Gold Price is Oversold but Broken

Commodities / Gold and Silver 2016 Nov 27, 2016 - 05:32 PM GMTBy: Jordan_Roy_Byrne

Last week we wrote that the 2016 bull market in Gold and gold stocks had gone off course. It had moved too far out of the historical boundaries to remain a bull market. There was also other evidence of such including but not limited to rising real yields. Gold’s last hope was to hold $1200-$1210 and rebound back to the highs. It has broken bull market support ($1200-$1210 and $1230) and could be on its way to $1050 in the next few months.

Last week we wrote that the 2016 bull market in Gold and gold stocks had gone off course. It had moved too far out of the historical boundaries to remain a bull market. There was also other evidence of such including but not limited to rising real yields. Gold’s last hope was to hold $1200-$1210 and rebound back to the highs. It has broken bull market support ($1200-$1210 and $1230) and could be on its way to $1050 in the next few months.

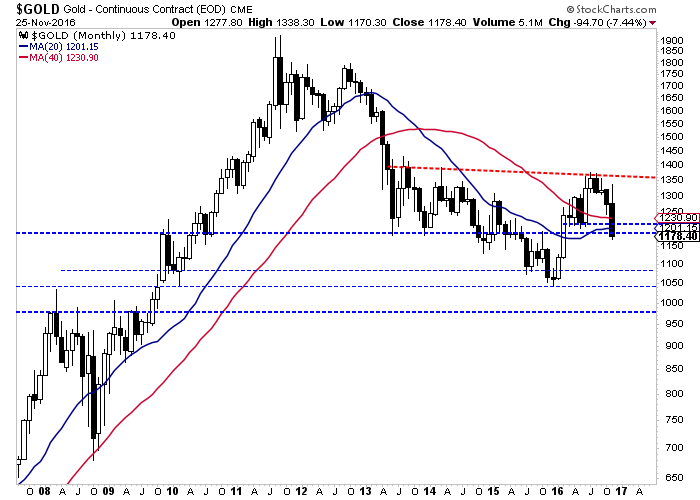

The monthly candle chart of Gold is shown below. Gold is down 7.4% on the month and has sliced through the important support at $1200-$1210 as well as the 20-month moving average at $1201 and the 40-month moving average at $1231. The 40-month moving average has been an excellent primary trend indicator throughout Gold’s history. There is a little support at $1150 but nothing standing in the way of Gold heading for a retest of its low at $1050.

Gold Monthly Candle Chart

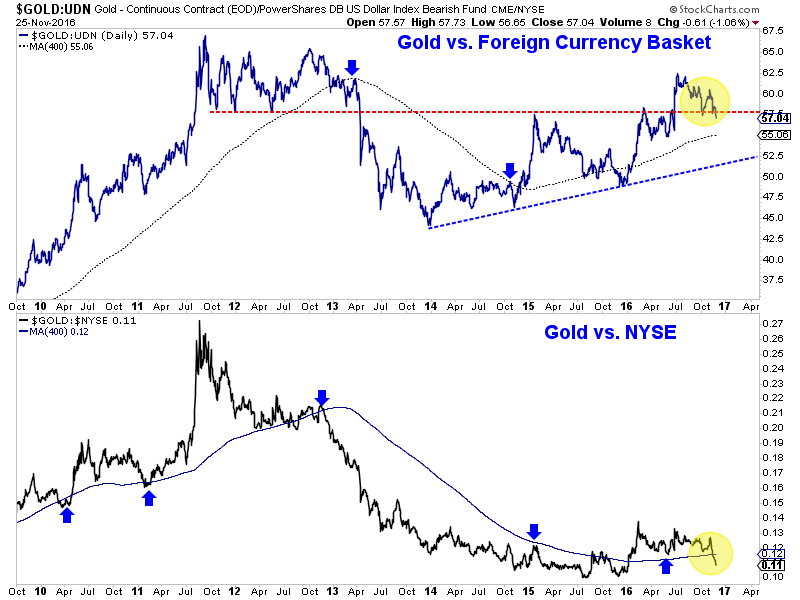

Gold is not only weak in nominal terms or US Dollar terms but it is showing weakness in real terms. Below we plot Gold against foreign currencies (the US Dollar basket) and the NYSE, a broad equity index. Gold/FC has been strong for several years but it has lost support and looks headed lower. Meanwhile, Gold/NYSE lost support at its 400-day moving average and could retest its 2015 low.

Gold vs. Foreign Currencies, Equities

Gold is clearly broken but its decline is due for a pause. Gold has been strongly correlated to the bond market which may have made an interim low last Wednesday. Also, the gold stocks are showing a positive divergence. Even as Gold lost $1200/oz and traded down to $1171/oz, the gold stocks (GDX, GDXJ) did not make a new low. Furthermore, the market has now fully priced in a quarter point rate hike in December.

The odds favor a rebound in the days and potentially weeks ahead. Traders and investors should use the rebound to de-risk their portfolios, raise cash and hedge if the opportunity presents itself. Don’t think about buying until we see sub $1080 Gold and an extreme oversold condition coupled with uber bearish sentiment.

For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.