Italian Bank Collapse European Sovereign Bond Carnage, Criss-Crossed Fuses & Lit Bonfire

Interest-Rates / Financial Crisis 2016 Nov 27, 2016 - 05:10 PM GMTBy: Jim_Willie_CB

Many are the potential fuses to be lit, which would create the conflagration, the massive bonfire of the bond vanities and bank charades. Many are the fuses lying around, all criss-crossed, all exposed, all overlapping each other in highly dangerous manner. If any single fuse is lit, then several will light and the detonation arrives. It is unavoidable since the financial world is so deeply interwoven. Never in modern history has the global financial structure been so badly weakened, so totally corrupted, so thoroughly undermined by control mechanisms, so intensely defended by sanctions even war. In 2007 and early 2008, the Jackass warned of a mortgage bust that would alter the global system forever. It happened with far reaching consequences which endure to this day.

Many are the potential fuses to be lit, which would create the conflagration, the massive bonfire of the bond vanities and bank charades. Many are the fuses lying around, all criss-crossed, all exposed, all overlapping each other in highly dangerous manner. If any single fuse is lit, then several will light and the detonation arrives. It is unavoidable since the financial world is so deeply interwoven. Never in modern history has the global financial structure been so badly weakened, so totally corrupted, so thoroughly undermined by control mechanisms, so intensely defended by sanctions even war. In 2007 and early 2008, the Jackass warned of a mortgage bust that would alter the global system forever. It happened with far reaching consequences which endure to this day.

In recent months the Jackass is warning of a Systemic Lehman event, where several major national systems are at heightened risk of a similar bust like what happened in September 2008. Except this time, the entire global financial system will erupt like a debt volcano, with several epicenters, all located in the West. The big Western banks are all lashed together, all tied to each other. The banker cabal believed that the interconnectivity within their bank structures would make them all immune to failure risk. The reality is that the failure of any one major bank guarantees the systemic breakdown of all of them. It will erupt like a cave-in of the flying buttresses at the Notre Dame in Paris, with numerous bank (churches) collapsing, all located in the West.

FINAL SOLUTION

When the collapse occurs, the solution will finally be discussed, the solution avoided for eight full years. THE GOLD STANDARD WILL BE INSTALLED. It will first arrive in the trade payment system. Then it will arrive in the banking reserves system. Lastly it will be seen in the gold backed currencies. The paper game has gone on since 2008 in grand style and unspeakable corruption.

This article attempts to list many threats to a systemic breakdown from ignition of several megatons of TNT dynamite. The financial press has often mentioned derivatives as capable of inflicting damage and devastation like with nuclear explosions. The systemic breakdown is due to occur soon, actually way overdue to occur. The prevention has been a massive global project run by the major central banks in coordination with a few ministries of finance. The primary control center is the USDept Treasury and their Exchange Stabilization Fund. This truly gigantic multi-$trillion fund is a very well-kept secret. Its recent activity has been to permit the USTreasury Bond yield to rise, but without pushing down the sacred USDollar. Not much mention has come from the sleepy lapdog financial press on this unusual anomaly. The motive is to keep the Japanese happy, since they are the last holdout among the $1 trillion USGovt debt holders. The Chinese are dumping USTBonds, but the United States cannot afford for Japan to dump USTBonds at the same time.

TOO MANY CRISS-CROSSED FUSES EXPOSED

The following are numerous potential lit fuses, with brief descriptions of the risk and effect. It is in no way complete as a list, but it might be somewhat comprehensive. No attempt will be made to be very thorough in the description of each potential fuse. That role is played with the Hat Trick Letter, with fallout effects discussed and analyzed in more thorough fashion.

Deutsche Bank failure

The actual failure has been going on for at least a couple years. Recall that D-Bank unwillingly accepted the merger & acquisition of Bankers Trust back in 1998. It became the European outpost for the rafts and scads of bank derivatives, managed outside the United States, free from regulation. The giant German bank has a net worth of around minus $1000 billion, or minus EUR 1000 billion, no matter the unit. All manner of relief and patchwork and emergency liquidity and false accounting and total lies are associated with this giant cesspool of a bank. They hold all types of ruined paper debt, and hold a mountain of Gold contracts which China wants to acquire. The New York and London crime center banks are vulnerable. When it blows out of control, the Western banks go poof and the USDollar dies.

USFed rate hike

The USFed might not be able to avoid an official rate hike. Ignore the fake rate hike in December 2015, which was really a Reverse REPO episode well concealed. That event permitted more leverage by the big US banks. In the last few months, the USTreasury Bond yields are all rising, including the short maturity. The long maturity might cause a derivative accident soon, since the Tower of Bond Babel cannot tolerate the big moves seen. The USFed might have to hike rates a notch, just to keep the short maturity of the USTreasurys from fracturing. But the long maturity is also at risk. When the hike comes, the Western banks go poof and the USDollar dies.

