What Investors Can Learn from Gold Yen Price?

Commodities / Gold and Silver 2016 Nov 26, 2016 - 04:50 PM GMTBy: Arkadiusz_Sieron

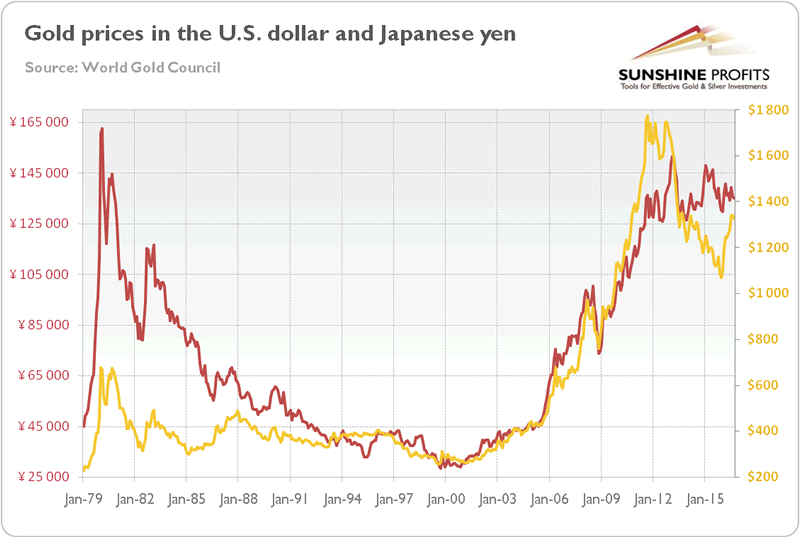

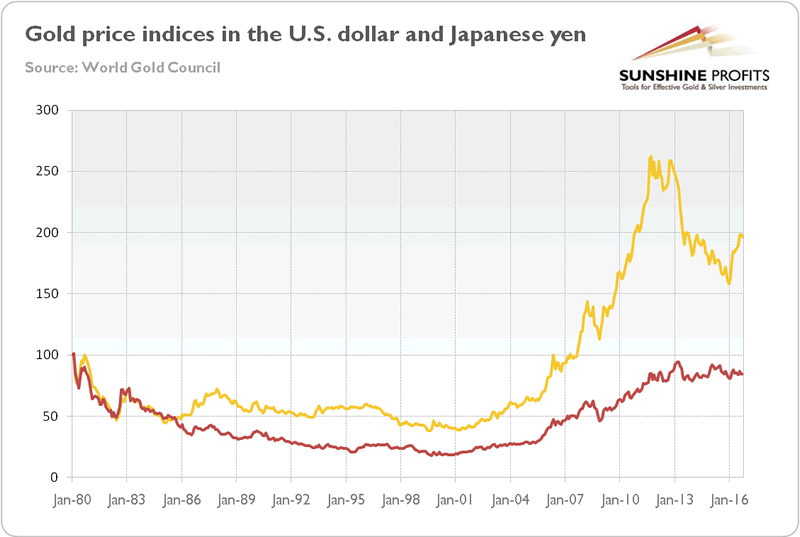

Our Market Overview would be incomplete without remarks about gold priced in the Japanese yen. Chart 1 shows nominal gold prices denominated both in the U.S. dollar and the Japanese currency, while Chart 2 plots the indices of gold prices in these two currencies.

Our Market Overview would be incomplete without remarks about gold priced in the Japanese yen. Chart 1 shows nominal gold prices denominated both in the U.S. dollar and the Japanese currency, while Chart 2 plots the indices of gold prices in these two currencies.

Chart 1: The price of gold in U.S. dollars (yellow line, right axis) and in Japanese yen (red line, left axis) from January 1979 to September 2016.

Chart 2: Indices of gold prices in the U.S. dollar (yellow line) and the Japanese yen (red line), January 1980=100.

