2131 pivots, with resistance at the 2212 and 2270 pivots. Short term momentum ended the week just above oversold, with the possibility of making a positive divergence with a slightly lower (2187) print. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly lower but ended mixed.

European markets were also mostly lower and lost 0.3%.

The DJ World index lost 0.5%.

COMMODITIES

Bonds continue to downtrend and lost 0.1% on the week.

Crude surged 12.2% and confirmed the uptrend.

Gold continues to downtrend and lost 0.1%.

The USD remains in an uptrend but lost 0.8%.

NEXT WEEK

Monday: ISM services at 10am. Tuesday: trade deficit and factory orders. Wednesday: consumer credit. Thursday: the ECB and weekly jobless claims. Friday: consumer sentiment and wholesale inventories. Best to your week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2016 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.