USDollar rejection in trade payments

The United States has been paying for its massive $500 billion trade deficit with paper IOU rubbish certificates called USTreasury Bills. The US nation has been a freeloader for over 20 years, lacking critical mass in industry, covering the bills with printed money of no intrinsic value. The Asian producers object loudly. In the last year, many foreign producers have been rejecting the USDollar as payment. Bobcat Inc (warehouse forklifts, construction backhoes) is only the most visible. The port facility confusion and mayhem is given too much attribution to the Hanjin Shipping bankruptcy. The truth is that the USTBill is being rejected as valid payment, despite the many empty disputes of this claim. The other shoe from those American feet is the end of the USDollar as global currency reserve. When the rejection is more broadly understood and openly discussed, the Western banks go poof and the USDollar dies.

USTreasury Bond complex bust with derivative

The bank derivatives are a $700 trillion set of buttresses, which if capably observed, would frighten the wits out of all people who have bank accounts. They are heavily leveraged contracts which hold the financial system together like glue, but lately more like chewing gum and bailing wire. These toxic units are called assets, while bank accounts are called liabilities subject to loss and confiscation (see bail-in procedures). The derivatives cannot tolerate big movements in bond yields. They serve as the site to produce artificial bond demand for the USGovt debt, whose supply is between $1.0 and $1.4 trillion per year, but without benefit of actual real investor buyers. The Asian bond dumping has put huge strains on the derivative machinery, which cannot sustain the pressure. The derivative jig is up very soon, to reveal a massive Ponzi Scheme in USGovt debt that exceeds $20 trillion without much attention or importance given to it. When the derivative complex shows wider cracks and open gushes of bond blood, the Western banks go poof and the USDollar dies.

Italian bank collapse & exit from Common Euro Currency

The Italians have a national referendum coming up very soon. The decision to push PM Renzi aside and to go on a more independent defiant path seems imminent. All his opponents have a common theme, to bail out the banks and to exit the Euro currency, which means a return to the Old Lira currency. The implications are staggering and lethal to the sovereign bond market in Southern Europe, since the PIGS all look alike. The dire implication is to the big European banks, primarily the French and German big banks. When the Italians flip the bird to the Euro Central Bank and their big bank masters, refusing to endure the financial rape as seen in Greece, the continent will undergo widespread tumult. Leaving the Euro currency must coincide with leaving the European Union itself. Key EU leaders are certain to leave en masse, much like in the style of Schultz recently. When Italy bails out its banks and leaves the Euro currency, the Western banks go poof and the USDollar dies.

Contagion in Europe in the Southern nations

Greece could follow Italy quickly out of the common Euro currency, even with exit from the European Union. After neighbor Turkey’s intriguing stability course and success, the Greek nation might quickly fall into the arms of Russia and China. The military security from Russia combined with the commercial security from China is a significant attraction. The EU masters have raped Greece, and they wish to leave the bedroom, even the European house. Worse, Portugal could be a dark horse in the unfolding takedown of the EU. When the contagion strikes and the fracture occurs among the PIGS pen, the Western banks go poof and the USDollar dies.

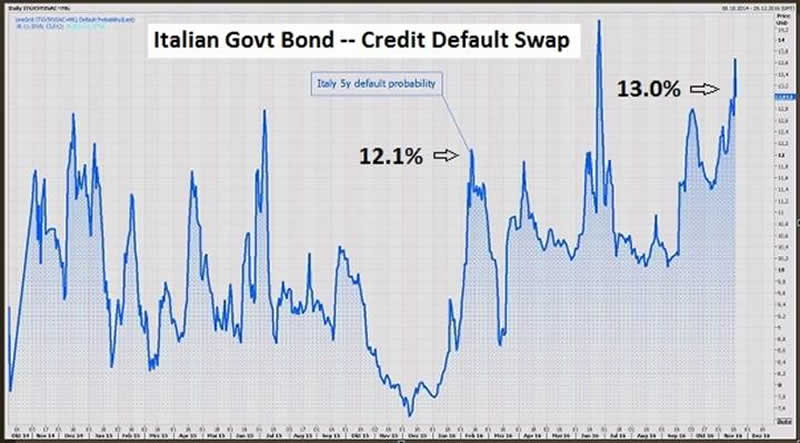

European Sovereign Bond Carnage

For the last three years or more, the Euro Central Bank has been quietly, and recently not so secretly, been supporting the entire Southern European sovereign bond market. The Germans at the Bundesbank were loud in objections in 2014, but they grew quiet. The Germans despise the ECB arrogance, and greatly dislike the ruin heaped upon them by the EU itself. The EuroCB has a higher order mission and marching orders from the elite fascists. The Italian Govt debt insurance is rising fast in price, a reliable early warning system much like seen in 2008 with Lehman Brothers CDSwap. The press ignored the signal in 2007, and again ignores it now. The EuroCB activity will backfire in a bonfire of the bond vanities, exposing Prince Draghi for his incredibly offensive arrogance. His paper castle will be taken down. The entire PIGS sovereign debt will break down and go bust, taking with it many large European banks, starting with the PIGS pen but extending into Central Europe. The strangulation of the REPO markets will result in huge liquidity and collateral issues. When the bond carnage begins in earnest, the shock wave will be clear, and the Western banks go poof and the USDollar dies.

