Why We Haven’t Seen Gold Price Rally after Trump Victory

Commodities / Gold and Silver 2016 Nov 30, 2016 - 06:56 PM GMTBy: Harry_Dent

Even though the markets haven’t behaved logically of late, it would have seemed a slam dunk for gold to rise if Donald Trump won. After all, we faced uncertainty around his policies, rising inflation from infrastructure spending, and higher expected growth rates.

Even though the markets haven’t behaved logically of late, it would have seemed a slam dunk for gold to rise if Donald Trump won. After all, we faced uncertainty around his policies, rising inflation from infrastructure spending, and higher expected growth rates.

But instead, gold has headed back down more sharply. It had its initial rise in the futures market when Trump looked like he was going to win. But since then, it’s reversed course – the opposite of the stock markets.

While I’ve been saying for a long time now that gold still has a lot to lose, a new and interesting dynamic has arisen to add more pressure to the downside.

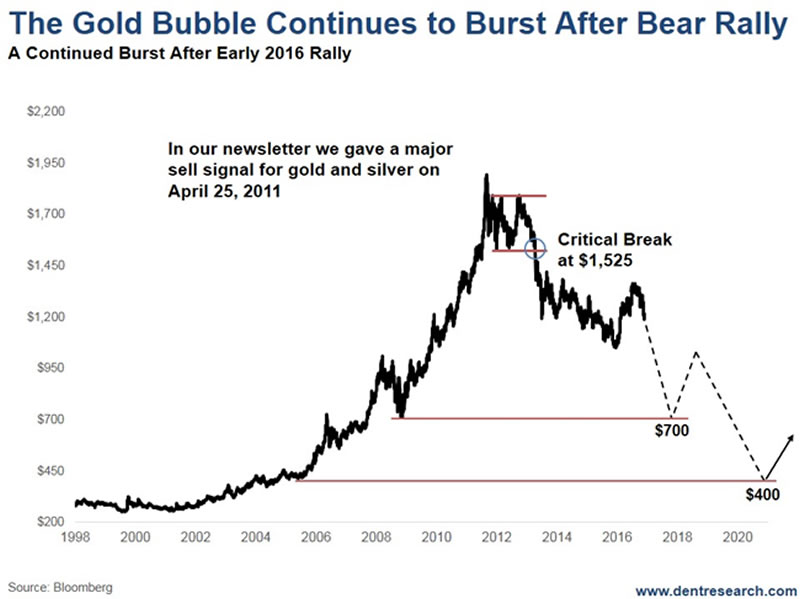

Before I explain, let’s first look at the chart pattern here…

This pattern suggests that the rally from late 2015 had seen a clear a-b-c bear market or corrective rally – I’m talking in Elliott Wave language here – just as I’d forecast to around $1,400.

The next stop, coming from strong support in the 2008 mini-crash, is around $700 and it looks like this move is already well into motion!

A slowing economy, with deflation, would be the biggest reason for gold melting to that level. The fall since the election would suggest such deflation is not very far away.

But, as I hinted earlier, there’s another reason for the sharp decline in recent weeks…

And that reason is: India.

India and China are the biggest buyers of gold, together consuming about 50% of the total. That dwarfs developed countries like the U.S., central banks and everyone else. China’s still the biggest player in the gold market, but Indians are second at 700-800 tons a year. They’re much poorer than Chinese, but they spend a higher percent of their income on gold! They wear the stuff in places we can’t even imagine.

Now a new reason for Indians to buy gold like it’s life-sustaining water has come to light: to launder money from illegal and underground businesses that make up 20-25% of their economy. And of course, they do that with larger bills as all money launderers do.

Well, the Modi government just forced the exchange of all 500 and 1,000 rupee bills ($7.50 and $15.00, respectively) to clamp down on these illegal businesses. And gold has declined steadily since. There’s far less money that’s easy to lauder. Gold imports are down 59% year-to-date from the same period last year.

The India Bullion and Jewelers Association is now warning its 2,500 members that Modi may even ban gold imports for a time to squeeze out these illegal activities even more. Just imagine what that would do to the price of gold!

Gold $700, here we come.

The Commitment of Traders Report shows that gold likely peaked back in early July of this year and has a long way down to go.

The dumb money or large speculators were net long 310,000 contracts right near the top and are still long 180,000. They’ll have to go all the way to the other side of the trade and get net short something like 300,000 before this next major move down is over. Hence, gold could easily drop to $700 over the next year or so.

Likewise, the smart money or commercials were net short at the recent top and are still 200,000 net short. That’s also a long way to go before they become 300,000 or so net long at the next major bottom as they are always right at extremes.

In short, I reiterate my warning to sell gold. I said to do so just before the top in 2011 and on the exact day of the silver top, and again recently when we got near that $1,400 target.

I’m saying it again now for those that did not heed – and I understand the natural emotional attachment to gold – but that just won’t hold in this deflationary environment as gold is primarily an inflation hedge, and yes, a commodity driven by consumption from consumers like the Chinese and Indians.

Modi’s potential impact on gold is the most urgent reason to sell yet. Don’t wait until his policy announcement in case it occurs. Gold could shed $200 in a day or two. Cut your losses now!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.