US Economic Data - These Were Supposed To Be Hillary’s Numbers!

Economics / US Economy Dec 01, 2016 - 01:46 PM GMTBy: John_Rubino

Good headlines just keep coming. The Chicago PMI index of Midwest economic activity jumps to its highest level in two years. The ADP employment report shows 216,000 new jobs added in November. US Q2 GDP growth is upgraded to a completely acceptable rate of 3.2%.

Good headlines just keep coming. The Chicago PMI index of Midwest economic activity jumps to its highest level in two years. The ADP employment report shows 216,000 new jobs added in November. US Q2 GDP growth is upgraded to a completely acceptable rate of 3.2%.

Very nice numbers all. And – had the election gone a different way – a big help in easing the transition from one Democrat administration to another. Success breeding success.

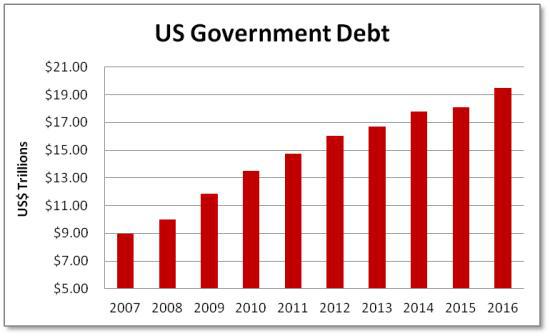

But a different number explains this apparently-accelerating expansion: US federal debt, which after growing by only $330 billion in 2015 soared by $1.38 trillion this year. For more on why this happened, see Another Election Year, Another Bunch Of Fake Growth Numbers. But for now it’s enough to say that $1.3 trillion is a lot for the entire US economy to borrow in a single year. For the federal government alone to do so is huge, and probably accounts for much of the recent above-trend growth.

Now let’s consider some other numbers that will emphatically not make things easier in the year ahead.

US interest rates are soaring. After rising gently from a June low of 1.4% to about 1.8% in early November, the yield on US 10-year Treasury bonds has since spiked to nearly 2.4%.

Higher interest rates are, in effect, a tax increase on borrowers – which is to say on pretty much everyone these days. By ratcheting up the interest cost of any debt that has to be rolled over or is linked to a reference rate like LIBOR or Prime, they siphon off capital that might otherwise be used for investing or consumption, thus slowing growth, lowering government tax revenues and generally making everything harder. One interesting stat: If the Japanese government had to pay an average of just 2% on its debt – that is, less than the US Treasury now pays – its interest costs would exceed its tax revenues. Sayonara Tokyo.

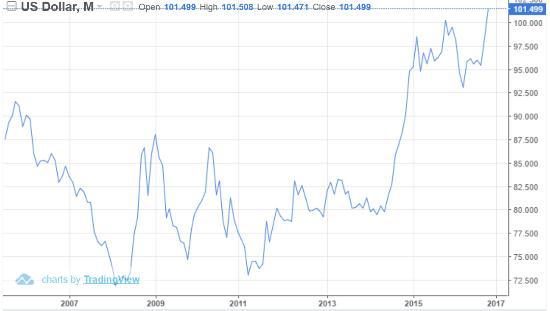

Nearly as scary is what’s happening with the US dollar. Rising interest rates tend to make a currency more attractive on foreign exchange markets, thus raising its exchange rate. Combine this with the expectation that President Trump will embark on a spending/tax cutting spree that puts previous administrations to shame, and you get serious demand for dollars and a soaring exchange rate. The dollar index, which measures the USD versus a basket of other currencies, is now at its highest level in a really long time.

Like rising interest rates, a soaring currency is in effect a tax increase on anyone hoping to sell US-made goods to foreign customers. A Ford Explorer, for instance, is priced in dollars when exported. So a more expensive dollar means a more expensive – and therefore harder to sell – SUV. Lower sales for US corporations mean lower profits and, if history is any guide, lower share prices.

The point of all this is that some serious headwinds are kicking up at a time when equities and bonds are priced for perfection and government policy both here and abroad is in flux. Which will make 2017 a fascinating, though probably not a fun, year.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.