As one can see, gold prices denominated in the greenback and the yen often move together. There were only two significant divergences in the relative performance of gold priced in the U.S. dollar versus gold prices in the yen. The first case occurred in the 1980s, when the yen strengthened against the greenback, leading to strong declines in yen-denominated gold prices. The second case started in mid-2014. In the second half of that year, gold priced in yen has outperformed its dollar cousin due to the strength of the greenback against the yen and the decline in Japanese real interest rates. However, in 2016 the U.S. dollar depreciated against the Japanese currency, which led to the underperformance of the yen-denominated gold prices. The reason may be the Fed being more-dovish-than-expected and the rising conviction that the Bank of Japan has been approaching the limits of monetary easing. Indeed, the introduction of negative interest rates in January and changes in the monetary policy framework in September have largely failed to weaken the yen, as investors judged that these actions implied that the BoJ had little scope to ease policy further. Such a belief diminished the perceived divergence in monetary policies between the Fed and the BoJ, which supported the gold market this year. Let’s analyze the chart below which plots gold prices against the balance sheets of the Fed and the BoJ, showing the divergence in the monetary pumping.

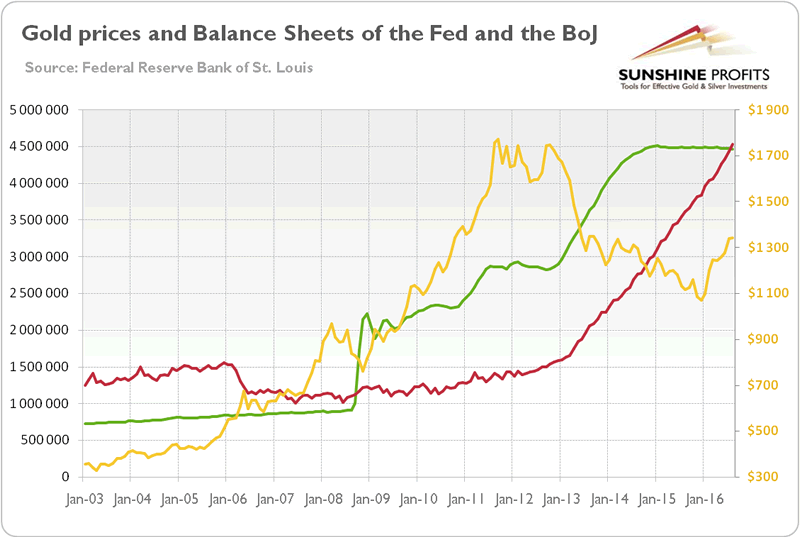

Chart 3: The price of gold (yellow line, right axis, P.M. London Fix), the Fed’s balance sheet (green line, left axis, in $ million) and the BoJ’s balance sheet (red line, left axis, in 100 ¥million), from January 2003 to August 2016.

As one can see, there is no clear correlation between gold prices and central banks’ total assets. However, the price of gold entered the bear market period at the end of 2012 when the BoJ adopted a more aggressive stance associated with Abenomics and the growth of its monetary base accelerated.

Looking forward, we expect that the divergence in monetary policy between the Fed and the BoJ will persist, supporting the U.S. dollar. The divergence has receded somewhat this year as the Fed has dialed back expectations for the pace of rising interest rates, however it may return to the spotlight in December when the Fed may hike interest rates, while the ECB and the BoJ would probably continue to loosen their monetary policies. Indeed, the BoJ left the possibility of more asset purchases and further interest rates cuts – at the press conference after its September meeting, Kuroda said:

“We won’t hesitate to adjust monetary policy with an eye on economic and price developments. “We will ease further when necessary. We can cut short-term rates, lower the long-term rate target, buy more assets or if conditions warrant, accelerate the pace of expansion in monetary base. There’s room to ease further with the three dimensions of quantity and quality of assets as well as interest rates.”

It goes without saying that a strong dovish statement from the BoJ could weaken the yen and strengthen the U.S. dollar, which would be negative for the price of gold. In a scenario of the broadening divergence in monetary policy between the major central banks, investing in gold priced in the yen (or the euro) would be a smarter choice than investing in gold priced in the U.S. dollar. Naturally, there is only one “gold” that can be purchased and the above simply means that those who hold the euro or yen and use it for purchasing gold, will likely benefit more (vs. the value of these currencies) than those, who hold the US dollars.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.