Silver Prices and Interest Rates

Commodities / Gold and Silver 2016 Dec 01, 2016 - 04:29 PM GMTBy: DeviantInvestor

“History shows the only place for interest rates to go from here is higher.”

“History shows the only place for interest rates to go from here is higher.”

Examine the above chart of interest rates for 200 years.

- Rates rise and fall in long cycles, 20 to 40 years from a peak to a trough.

- Important highs occurred in 1920 and 1981.

- Important lows occurred in 1946 and probably 2016.

- Current rates are the lowest in 200 years. Some analysts have said the lowest in 5,000 years.

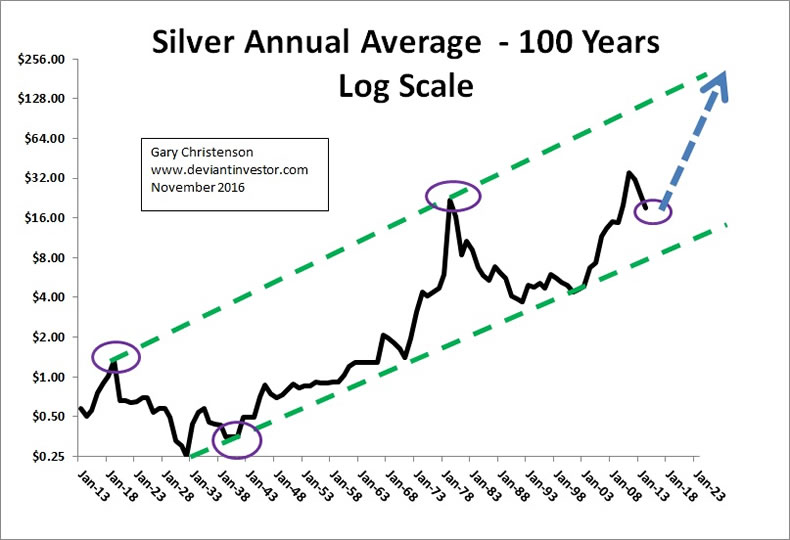

Examine the chart of annual silver prices since 1913 on a log scale. The upward trend in silver prices is clear and will continue as long as debt is increasing in our fiat currency system.

INTEREST RATES AND SILVER PRICES:

Refer back to the 200 year chart of interest rates and the 100 year chart of silver prices. Note the correlation between interest rate highs and silver price highs and similar lows (ovals).

Highs: Interest rates 1920 – silver 1919

Highs: Interest rates 1981 – silver 1980

Lows: Interest rates 1946 – silver 1932 and 1941

Lows: Interest rates 2016 – silver 2015

Interest rates rose approximately 35 years from 1946 – 1981 and fell for 35 years from 1981 – 2016. Silver prices could rise for several decades, along with interest rates, as the dollar is devalued further, silver is aggressively used for industrial applications, investment demand increases, and perhaps … the world is forced to return to a monetary system tied more closely to gold or silver.

RISING INTEREST RATES:

We also know that interest rates are the “cost of money” and have been steadily pushed lower for 35 years by government and central bank actions. Further, the bond market rises as interest rates fall (good times for Wall Street) and falls as interest rates rise. Higher rates mean the $200 trillion or so of debt is more costly to service – we know it will never be paid back in current dollars – but interest to service the debt is more onerous. Budgets are squeezed, projects are curtailed, weak businesses go bankrupt, stock buy-backs are reduced and all those derivatives that are tied to interest rates — well, it won’t be good for many of them…

The Resolution:

- Let it all crash. Admit the governments of the world have no intention of repaying the debt (at least since 2008), let the depression begin, destroy economies, governments, businesses, and millions of lives including the politicians and central bankers who created unsustainable systems and encouraged deficit spending.

or

-

Monetize debt, fire up the printing presses, launch the Bernanke helicopters, and blame someone for the inflationary consequences later.

What politician, banker, Wall Street CEO, central banker, or corporation CEO will choose the crash option? Hence expect the inflation option. For review:

In 1913 a dollar bought almost 1/20 ounce of gold, 8 gallons of gasoline, and 14 loaves of bread.

Today we all know the devalued dollar buys much less. In round numbers our politicians and central bankers have devalued the dollar by perhaps 98%. Expect the devaluation of all fiat currencies to accelerate.

During the 8 long years of the Obama administration total official U.S. government debt has approximately doubled, from about $10 trillion to about $20 trillion. Expect more debt, lots more debt. LOTS MORE DEBT!

What does this suggest about silver prices?

- More debt means more dollars are in circulation and that means erratically higher prices for most items including bread, energy, health care and silver.

- Bond monetization, “printing” dollars, and helicopter money will suggest to everyone – eventually – that the dollar is not a reliable store of value and has not been since 1913. When that realization is finally common knowledge, people will act to protect their wealth and purchasing power. Silver and gold will perform better than crashing bonds, over-valued stocks and promises from politicians.

- Silver and gold are insurance against crashing markets, central bank and government manipulations, devaluing currencies, collapsing “Ponzi” schemes in debt and currency markets, and more.

- The dollar has lost about 98% of its value in 100 years. Silver and gold have, on average, retained their value. Expect their current low prices to spike higher as fiat currency declines toward its intrinsic value.

HYPERINFLATIONS:

Many hyperinflations have occurred in the past 100 years. Example: Argentina has devalued against the U.S. dollar by 10 trillion to one since about 1950. The continued devaluation of the U. S. dollar, loss of reserve currency status, and coming massive “stimulus” spending could result in hyperinflation in the United States. Silver will reach incredible prices in such a disastrous situation. Few if any will be pleased with the consequences of hyperinflation, but owning silver will help mitigate the trauma.

Expect interest rates and silver prices to rise, along with debt, accelerating currency devaluations, and economic craziness until a massive reset occurs.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.