Gold Market Arbitrage Breakdown

Ever since the Shanghai Gold Exchange opened and the London Gold Fix was exposed as a grand fraud, the pressures have risen on arbitrage within the gold market. A hidden battle has been waged, sometimes intense with big gaps, often mild with smaller gaps, between the East and West. The arbitrage gap is currently around US$20-25 per ounce in price, but could change quickly and suddenly. It is likely to rise to hundreds of dollars, but gradually, and later perhaps in large chunk increments. The result will be the wreckage of paper Gold & Silver markets. Big players would be free to buy cheap in London, sell dear in Shanghai, and bust the fraudulent market wide open. When the gold market arbitrage undergoes a collision between reality of physical gold in movement and the fantasy of phony paper market pricing, the Western banks go poof and the USDollar dies.

Gold-backed currency announced in East

It is really just a matter of time. The de-Dollarization process underway in the East has been going on for over two years, another Jackass forecast coming to pass. The United States with its wars and sanctions has spurred the non-USD movement in earnest, if not hidden hyper-drive. Both Russia and China simultaneously will soon announce Gold backed currencies, while also making public their true gold holdings in the tens of thousands of gold tons. The buzz has been clear for a couple years that Russia has over 25,000 tons gold in reserves, and China has over 30,000 tons gold in reserves. When the new gold-backed currencies are announced, publicized, launched, used in commerce & banking, and compared to the Western toilet paper passing as currency, the Western banks go poof and the USDollar dies.

Saudi acceptance of RMB in Chinese oil sales

The event is overdue, except that the Saudis are tied in two ways. They own a boatload of sequestered USTreasury Bonds, held tightly in the USDept Tresasury ESFund. Tough noogies but the Saudis will never see $3 trillion in their USTBond reserves. Also, more on the ugly tarnished side, the Saudis depend upon the USMilitary for weapons purchases in their insidious Yemen War. Regardless of bondage to the US fascists, the Saudis must move forward. The Chinese are demanding the right to make oil payments in their RMB currency terms. Look soon afterwards for the Chinese to use Gold Trade Notes, possibly as an introduction in the oil market. Doing so would slam the Petro-Dollar defacto standard in force for 42 years, putting numerous nails in the USDollar coffin. The collapse in crude oil prices would result in a breakdown of the recent OPEC output freeze. When the Saudis announce acceptance of RMB payments for Chinese oil sales, the Western banks go poof and the USDollar dies.

Miscellaneous factors

Many other factors are too numerous to list, but which could also bring about the systemic breakdown described above. They are far more numerous than the following, but these are major items. The NATO alliance might be dismantled. Either publicity of its warmonger nature or its narcotics trafficking activity could bring this event about. The EU member nations object to taking orders from the Supreme Commander, trampling upon the national sovereign leadership. Then NATO would publically become irrelevant, and lead to USMilitary withdrawal from mainland Europe, save for a token unit like in Germany. Also, the ISIS exposure could explode on the scene for USGovt involvement, Mossad involvement, and even British MI-6 involvement. ISIS is a joint creation from these three national security centers, adopted from the Axis of Global Fascism. The defeat of the Islamic State in Syria and Iraq could lead to an explosion of sporadic attacks across the entire European continent. For staged terror events, see Paris, Brussels, and Nice. Another, the growing discontent and stirred racial violence in the United States might couple with political stirred violence, coming from the Soros funded groups. Riots in the United States could result in USEconomic stagnation and severe effects in consequence. These other lesser but important factors could stoke the fires, and lead to chaos as the Western banks go poof and the USDollar dies.

GOLD TRADE NOTE INTRODUCTION

The Gold Trade Notes for trade payment might be coming into view, initially with commodity transfers, later swap contracts, and finally gold-backed short-term notes which supplant the USTBill. One might think of used newspapers on the floor, or of the dodo bird. The trade might be made in exchange for either goods delivered or USTBills held. Detect a growing connection to finished goods being withheld from delivery. This is probably another sign of refusal of USTBills as payment. As footnote, be sure to know that the preliminary steps to the Global Currency RESET will not be laid out in full disclosure for public benefit. It represents a tremendous investment opportunity for the elite, which they never tend to share. In fact, the RESET might be well along before it is even recognized. End to EuroRaj main thoughts and open analysis, for which much gratitude is given. The Jackass believes a few critical elements to the RESET are in place. More details on DIP Financing feature is included in the September Hat Trick Letter report.

