Burn the Flags, Can Trump Salvage The Sinking US Economic Ship?

Economics / US Economy Dec 01, 2016 - 01:54 PM GMTBy: Jeff_Berwick

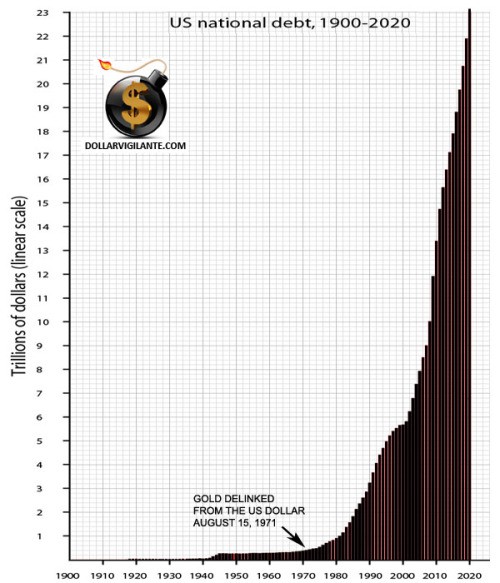

When Nobel Peace Prize winner, Barack O’Bomber, was sworn into office on January 20, 2009, the national debt was $10.62 trillion.

When Nobel Peace Prize winner, Barack O’Bomber, was sworn into office on January 20, 2009, the national debt was $10.62 trillion.

The United States currently has a national debt total of over $19.9 Trillion according to the US national debt clock as of the writing of this blog. That’s an astonishing 87% increase in less than an 8 year period.

However, this past summer, during the US republican primary race, Dr. Ben Carson made a good point in mentioning that the $19 trillion dollar debt figure was actually quite misleading.

Most people never take into account that there is something called the Fiscal Gap, which at this point sits well over $210 trillion. Given the current approximated population in the US of 315 million tax slaves, that is $666,666.66 per person!

This number includes all the unfunded liabilities owed by the government which are not put on the books such as the expenses of social security, medicare, medicaid, and departmental program funding etc vs the expected revenues from taxes. The two numbers should be equal or roughly balanced much like you balance your checkbook. When they are not in alignment it is referred to, politely, as a gap.

The only reason the United States is able to sustain such a massive gap and debt is because the dollar is a world reserve currency and as such, has the ability through the Federal reserve, to print infinite amounts of money.

In the past, we have seen how destructive the renunciation of a nation’s debt can be. For example, in the case of Brazil in 1982, when it announced that it was unable to make payments on its debt, the US Treasury responded by extending a direct loan of $1.23 billion to keep those checks going to the banks while a more permanent solution was negotiated through the IMF.

Of course, these restructurings never end up working which is evident because five years later, Brazil once again was forced to default on it’s then even larger $121 billion debt, a massive amount for the time, which rendered it so impossibly broke that it couldn’t even buy gasoline for its police cars. (Not a particularly bad thing in and of itself)

The result of a default or restructuring is always the same – the burden rests upon the shoulders of the taxpayers.

The same was true of Argentina in 1982 when they too could no longer service their debt. As always, their creditors immediately began negotiations for rollovers, guarantees, and new IMF loans which would inevitably plunge them even further into debt. By 1988, after the extension of new loans in the years prior, Argentina once again fell behind and stopped payments.

Getting back to the US, Trump is sending more mixed signals than a quarterback with Tourette’s.

On the one hand, Donald Trump has appeared to have expressed interest in returning to a precious metals standard through his meeting with the former CEO of the bank BB&T, John Allison, who stated “the US should go back to a banking system backed by a market standard such as gold.”

On the other hand, it was just confirmed that ex-Goldman Sachs banker Steven Mnuchin, is Trump’s pick for Treasury Secretary. This is incredibly ironic considering Donald’s staunch criticism of Killary’s acceptance of money from the bank for speaking engagements. This, along with many other potential appointments makes it seem as though Trump is just refilling the swamp, not draining it.

The truth is though, that this is all noise. Trump has no real viable plan for debt reduction, which is the biggest problem facing the nation. Even a return to a gold standard, which would be the best case scenario, would cause the biggest worldwide depression in world history as it would necessitate a reneging on the current debt which mostly underpins the world’s financial system.

In other words, something major must be broken if you want the debt to stop piling up. There must be a washing away of sorts.

That said, Trump brings a whole array of unknowns with him and there are sure to be plenty of shake-ups, which spell opportunities for speculators. We’ll be analyzing many of them in the next issue of TDV to subscribers (see more info on subscribing here) set to go out later this evening.

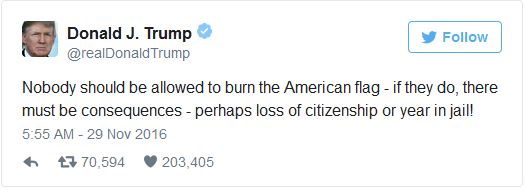

We’ll soon find out exactly what Trump is up to… but in the meantime it appears he is already getting the hang of being a dick-tator:

Here was my polite, freedom friendly response to it:

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.