***A major hitch obstacle can be inferred. Payment in USD terms might be the clot in the artery. Demands might be for hard asset swaps, and the contract security from large scale commitment of commodities, facilities, and property. The swap trade is coming into view, a presage of the Gold Trade Note.***

The Jackass concludes the USD rejection could be lifting its head within a gathering storm, without clear identification. It is indeed difficult to identify all the elements when hidden deals at the highest level are underway, and friction is omnipresent. The Bobcat Corp rejection of USTBills at Pacific ports is a clear story. For every one story recounted, there are 10 to 20 not yet heard. My firm belief is that in Asian banking systems, they do not want the USTBills anymore. The banks in Asia are trying to dump them in heavy volume, not accumulate more worthless toilet paper. Finally the sharp blowback from printing QE money has hit. The USFed monetary policy saves the big insolvent banks, but kills capital. The result has finally seen manifested in USD global rejection, or at least hints toward the same. Asian banks still hold vast sums of USTBonds. They are not going to announce the rejection, but instead fight behind the walls for better terms of payment, even as they pursue the Gold Trade Note for payment at ports. It is coming, like daybreak follows the long night.

NEW SCHEISS DOLLAR & GOLD TRADE STANDARD

In time, expect an eventual refusal by Eastern producing nations to accept USTreasury Bills in payment for trade. The IMF reversal decision assures this USTBill blockade in time, and might accelerate the timetable. The United States Govt cannot continue on five glaring fronts of gross negligence and major violations. These violations have prompted the BRICS & Alliance nations to hasten their development of diverse non-USD platforms toward the goal of displacing the USDollar while at the same time take steps toward the return of the Gold Standard.

The New Scheiss Dollar will arrive in order to assure continued import supply to the USEconomy. It will be given a 30% devaluation out of the gate, then many more devaluations of similar variety. The New Dollar will fail all foreign and Eastern scrutiny. The USGovt will be forced to react to USTBill rejection at the ports. The US must accommodate with the New Scheiss Dollar in order to assure import supply, and to alleviate the many stalemates to come. The United States finds itself on the slippery slope that leads to the Third World, a Jackass forecast that has been presented since Lehman fell (better described as killed by JPM and GSax). The only apparent alternative is for the United States Govt to lease a large amount of gold bullion (like 10,000 tons) from China in order to properly launch a gold-backed currency. Doing so would open the gates for a generation of commercial colonization, but actual progress in returning capitalism to the United States. The cost would be supply shortages to the USEconomy, a result of enormous export increases to China.

The colonization has already begun, with secret deals galore. It is very unclear what deals are being struck in order to arrange for the USGovt to have a proper gold reserve hoard, for backing a new legitimate USDollar. Meetings at very high level are in progress, with little if any popular representation, only elite members present. Failure to produce a legitimate bonafide gold-backed currency would mean the United States must proceed with the New Scheiss Dollar, an illegitimate fake phony farce of a currency. It would be subjected to a series of devaluations. The result would be heavy powerful painful price inflation from the import front. The effect would be to reverse a generation of exported inflation by the United States. The entire USEconomy would go into a downward spiral with higher prices, supply shortages, and social disorder. However, the rising prices would come from the currency crisis, and not so much from the hyper monetary inflation. That flood of $trillions has been effectively firewalled off.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

"As a Golden Jackass subscriber, I greatly enjoy listening to your interviews because it really lends a sense of passion that lies behind the tremendous body of information and formulation that goes into your monthly research. Though I must admit, it scares the hell out of me most of the time. Still, I will not miss it for the world. I feel that having a truly objective insight from your research, in depth analysis, and accurate forecasts gives me and my family an important life saving advantage. And I mean that sincerely."

(MichaelS in Ontario)

"I have continued my loyal patronage of your excellent commentaries not so much because of my total agreement with your viewpoints, but because you have proven yourself to be correct so often over the years. When you are wrong, you have publicly admitted it. You are, I suppose by nature, an outspoken and irreverent spokesman for TRUTH against power, which differentiates you from almost all other pundits on world affairs."

(PaulR in Hawaii)

"For over five years I have been eagerly assimilating any and all free information (articles, interviews, etc) that Jim Willie puts out there. Just recently I finally took the plunge and became a paid subscriber. I regret not doing this much sooner, as my expectations were blown away with the vast amount of sourced information, analysis tied together, and logical forecasts contained in each report."

(JosephM in South Carolina)

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.